1120s Form

What is the 1120S?

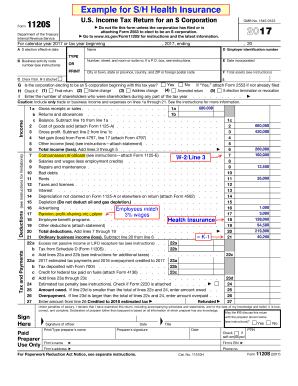

The 1120S form is a tax return specifically designed for S corporations in the United States. This form allows S corporations to report income, deductions, and credits to the Internal Revenue Service (IRS). Unlike traditional corporations, S corporations pass their income directly to shareholders, avoiding double taxation. The 1120S is crucial for shareholders as it provides the necessary information to report their share of the corporation's income on their personal tax returns.

How to Use the 1120S

To effectively use the 1120S form, S corporations must gather all relevant financial data, including income, expenses, and shareholder distributions. Each shareholder's share of income, deductions, and credits must be accurately reported. The form requires detailed entries, including the corporation's name, address, and Employer Identification Number (EIN). After completing the form, it must be filed with the IRS, typically by March 15 for calendar year filers. Shareholders will then receive a Schedule K-1, which details their share of the corporation's income and deductions.

Steps to Complete the 1120S

Completing the 1120S form involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the basic information section, including the corporation's name, address, and EIN.

- Report income and deductions in the appropriate sections, ensuring accuracy.

- Complete the Schedule K-1 for each shareholder, detailing their share of income and deductions.

- Review the form for accuracy and completeness before submission.

- File the form electronically or via mail by the deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the 1120S form. It is essential to adhere to these guidelines to ensure compliance and avoid penalties. The IRS outlines the requirements for S corporation eligibility, including the number of shareholders and types of allowable shareholders. Additionally, the IRS specifies how to report various types of income and deductions, which can vary based on the corporation's activities. Familiarizing oneself with these guidelines can help streamline the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the 1120S form are critical for compliance. Generally, the due date for filing is March 15 for calendar year S corporations. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may apply for a six-month extension, but this does not extend the time to pay any taxes owed. Keeping track of these important dates helps ensure timely filing and avoids unnecessary penalties.

Required Documents

When preparing to file the 1120S form, certain documents are required to ensure accurate reporting. These include:

- Income statements detailing revenue generated by the corporation.

- Expense records, including operational costs and deductions.

- Shareholder information, including names, addresses, and ownership percentages.

- Previous year’s tax return for reference.

Having these documents organized and readily available can facilitate a smoother filing process.

Penalties for Non-Compliance

Failing to file the 1120S form on time or inaccurately reporting information can lead to significant penalties. The IRS imposes a penalty for late filing, which can accumulate daily until the form is submitted. Additionally, inaccuracies in reporting can trigger audits or further scrutiny from the IRS. It is essential for S corporations to understand these risks and ensure compliance with all filing requirements to avoid financial repercussions.

Quick guide on how to complete 1120s

Prepare 1120s effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct format and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 1120s on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign 1120s with ease

- Find 1120s and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign 1120s and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to the treasury internal revenue service?

airSlate SignNow is a powerful solution that allows businesses to send and eSign documents efficiently. It facilitates compliance with various government regulations, including those enforced by the treasury internal revenue service, ensuring your financial documents are handled accurately and securely.

-

How can airSlate SignNow help with IRS tax compliance?

By using airSlate SignNow, businesses can streamline their documentation process, making it easier to comply with the requirements set forth by the treasury internal revenue service. Our platform ensures that all eSigned documents are legally binding and securely stored, which is essential for IRS compliance.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. With features tailored to meet the needs related to documentation for the treasury internal revenue service, our plans are designed to be cost-effective while providing maximum value.

-

Can airSlate SignNow integrate with accounting software used for IRS reporting?

Yes, airSlate SignNow can seamlessly integrate with popular accounting software that are commonly used for IRS reporting. This integration simplifies the workflow of collecting signatures for financial documents as required by the treasury internal revenue service.

-

What features does airSlate SignNow offer to enhance document management?

airSlate SignNow offers a variety of features including document templates, real-time tracking, and automated reminders. These features ensure that all documents, including those related to the treasury internal revenue service, are managed efficiently and in compliance with legal standards.

-

How does airSlate SignNow ensure document security for IRS-related transactions?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technology and comply with federal regulations to protect documents, including those required by the treasury internal revenue service, ensuring that sensitive information remains confidential.

-

Is airSlate SignNow user-friendly for beginners dealing with IRS documentation?

Absolutely! airSlate SignNow is designed with an intuitive interface, making it easy for beginners to navigate, especially when handling documentation for the treasury internal revenue service. The platform provides helpful guides and support to assist new users in getting started quickly.

Get more for 1120s

Find out other 1120s

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors