W 8ben E Cdn Entities Form

What is the W-8BEN-E for Canadian Entities?

The W-8BEN-E form is a tax document used by foreign entities, including Canadian businesses, to certify their foreign status for U.S. tax purposes. This form is essential for non-U.S. entities receiving income from U.S. sources, such as dividends, interest, or royalties. By completing the W-8BEN-E, Canadian entities can claim a reduced rate of withholding tax under applicable tax treaties between the United States and Canada.

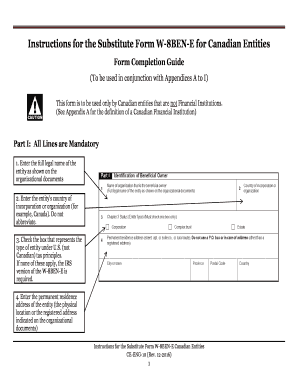

Steps to Complete the W-8BEN-E for Canadian Entities

Completing the W-8BEN-E involves several key steps to ensure accuracy and compliance:

- Identify the entity type: Determine whether the entity is a corporation, partnership, or other type of organization.

- Provide identification: Include the entity's name, country of incorporation, and address.

- Claim tax treaty benefits: Indicate the relevant tax treaty provisions that apply to the income being received.

- Sign and date the form: Ensure that an authorized representative of the entity signs the form to validate it.

Legal Use of the W-8BEN-E for Canadian Entities

The W-8BEN-E must be used in compliance with U.S. tax laws to avoid penalties. It serves as proof that the entity is not subject to U.S. taxation on certain types of income. To be legally valid, the form must be completed accurately and submitted to the withholding agent or financial institution requesting it. Failure to provide this form may result in higher withholding tax rates being applied.

IRS Guidelines for the W-8BEN-E

The Internal Revenue Service (IRS) provides specific guidelines for completing the W-8BEN-E. These guidelines include instructions on how to fill out each section of the form, what information is required, and how to submit the form. It is important for Canadian entities to refer to these guidelines to ensure compliance and to understand their tax obligations when dealing with U.S. income.

Required Documents for the W-8BEN-E

When completing the W-8BEN-E, certain documents may be necessary to support the information provided. These can include:

- Proof of entity status: Documentation that verifies the entity's legal status in Canada.

- Tax identification number: The Canadian entity's business number or other relevant tax identification.

- Tax treaty information: Any documents that support claims for reduced withholding tax rates under the U.S.-Canada tax treaty.

Form Submission Methods for the W-8BEN-E

The W-8BEN-E can be submitted through various methods, depending on the requirements of the withholding agent. Common submission methods include:

- Online submission: Some financial institutions may allow electronic submission of the form.

- Mail: The completed form can be mailed directly to the withholding agent.

- In-person delivery: Entities may also deliver the form in person if required by the requesting party.

Quick guide on how to complete w 8ben e cdn entities

Effortlessly Prepare W 8ben E Cdn Entities on Any Device

Digital document management has gained signNow traction among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage W 8ben E Cdn Entities on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign W 8ben E Cdn Entities with Ease

- Obtain W 8ben E Cdn Entities and then click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details, then click the Done button to save your modifications.

- Select your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or errors that necessitate creating new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and electronically sign W 8ben E Cdn Entities and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the instructions w 8ben e form for completing the document?

The instructions w 8ben e form provide detailed guidelines on how to fill out the form correctly. These instructions help ensure that all required information is submitted accurately, which is essential for tax reporting. Familiarizing yourself with the instructions can prevent common mistakes that could delay processing.

-

How can airSlate SignNow help with the instructions w 8ben e form?

airSlate SignNow streamlines the process of filling out and signing the instructions w 8ben e form. Our platform offers intuitive features that guide you through each step, making it easier to complete the required details. Additionally, electronic signature capabilities ensure your form is legally binding and securely submitted.

-

Is there a cost associated with using airSlate SignNow for the instructions w 8ben e form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs when working with the instructions w 8ben e form. Our plans provide access to all the necessary features for document management, including eSigning and form integrations. We also offer a free trial, allowing you to explore the platform before committing.

-

Can I integrate other tools with airSlate SignNow for managing the instructions w 8ben e form?

Absolutely! airSlate SignNow supports integration with various tools and platforms to enhance your workflow around the instructions w 8ben e form. From CRM systems to cloud storage solutions, these integrations enable seamless document management and ensure you can work efficiently.

-

What benefits does airSlate SignNow provide when using instructions w 8ben e form?

Using airSlate SignNow for the instructions w 8ben e form offers numerous benefits, including increased efficiency and security. Our platform allows for faster document turnaround, reducing the time spent on manual processing. Moreover, with secure storage and signing capabilities, you can ensure that your sensitive information is protected.

-

How secure is airSlate SignNow when handling the instructions w 8ben e form?

Security is our top priority at airSlate SignNow, especially when handling sensitive documents such as the instructions w 8ben e form. We implement advanced encryption and compliance measures to protect your data. You can confidently manage your documents, knowing they are safe from unauthorized access.

-

Are there any tips for completing the instructions w 8ben e form effectively?

To complete the instructions w 8ben e form effectively, take time to read through each section carefully. Ensure that you gather all necessary information before starting, and utilize our platform's built-in guidance features. Additionally, double-check your entries for accuracy to prevent any delays in processing.

Get more for W 8ben E Cdn Entities

- Abkc point tracker form

- Printable hipaa notice of privacy practices form

- Printable federal tax forms

- Utah new hire registry reporting form

- Pef performance evaluation

- Bocconi cv template form

- Online applications assistance form

- Solar construction safety manual solar construction safety coshnetwork form

Find out other W 8ben E Cdn Entities

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast