CA BOE 267 L AP1 Los Angeles County Form

What is the CA BOE 267 L AP1 Los Angeles County

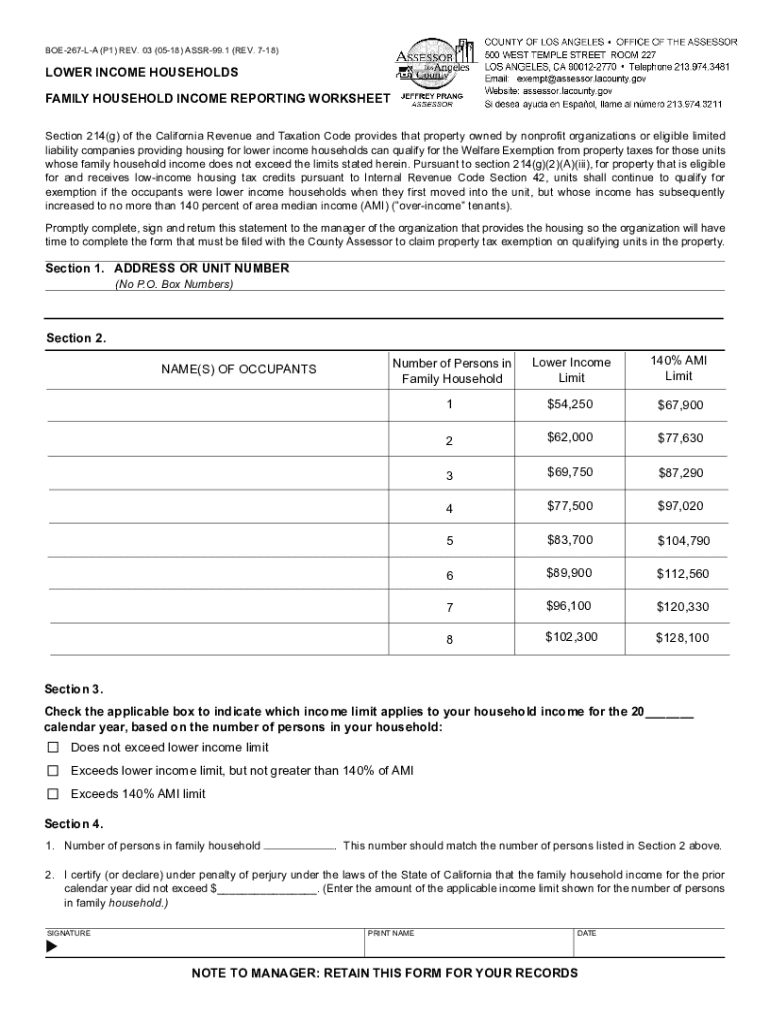

The CA BOE 267 L AP1 is a form used in Los Angeles County for property tax assessment purposes. This form is essential for property owners who need to report changes regarding their property, such as ownership transfers or changes in property use. It is a crucial document for ensuring accurate property tax calculations and maintaining compliance with local regulations.

How to use the CA BOE 267 L AP1 Los Angeles County

Using the CA BOE 267 L AP1 involves filling out the required information accurately. Property owners must provide details about the property, including its address, the nature of the change, and any relevant dates. Once completed, the form should be submitted to the appropriate county office to ensure that the property records are updated accordingly.

Steps to complete the CA BOE 267 L AP1 Los Angeles County

Completing the CA BOE 267 L AP1 involves several steps:

- Gather necessary information about the property, including its current assessment and any changes that have occurred.

- Fill out the form with accurate details, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Los Angeles County Assessor's office via the designated method, whether online, by mail, or in person.

Legal use of the CA BOE 267 L AP1 Los Angeles County

The CA BOE 267 L AP1 is legally binding when submitted correctly and in accordance with local laws. It serves as an official record of property changes and is used by the county to adjust property tax assessments. Proper use of this form ensures compliance with state regulations and protects property owners from potential penalties.

Key elements of the CA BOE 267 L AP1 Los Angeles County

Key elements of the CA BOE 267 L AP1 include:

- Property identification details, such as parcel number and address.

- Information regarding the nature of the change, including ownership status.

- Signature of the property owner or authorized representative.

- Dates relevant to the change being reported.

State-specific rules for the CA BOE 267 L AP1 Los Angeles County

California has specific rules governing the use of the CA BOE 267 L AP1, including deadlines for submission and requirements for documentation. Property owners must be aware of these regulations to ensure that their submissions are timely and compliant. Failure to adhere to state-specific rules may result in delays or complications in property tax assessments.

Quick guide on how to complete ca boe 267 l ap1 los angeles county

Complete CA BOE 267 L AP1 Los Angeles County effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage CA BOE 267 L AP1 Los Angeles County on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign CA BOE 267 L AP1 Los Angeles County with ease

- Locate CA BOE 267 L AP1 Los Angeles County and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or misplaced files, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign CA BOE 267 L AP1 Los Angeles County and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is boe 267 l a?

The boe 267 l a represents a specific document type that can be seamlessly managed within airSlate SignNow. It allows businesses to standardize their document processes while ensuring legal compliance. By utilizing airSlate SignNow, you can easily send and eSign boe 267 l a documents efficiently.

-

How much does it cost to use airSlate SignNow for boe 267 l a documents?

airSlate SignNow offers flexible pricing plans tailored to your needs, making it affordable for managing boe 267 l a documents. You can choose a plan that fits your business size and usage. Additionally, there is a free trial available so you can test its capabilities before committing.

-

What features does airSlate SignNow provide for managing boe 267 l a?

airSlate SignNow provides several features specifically for handling boe 267 l a documents, including templates, real-time collaboration, and secure eSigning. This platform ensures that all users can engage with documents easily. Furthermore, customizable workflows can streamline your document management process.

-

Can I integrate airSlate SignNow with other software for boe 267 l a?

Yes, airSlate SignNow seamlessly integrates with a wide range of applications to enhance your handling of boe 267 l a documents. Whether you are using CRM systems, cloud storage, or other business tools, the integrations help streamline your workflows. This ensures that your document management is efficient and cohesive.

-

What are the benefits of using airSlate SignNow for boe 267 l a?

Using airSlate SignNow for boe 267 l a offers numerous benefits, such as increased efficiency in document turnaround time and enhanced security. It allows users to track document status and provides a legally binding eSignature solution. Ultimately, it empowers your business to operate more smoothly and with greater transparency.

-

Is airSlate SignNow secure for handling boe 267 l a documents?

Absolutely, airSlate SignNow prioritizes security and compliance, especially for sensitive documents like boe 267 l a. The platform utilizes advanced encryption protocols to keep your documents safe from unauthorized access. You can trust airSlate SignNow to protect your information and provide a secure eSigning experience.

-

How can I get started with airSlate SignNow for my boe 267 l a documents?

To get started with airSlate SignNow for your boe 267 l a documents, simply visit the website and sign up for an account. The onboarding process is user-friendly, with plenty of resources available to guide you through the initial setup. You can begin sending, signing, and managing your documents in no time.

Get more for CA BOE 267 L AP1 Los Angeles County

- Yamaha yzf 1000 r thunderace reparaturanleitung pdf form

- Rathus assertiveness scale pdf 101085868 form

- Donation card template form

- Acn cancellation form

- Certificate of adoption application to amend a birth record health state mn form

- Tax credit form marana unified school district

- Call 1 877 423 6711 form

- Form rp 425 e application for enhanced star exemption for the 2025 2026 school year revised 724

Find out other CA BOE 267 L AP1 Los Angeles County

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile