What Attorneys Should Know About the Fair Debt Collection Practices Form

What is the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act (FDCPA) is a federal law that regulates the practices of debt collectors in the United States. It aims to protect consumers from abusive, deceptive, and unfair collection practices. Under the FDCPA, debt collectors are required to provide clear information about the debt, including the amount owed and the name of the creditor. They are also prohibited from using harassing tactics, such as calling at unreasonable hours or using threatening language. Understanding the FDCPA is crucial for attorneys advising clients on debt-related issues.

Key Elements of the Fair Debt Collection Practices Act

Several key elements define the Fair Debt Collection Practices Act and its implications for both consumers and debt collectors:

- Communication Restrictions: Debt collectors must follow specific guidelines regarding when and how they can contact consumers.

- Validation of Debts: Consumers have the right to request validation of the debt, which requires collectors to provide proof of the amount owed.

- Prohibited Practices: The FDCPA prohibits practices such as harassment, false statements, and threats of violence.

- Consumer Rights: Consumers can dispute debts and request that collectors cease communication.

How to Use the Fair Debt Collection Practices Act in Legal Cases

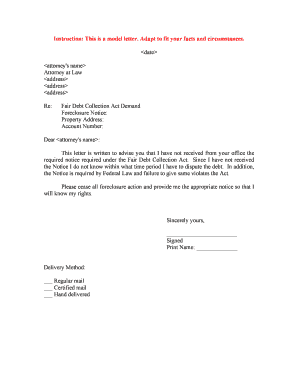

Attorneys can leverage the Fair Debt Collection Practices Act in various legal scenarios. When representing clients facing aggressive debt collection, attorneys should first assess whether the debt collector has violated any provisions of the FDCPA. If violations are found, attorneys can assist clients in filing complaints with the Federal Trade Commission or pursuing legal action against the collector. Additionally, attorneys can educate clients about their rights under the FDCPA, empowering them to handle debt collection situations more effectively.

Steps to Complete a Fair Debt Collection Practices Case

When handling a case involving the Fair Debt Collection Practices Act, attorneys should follow these steps:

- Gather all relevant documentation, including communication from the debt collector and any notices received.

- Review the FDCPA to identify potential violations based on the collector's actions.

- Consult with the client to discuss their experience and any specific incidents of harassment or misconduct.

- Consider filing a complaint with the appropriate regulatory agency or pursuing litigation if necessary.

State-Specific Rules for Debt Collection Practices

In addition to federal regulations, many states have their own laws governing debt collection practices. These state-specific rules may offer additional protections beyond those provided by the Fair Debt Collection Practices Act. Attorneys should be familiar with the laws in their jurisdiction, as they can vary significantly. Some states may impose stricter limits on collection practices or require additional disclosures from collectors. Understanding these nuances is essential for effective legal representation.

Penalties for Non-Compliance with the Fair Debt Collection Practices Act

Debt collectors who violate the Fair Debt Collection Practices Act may face significant penalties. Consumers have the right to sue for damages, which can include actual damages, statutory damages up to $1,000, and attorney fees. Additionally, regulatory agencies may impose fines on collectors who fail to adhere to the FDCPA. These penalties serve as a deterrent against abusive collection practices, reinforcing the importance of compliance for all debt collectors operating in the United States.

Quick guide on how to complete what attorneys should know about the fair debt collection practices

Prepare What Attorneys Should Know About The Fair Debt Collection Practices effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without any delays. Manage What Attorneys Should Know About The Fair Debt Collection Practices on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign What Attorneys Should Know About The Fair Debt Collection Practices effortlessly

- Locate What Attorneys Should Know About The Fair Debt Collection Practices and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Edit and eSign What Attorneys Should Know About The Fair Debt Collection Practices and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow that attorneys should know about the Fair Debt Collection Practices?

airSlate SignNow offers features such as legally binding electronic signatures, customizable document templates, and secure cloud storage, which are essential for attorneys navigating the Fair Debt Collection Practices. By leveraging these tools, attorneys can streamline their document workflows while ensuring compliance with relevant regulations.

-

How does airSlate SignNow ensure compliance with the Fair Debt Collection Practices Act?

airSlate SignNow adheres to strict security protocols and utilizes industry-standard encryption to protect sensitive client information. This compliance framework is vital for attorneys to maintain when engaging with clients under the Fair Debt Collection Practices Act.

-

What pricing options does airSlate SignNow offer for attorneys?

airSlate SignNow provides flexible pricing plans tailored to meet the unique needs of attorneys. Understanding these options can help attorneys decide on the most cost-effective solution for managing document signing related to the Fair Debt Collection Practices.

-

How can airSlate SignNow improve document management for attorneys dealing with debt collection?

By using airSlate SignNow, attorneys can easily manage and track the status of documents related to debt collection. This efficiency is crucial for those who need to stay compliant with the Fair Debt Collection Practices while reducing turnaround time on critical documents.

-

What integrations does airSlate SignNow offer that are beneficial for attorneys?

airSlate SignNow integrates seamlessly with various popular software tools commonly used by attorneys, such as CRM systems and practice management software. These integrations enable attorneys to manage client interactions more effectively in line with what they should know about the Fair Debt Collection Practices.

-

Can airSlate SignNow help attorneys create legally compliant documents for debt collection?

Yes, airSlate SignNow provides attorneys with the ability to create and customize legally compliant documents that adhere to the Fair Debt Collection Practices. This feature is essential for ensuring that all communications are proper and protect the rights of both the creditor and the debtor.

-

What benefits does airSlate SignNow provide to attorneys specializing in debt collection?

The benefits for attorneys using airSlate SignNow include increased efficiency, reduced operational costs, and enhanced client satisfaction. These advantages are particularly relevant for those focused on what attorneys should know about the Fair Debt Collection Practices, helping them serve their clients better.

Get more for What Attorneys Should Know About The Fair Debt Collection Practices

- Pdf fillable form 6236

- My many colored days coloring pages pdf wise owl factory form

- Kkm notification form

- Living will wv form

- How and when to apply for education maintenance form

- Med 10 form

- Cctv inspection contractor qualifications certification form

- Zoning administrator determination application 24155669 form

Find out other What Attorneys Should Know About The Fair Debt Collection Practices

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy