In DO 10 Form

What is the IN DO 10

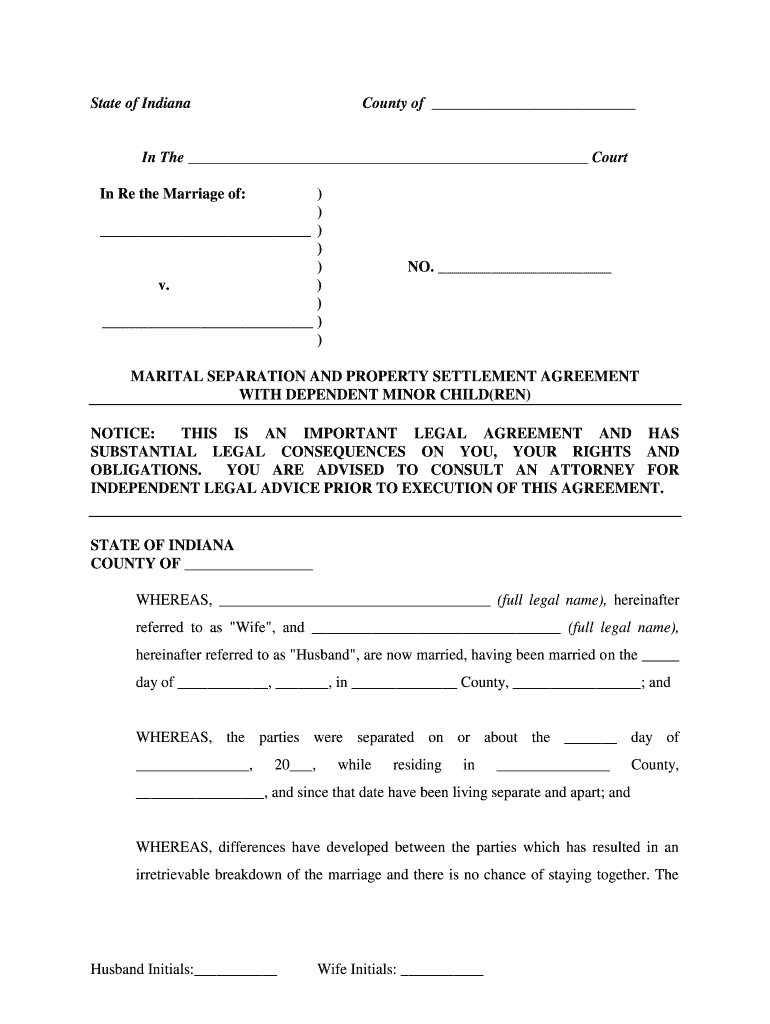

The IN DO 10 form is an essential document used primarily for reporting and documenting certain tax-related information. This form is specifically designed to assist individuals and businesses in fulfilling their tax obligations in a structured manner. It serves as a means to collect necessary details that the Internal Revenue Service (IRS) requires for accurate tax processing. Understanding the purpose and requirements of the IN DO 10 is crucial for ensuring compliance with federal tax regulations.

How to use the IN DO 10

Using the IN DO 10 form involves several straightforward steps. First, gather all relevant information required for completion, including personal identification details and financial data. Next, carefully fill out the form, ensuring accuracy in all entries to avoid potential issues with the IRS. Once completed, review the form for any errors or omissions before submission. It is advisable to keep a copy of the filled form for your records, as this can be useful for future reference or in case of any inquiries from tax authorities.

Steps to complete the IN DO 10

Completing the IN DO 10 form can be broken down into a series of clear steps:

- Gather necessary documents, such as identification and financial records.

- Access the IN DO 10 form from a reliable source.

- Fill in personal information accurately, including name, address, and taxpayer identification number.

- Provide financial details, ensuring all figures are correct and reflect your current situation.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified guidelines, whether electronically or by mail.

Legal use of the IN DO 10

The legal use of the IN DO 10 form is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted within the designated timeframes. Failure to comply with these requirements can lead to penalties or delays in processing. Additionally, it is important to ensure that all information provided is truthful and complete, as discrepancies can result in legal consequences. Utilizing a reliable electronic signature solution can further enhance the legitimacy of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the IN DO 10 form are critical for compliance with tax regulations. Typically, the form must be submitted by the designated due date, which may vary depending on individual circumstances or changes in tax law. It is essential to stay informed about any updates regarding deadlines to avoid late filing penalties. Marking these dates on a calendar can help ensure timely submission and maintain compliance with IRS requirements.

Required Documents

To successfully complete the IN DO 10 form, certain documents are required. These may include:

- Government-issued identification, such as a driver's license or passport.

- Taxpayer identification number or Social Security number.

- Financial records, including income statements and expense receipts.

- Any previous tax returns that may be relevant to the current filing.

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete in do 10

Manage IN DO 10 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage IN DO 10 on any device using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

Steps to edit and eSign IN DO 10 with ease

- Obtain IN DO 10 and then click Get Form to begin.

- Leverage the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device. Modify and eSign IN DO 10 to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the cost of using airSlate SignNow for IN DO 10?

airSlate SignNow offers competitive pricing plans tailored to suit businesses of all sizes. With flexible subscription options, you can choose a plan that meets your needs while efficiently managing your document signing process with IN DO 10. Visit our pricing page for detailed information on the various plans available.

-

How can IN DO 10 improve my document signing process?

Using airSlate SignNow with IN DO 10 enhances your document signing experience by enabling fast and secure eSignatures. The platform simplifies the management of documents, ensuring you can send, track, and store important files with ease. This efficiency allows you to focus more on your core business activities.

-

What features does airSlate SignNow include for IN DO 10?

airSlate SignNow includes a suite of powerful features for IN DO 10, such as customizable templates, automated workflows, and real-time tracking of document status. These features allow businesses to streamline their signing processes and improve productivity while ensuring compliance with legal standards.

-

Is there a free trial available for airSlate SignNow with IN DO 10?

Yes, airSlate SignNow offers a free trial for new users interested in exploring the IN DO 10 capabilities. This trial period allows you to experience the platform's features and benefits firsthand, helping you make an informed decision before committing to a subscription.

-

Can I integrate airSlate SignNow with other applications for IN DO 10?

Absolutely! airSlate SignNow supports a variety of third-party integrations that enhance its functionality for IN DO 10. You can seamlessly connect with applications like Google Drive, Salesforce, and others, allowing for a more streamlined workflow across your business operations.

-

What security measures does airSlate SignNow implement for IN DO 10?

Security is a top priority for airSlate SignNow, especially for IN DO 10 users. The platform utilizes advanced encryption and complies with industry standards to protect your sensitive documents. You can rest assured that your data is secure while signing and managing important paperwork.

-

How user-friendly is airSlate SignNow for beginners with IN DO 10?

airSlate SignNow is designed with user-friendliness in mind, making it accessible for beginners as well as experienced users with IN DO 10. The intuitive interface simplifies the process of sending and signing documents, ensuring a smooth experience regardless of your technical background.

Get more for IN DO 10

Find out other IN DO 10

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP