52 IAM 4 H Indian Affairs Mortgage Handbook Bureau of Form

What is the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of

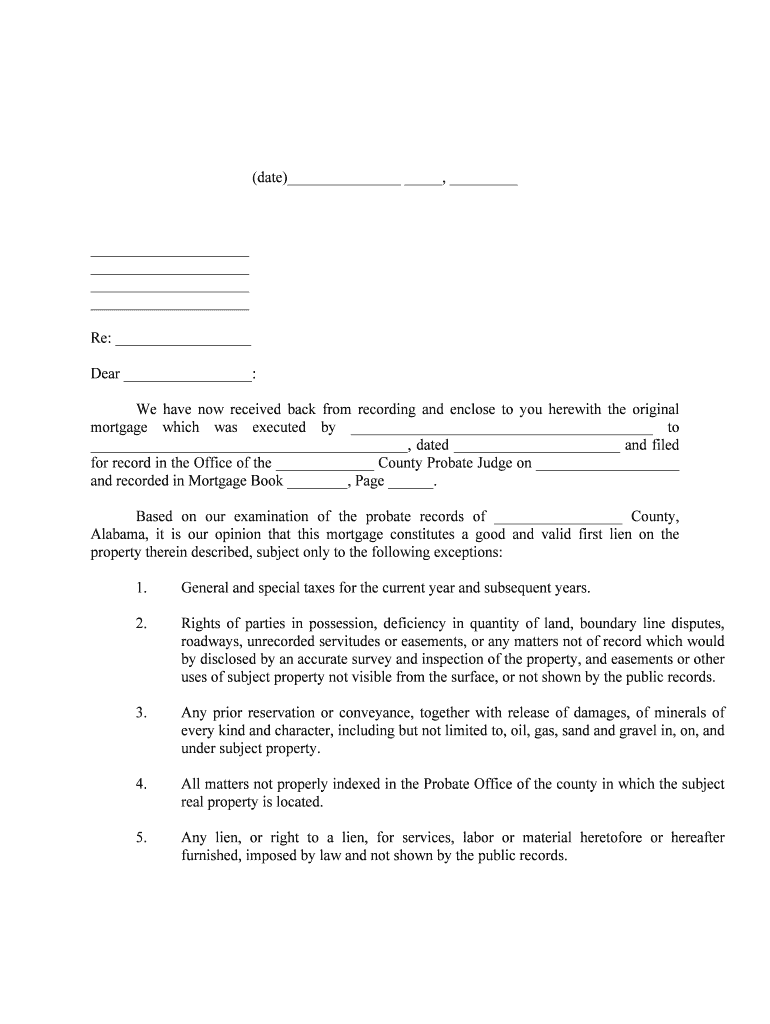

The 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of is a comprehensive guide that outlines the policies and procedures related to mortgage lending for Native American tribes and individuals. This handbook serves as a crucial resource for understanding the requirements and processes involved in securing a mortgage within Indian Country. It provides detailed information on eligibility criteria, application procedures, and the legal framework governing these transactions, ensuring that borrowers and lenders are well-informed about their rights and responsibilities.

How to use the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of

Using the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of effectively involves familiarizing yourself with its sections, which cover various aspects of mortgage lending. Start by reviewing the eligibility criteria to determine if you qualify for a mortgage. Next, follow the outlined application process, which includes gathering necessary documentation and submitting your application to the appropriate authority. The handbook also provides guidance on compliance with federal regulations, ensuring that all parties involved adhere to legal standards throughout the lending process.

Steps to complete the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of

Completing the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of involves several key steps:

- Review the eligibility requirements to confirm your qualification.

- Gather all necessary documents, including proof of income, credit history, and tribal affiliation.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application to the designated authority, either electronically or by mail, as specified in the handbook.

- Await a response regarding your application status and be prepared to provide additional information if requested.

Legal use of the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of

The legal use of the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of is grounded in compliance with federal laws and regulations governing mortgage lending in Indian Country. This handbook ensures that all mortgage transactions are conducted in accordance with the Indian Housing Block Grant program and other relevant legislation. It is essential for both lenders and borrowers to understand these legal frameworks to ensure that their agreements are valid and enforceable, protecting the rights of all parties involved.

Key elements of the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of

Key elements of the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of include:

- Eligibility criteria for borrowers, including income limits and creditworthiness.

- Detailed application procedures, including required documentation.

- Guidelines for lenders regarding compliance and reporting.

- Information on loan types available to eligible borrowers.

- Resources for dispute resolution and legal recourse in case of issues.

Eligibility Criteria

The eligibility criteria outlined in the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of are designed to ensure that only qualified individuals and tribes can access mortgage funding. Generally, applicants must demonstrate tribal affiliation, meet income requirements, and have a satisfactory credit history. Additionally, the handbook specifies that applicants should be able to provide proof of residency within the tribal jurisdiction and comply with any additional local regulations that may apply.

Application Process & Approval Time

The application process for the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of typically involves several stages, including document submission, review, and approval. After submitting your application, the review process may take several weeks, depending on the volume of applications and the completeness of the submitted documents. It is important to stay in communication with the reviewing authority to address any questions or requests for additional information promptly, which can help expedite the approval process.

Quick guide on how to complete 52 iam 4 h indian affairs mortgage handbook bureau of

Easily Prepare 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally-friendly option to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Edit and Electronically Sign 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of with Ease

- Obtain 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of?

The 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of provides guidelines and procedures for obtaining mortgage loans through the Bureau of Indian Affairs. It is designed to help Native Americans navigate the complexities of mortgage applications. This handbook outlines eligibility criteria, application processes, and the rights of applicants.

-

How can airSlate SignNow facilitate the signing process for documents related to the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of?

airSlate SignNow empowers users to send and eSign documents related to the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of effortlessly. By using our platform, you can streamline the entire signing process, ensuring that all necessary documents are completed quickly and securely. This saves time and reduces errors during the application process.

-

Is there a cost associated with using airSlate SignNow for the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of documentation?

Yes, there are pricing plans available for airSlate SignNow that cater to various business needs. These plans are designed to be cost-effective while providing comprehensive features tailored for managing documents related to the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of. You can choose the plan that best fits your requirements.

-

What features does airSlate SignNow offer for documents pertaining to the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of?

airSlate SignNow offers features such as customizable templates, bulk sending, and real-time tracking that are particularly useful for documents associated with the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of. These features streamline the signing process and ensure that all parties are kept informed of document status, enhancing overall efficiency.

-

How does airSlate SignNow ensure the security of documents related to the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of?

Security is a top priority for airSlate SignNow. We implement advanced encryption and access control measures to protect all documents, including those related to the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure.

-

Can airSlate SignNow integrate with other applications for managing the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of processes?

Yes, airSlate SignNow offers integrations with various applications that can enhance your experience in managing documents related to the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of. These integrations allow for seamless workflows, enabling you to sync data across platforms and improve collaboration among team members.

-

What are the benefits of using airSlate SignNow for the 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of documentation?

Using airSlate SignNow for handling 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of documentation offers numerous benefits, including increased efficiency, cost savings, and enhanced user experience. Our platform simplifies document management, allowing you to focus on your core business activities while ensuring compliance with the mortgage handbook's requirements.

Get more for 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of

- Re registration application wvdhhr form

- Case formulation template

- Nonresidence and military service exemption from form

- Fertilizer stock register form

- Notification of participation in the delegated statutory inspection program form

- Stat dec 46091653 form

- Novo nordisk patient assistance program reorder request form

- Tdlr form cos018

Find out other 52 IAM 4 H Indian Affairs Mortgage Handbook Bureau Of

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now