Promissory Note Secured by Real Property with a Fixed Form

What is the Promissory Note Secured By Real Property With A Fixed

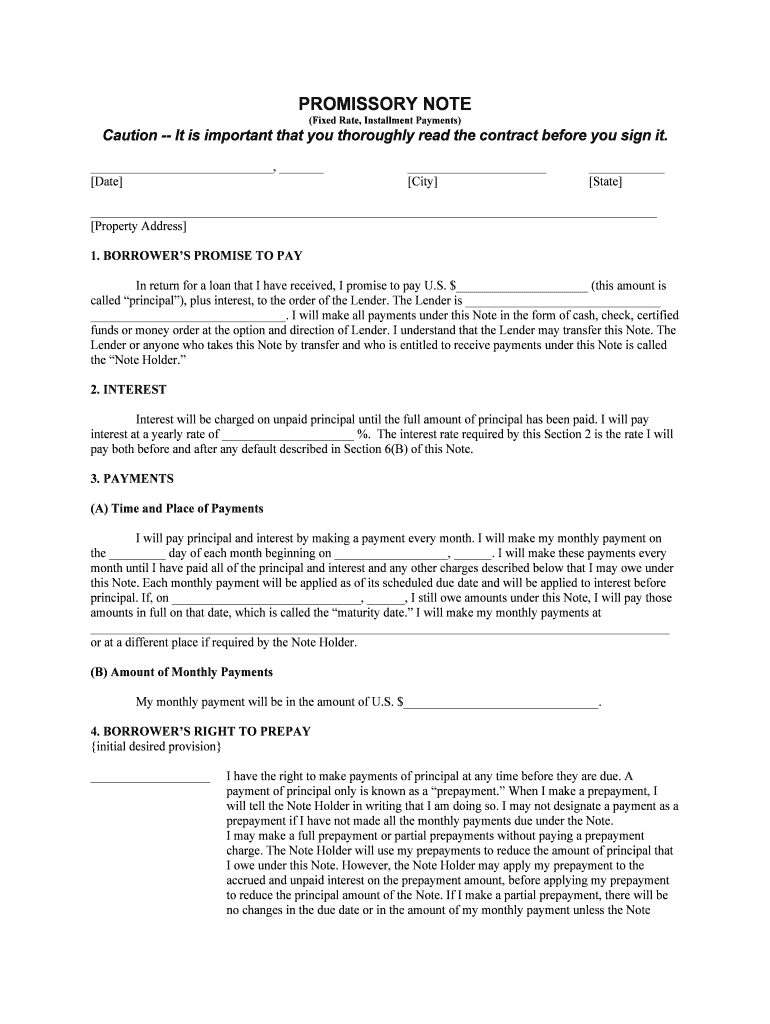

A promissory note secured by real property with a fixed interest rate is a financial instrument that outlines a borrower's promise to repay a loan under specific terms. This type of note is backed by real estate, meaning that the property serves as collateral for the loan. If the borrower defaults, the lender has the right to claim the property to recover the owed amount. The fixed interest rate ensures that the borrower pays the same interest throughout the loan term, providing predictability in monthly payments.

Key Elements of the Promissory Note Secured By Real Property With A Fixed

Understanding the key elements of this promissory note is essential for both borrowers and lenders. The main components include:

- Principal Amount: The total amount borrowed that must be repaid.

- Interest Rate: The fixed percentage charged on the principal, determining the cost of borrowing.

- Loan Term: The duration over which the loan must be repaid.

- Payment Schedule: Details on how and when payments are to be made, including frequency and due dates.

- Collateral Description: A clear description of the real property securing the loan.

- Default Clauses: Terms outlining what constitutes a default and the lender's rights in such cases.

Steps to Complete the Promissory Note Secured By Real Property With A Fixed

Completing a promissory note secured by real property involves several important steps to ensure legality and clarity:

- Gather Information: Collect all necessary details, including borrower and lender information, property details, and loan specifics.

- Draft the Document: Use a template to draft the note, ensuring all key elements are included.

- Review Terms: Both parties should review the terms to ensure mutual understanding and agreement.

- Sign the Document: Both parties must sign the note in the presence of a notary public to validate it.

- File the Document: Depending on state laws, the signed note may need to be filed with local authorities or recorded in public records.

Legal Use of the Promissory Note Secured By Real Property With A Fixed

The legal use of a promissory note secured by real property is governed by state and federal laws. It is crucial for the note to comply with the Uniform Commercial Code (UCC) and any applicable state laws regarding secured transactions. This ensures that the note is enforceable in court and that the lender's rights are protected. Proper execution, including notarization and recording, enhances the document's legal standing, making it a reliable tool for both parties involved.

How to Use the Promissory Note Secured By Real Property With A Fixed

Using a promissory note secured by real property is straightforward. Once the note is completed and signed, it serves as a binding agreement between the borrower and lender. The borrower must adhere to the payment schedule outlined in the note, making timely payments as agreed. In the event of default, the lender can initiate foreclosure proceedings to reclaim the property. It is advisable for both parties to keep copies of the signed note and any related correspondence for their records.

State-Specific Rules for the Promissory Note Secured By Real Property With A Fixed

Each state in the U.S. may have specific rules and regulations governing promissory notes secured by real property. These can include requirements for notarization, recording the note, and specific language that must be included in the document. It is essential for both borrowers and lenders to familiarize themselves with their state's laws to ensure compliance and avoid potential legal issues. Consulting with a legal professional can provide clarity on these state-specific requirements.

Quick guide on how to complete promissory note secured by real property with a fixed

Easily prepare Promissory Note Secured By Real Property With A Fixed on any gadget

Digital document management has gained traction among companies and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly and without issues. Manage Promissory Note Secured By Real Property With A Fixed on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Promissory Note Secured By Real Property With A Fixed effortlessly

- Locate Promissory Note Secured By Real Property With A Fixed and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or black out sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to finalize your changes.

- Choose how you want to share your form—via email, SMS, or invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign Promissory Note Secured By Real Property With A Fixed to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Promissory Note Secured By Real Property With A Fixed?

A Promissory Note Secured By Real Property With A Fixed is a legal document that outlines a borrower's promise to pay a lender a specified amount, secured by real estate as collateral. This type of note typically includes a fixed interest rate and a predetermined payment schedule. It provides security for the lender while also giving the borrower access to funds.

-

How can airSlate SignNow help with creating a Promissory Note Secured By Real Property With A Fixed?

airSlate SignNow simplifies the process of creating a Promissory Note Secured By Real Property With A Fixed by providing customizable templates and an intuitive interface. Users can easily input relevant details, ensuring compliance with legal standards. The electronic signing feature allows for quick and secure execution of the document.

-

What are the benefits of using a Promissory Note Secured By Real Property With A Fixed?

A Promissory Note Secured By Real Property With A Fixed offers numerous benefits, including lower interest rates due to collateralization and clear loan terms. It also protects lenders by providing legal recourse in case of default. Both parties can easily track payments and maintain clear records through electronic documentation.

-

What is the cost of using airSlate SignNow for a Promissory Note Secured By Real Property With A Fixed?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including options for creating and managing a Promissory Note Secured By Real Property With A Fixed. Pricing typically depends on the number of users and features required. Check our website for the latest pricing details and any available discounts.

-

Can I integrate airSlate SignNow with other applications for managing Promissory Notes?

Yes, airSlate SignNow offers integration with various business applications, allowing you to manage a Promissory Note Secured By Real Property With A Fixed seamlessly. This can include CRM systems, document management tools, and cloud storage services. These integrations help streamline the process and enhance productivity.

-

Is it legally binding to eSign a Promissory Note Secured By Real Property With A Fixed?

Yes, an electronically signed Promissory Note Secured By Real Property With A Fixed is legally binding, provided it complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act. airSlate SignNow ensures that all documents generated meet legal standards for enforceability. This gives both parties confidence in their agreements.

-

What information do I need to include in a Promissory Note Secured By Real Property With A Fixed?

A Promissory Note Secured By Real Property With A Fixed should include the borrower's and lender's information, the loan amount, interest rate, payment terms, and any applicable collateral details. It's essential to also specify the conditions for default and remedies. Utilizing airSlate SignNow's templates can ensure you include all necessary details.

Get more for Promissory Note Secured By Real Property With A Fixed

- Glencoe algebra 1 workbook answer key pdf form

- Dietary requirements email template form

- Mv3128 wisconsin department of transportation dot wisconsin form

- Dampd basic player character record sheet replica mad irishman form

- Brighthouse forms

- Nj reg nj business entity and tax registration forms cumberland

- Court extract form

- Camp registration card michigan department of natural form

Find out other Promissory Note Secured By Real Property With A Fixed

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself