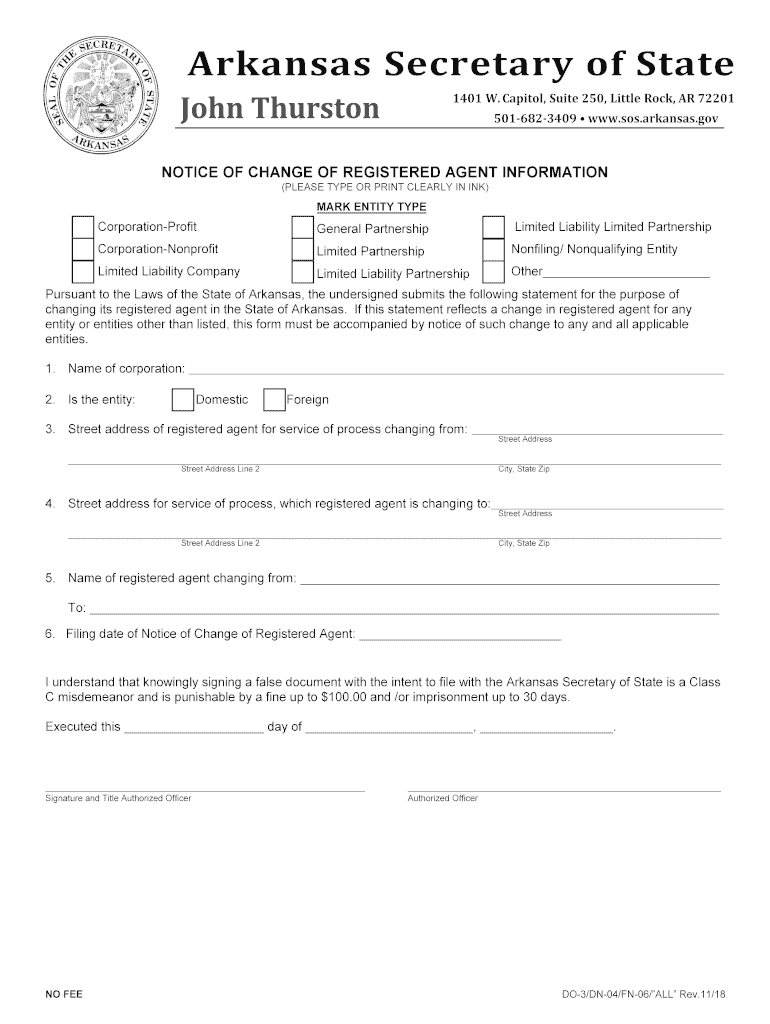

MARK ENTITY TYPE Form

What is the mark entity type?

The mark entity type is a classification used primarily in the context of business and legal documentation. It refers to the designation of a specific type of entity that is recognized under U.S. law. This includes various forms of business structures such as corporations, limited liability companies (LLCs), partnerships, and sole proprietorships. Understanding the mark entity type is essential for compliance with state and federal regulations, as it affects taxation, liability, and operational requirements.

How to use the mark entity type

Using the mark entity type involves identifying the appropriate classification for your business entity when filling out legal documents or forms. This classification determines how your business will be treated under the law, including tax obligations and liability protections. When completing forms, ensure you select the correct mark entity type to avoid legal complications. This is particularly important when filing taxes, applying for permits, or entering contracts.

Steps to complete the mark entity type

Completing the mark entity type form involves several key steps:

- Identify your business structure: Determine whether your entity is a corporation, LLC, partnership, or sole proprietorship.

- Gather necessary information: Collect all relevant details, such as the business name, registration number, and the names of owners or partners.

- Fill out the form accurately: Ensure all information is correct and complete to avoid delays or rejections.

- Review for compliance: Check that your form meets all state and federal requirements related to your specific mark entity type.

- Submit the form: Follow the designated submission method, whether online, by mail, or in person.

Legal use of the mark entity type

The legal use of the mark entity type is crucial for ensuring that your business operates within the framework of U.S. law. Proper classification affects not only tax responsibilities but also liability issues. For example, corporations offer limited liability protection to their owners, while sole proprietorships do not. It is vital to understand the implications of your chosen mark entity type, as it can influence your legal standing in contracts, lawsuits, and regulatory compliance.

Required documents for the mark entity type

When filing for a mark entity type, several documents may be required, depending on the specific business structure. Common documents include:

- Articles of Incorporation or Organization: Required for corporations and LLCs.

- Operating Agreement: Often needed for LLCs to outline management structure.

- Partnership Agreement: Necessary for partnerships to define roles and responsibilities.

- Tax Identification Number (TIN): Required for tax purposes.

- Business licenses and permits: Depending on your industry and location.

Who issues the mark entity type form?

The mark entity type form is typically issued by state government agencies, such as the Secretary of State's office or the Department of Business Regulation. Each state has its own requirements and processes for classifying and registering business entities. It is important to consult the specific agency in your state to ensure compliance with local regulations and to obtain the correct form for your mark entity type.

Quick guide on how to complete mark entity type

Effortlessly Complete MARK ENTITY TYPE on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage MARK ENTITY TYPE on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

Edit and eSign MARK ENTITY TYPE with Ease

- Obtain MARK ENTITY TYPE and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight key sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Modify and eSign MARK ENTITY TYPE to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to MARK ENTITY TYPE in airSlate SignNow?

To MARK ENTITY TYPE in airSlate SignNow means defining the type of legal entity involved in a document. This feature ensures that all signers understand their roles clearly, enhancing the legal validity of the signed documents. Properly marking the entity type can also streamline document management and compliance.

-

How can MARK ENTITY TYPE improve my document workflow?

By using the MARK ENTITY TYPE feature, you can categorize documents based on the types of entities involved, such as individuals, businesses, or organizations. This categorization allows for more streamlined workflows and ensures that documents are directed to the appropriate signers efficiently. Additionally, it helps maintain clear records for future reference.

-

Is there an additional cost for using the MARK ENTITY TYPE feature?

No, there are no additional costs for using the MARK ENTITY TYPE feature in airSlate SignNow. This feature is included in our pricing plans, allowing you to easily mark entity types without any extra fees. You can streamline your document processes at no extra charge.

-

Can I customize the MARK ENTITY TYPE options?

Yes, airSlate SignNow allows you to customize the MARK ENTITY TYPE options based on your specific needs. You can define your entity types according to industry standards or your business preferences. This flexibility ensures a tailored experience that fits your document management requirements.

-

What are the benefits of marking entity types in eSign documents?

Marking entity types in eSign documents enhances clarity and reduces confusion during the signing process. It ensures all parties understand their legal standings, which can prevent disputes later on. Additionally, this process aids in compliance with various regulatory frameworks governing electronic signatures.

-

Does airSlate SignNow integrate with other tools for MARK ENTITY TYPE?

Yes, airSlate SignNow seamlessly integrates with numerous business applications, enhancing the functionality of the MARK ENTITY TYPE feature. You can integrate it with CRM systems, document management tools, and other software, allowing for a smooth transition of data and improving your overall workflow. This connectivity boosts efficiency and productivity.

-

How can I learn more about the MARK ENTITY TYPE feature?

To learn more about the MARK ENTITY TYPE feature, you can explore our comprehensive help center and user guides provided on the airSlate SignNow website. Additionally, we offer webinars and tutorials that explain how to utilize this feature effectively. Our support team is also available to assist you with any specific questions.

Get more for MARK ENTITY TYPE

Find out other MARK ENTITY TYPE

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors