PLAINTIFFCREDITOR Form

What is the PLAINTIFFCREDITOR

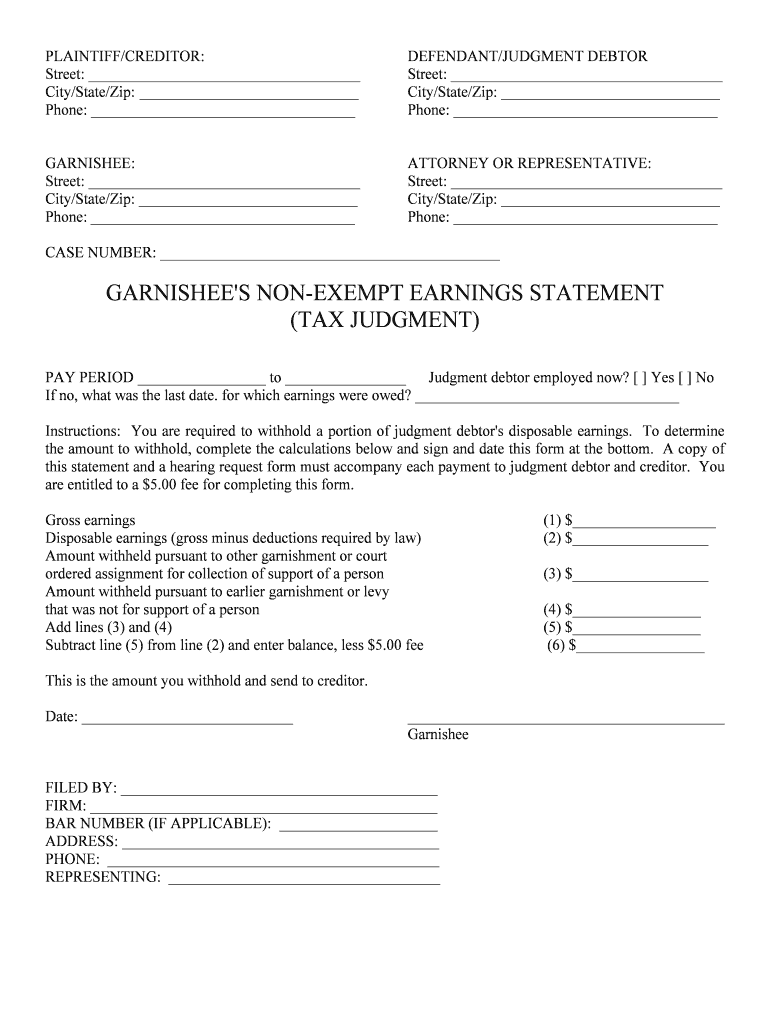

The plaintiffcreditor form is a legal document used in debt recovery cases. It serves as a formal request for the court to recognize a creditor's claim against a debtor. This form outlines the details of the debt, including the amount owed, the nature of the obligation, and any relevant agreements between the parties involved. Understanding its purpose is crucial for both creditors seeking to recover debts and debtors who may need to respond to claims.

How to use the PLAINTIFFCREDITOR

Using the plaintiffcreditor form involves several key steps. First, the creditor must accurately fill out the form with all required information, ensuring that all details regarding the debt are complete and correct. Next, the completed form must be submitted to the appropriate court, following local procedures for filing. It is essential to retain copies of the submitted form and any accompanying documents for personal records. Additionally, creditors should be prepared to present evidence of the debt in court if necessary.

Steps to complete the PLAINTIFFCREDITOR

Completing the plaintiffcreditor form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information regarding the debt, including the debtor's details and the amount owed.

- Fill out the form accurately, ensuring that all sections are completed, including any required signatures.

- Review the form for accuracy and completeness before submission.

- File the form with the appropriate court, adhering to local filing requirements.

- Keep a copy of the filed form for your records and any future reference.

Legal use of the PLAINTIFFCREDITOR

The legal use of the plaintiffcreditor form is governed by state laws and regulations. This form must be executed in accordance with the legal requirements of the jurisdiction where the debt is being pursued. It is important for creditors to understand these regulations to ensure that their claims are valid and enforceable. Proper use of the form can help creditors secure their rights and facilitate the recovery of owed amounts.

Key elements of the PLAINTIFFCREDITOR

Several key elements must be included in the plaintiffcreditor form to ensure its validity:

- Creditor Information: Full name, address, and contact details of the creditor.

- Debtor Information: Full name, address, and contact details of the debtor.

- Debt Details: A clear description of the debt, including the amount owed and the basis for the claim.

- Signature: The form must be signed by the creditor or their authorized representative.

State-specific rules for the PLAINTIFFCREDITOR

Each state has its own rules regarding the use and submission of the plaintiffcreditor form. These rules can vary significantly, affecting everything from the required information to the filing process. Creditors should familiarize themselves with their state's specific regulations to ensure compliance. This may include understanding deadlines for filing, any fees associated with the submission, and the court's procedures for handling such claims.

Quick guide on how to complete plaintiffcreditor

Effortlessly Prepare PLAINTIFFCREDITOR on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing easy access to the correct form and secure online storage. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly, without any delays. Handle PLAINTIFFCREDITOR on any platform using the airSlate SignNow apps for Android or iOS, and simplify any document-based task today.

How to Edit and eSign PLAINTIFFCREDITOR with Ease

- Obtain PLAINTIFFCREDITOR and click on Get Form to begin.

- Leverage the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or black out sensitive details using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to finalize your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign PLAINTIFFCREDITOR and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit PLAINTIFFCREDITOR situations?

airSlate SignNow is an eSignature solution that simplifies the process of sending and signing documents. For PLAINTIFFCREDITOR situations, it offers a seamless way to manage legal documents efficiently, ensuring that all necessary signatures are collected promptly to support your case.

-

How much does airSlate SignNow cost for users in the PLAINTIFFCREDITOR field?

airSlate SignNow offers various pricing plans tailored for businesses, including those dealing with PLAINTIFFCREDITOR needs. Our competitive pricing is designed to be budget-friendly, allowing firms to access essential eSigning features without breaking the bank.

-

What features does airSlate SignNow provide for PLAINTIFFCREDITOR transactions?

airSlate SignNow includes features such as customizable templates, real-time tracking, and robust security measures, which are crucial for PLAINTIFFCREDITOR transactions. These features help ensure that documents remain compliant and secure throughout the signing process.

-

Can airSlate SignNow integrate with other tools used by PLAINTIFFCREDITOR professionals?

Yes, airSlate SignNow seamlessly integrates with popular tools like Google Drive, Salesforce, and others commonly used in the PLAINTIFFCREDITOR domain. This capability enhances workflow efficiency by allowing users to manage documents alongside their other platforms.

-

How does airSlate SignNow ensure the security of PLAINTIFFCREDITOR documents?

Security is paramount for PLAINTIFFCREDITOR documents, and airSlate SignNow employs advanced encryption and compliance with industry standards. This ensures that your sensitive documents remain safe from unauthorized access during the signing process.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSignatures in PLAINTIFFCREDITOR cases?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those new to eSignatures in PLAINTIFFCREDITOR cases. Our intuitive interface and helpful guides facilitate a smooth onboarding experience.

-

What kind of customer support does airSlate SignNow offer for PLAINTIFFCREDITOR users?

airSlate SignNow provides comprehensive customer support, including live chat, email, and phone assistance. This ensures that PLAINTIFFCREDITOR users receive prompt help whenever they encounter challenges or have questions regarding the platform.

Get more for PLAINTIFFCREDITOR

- Verbale riconsegna appartamento locazione form

- Bankruptcy form 16b

- Counter petition sample form

- Pearson vue reciprocity form

- Student refund request form de anza college deanza

- Ccny fieldwork timesheet 481065115 form

- Wenatchee valley college course change form plea

- Recommendation form wesley college wesley

Find out other PLAINTIFFCREDITOR

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now