NOTICETOCOTENANTofEXPENDITURE for BENEFIT of COMMONPROPERTY Demand for Contribution L&T20 Form

What is the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20

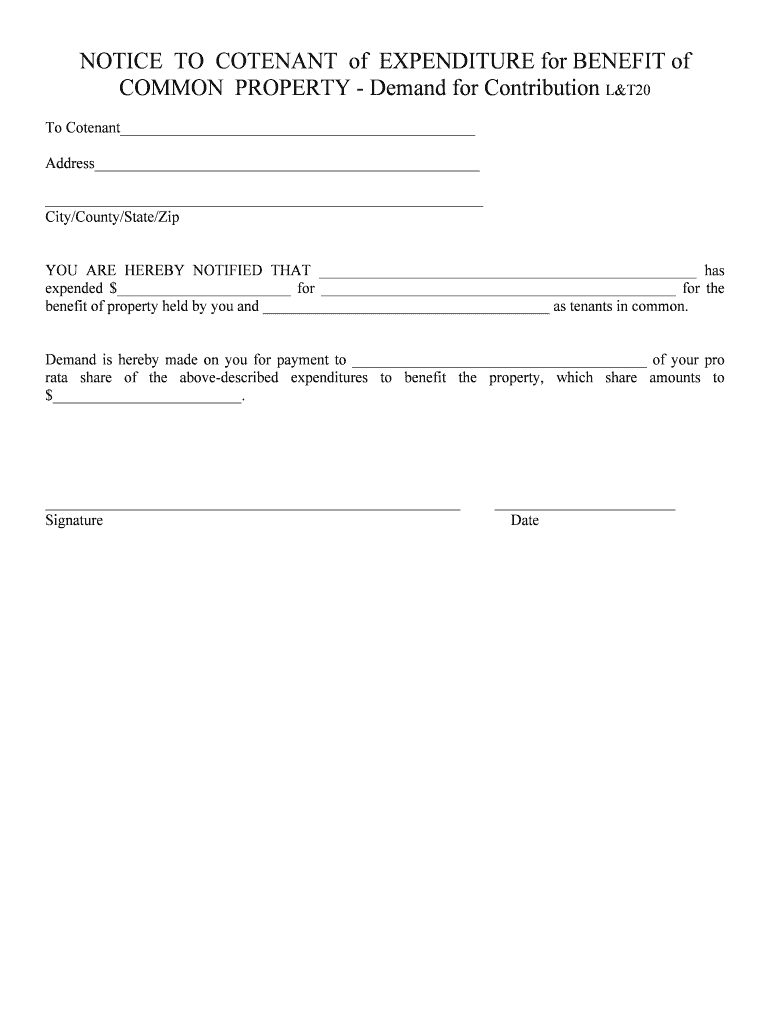

The NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 is a formal document used in property management and common interest communities. This form serves as a notification to tenants regarding their contribution obligations towards shared expenses that benefit common property. It outlines the specific expenditures that require financial input from tenants, ensuring transparency and accountability in managing communal resources.

How to use the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20

Using the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 involves several steps. First, property managers or owners should accurately fill out the form, detailing the expenditures and the corresponding amounts owed by each tenant. Next, distribute the completed form to all relevant tenants, ensuring they understand their financial responsibilities. It is advisable to retain copies for record-keeping and future reference.

Steps to complete the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20

Completing the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 requires careful attention to detail. Follow these steps:

- Gather all necessary information regarding the expenditures related to common property.

- Clearly outline each expenditure, including the total amount and the share for each tenant.

- Fill in the form with accurate details, ensuring clarity and completeness.

- Review the form for any errors before distribution.

- Distribute the form to all tenants and provide a deadline for contributions.

Key elements of the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20

Key elements of the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 include:

- Expenditure Description: A detailed account of what the contributions are funding.

- Amount Due: The total amount each tenant is responsible for contributing.

- Payment Deadline: The date by which contributions must be made.

- Contact Information: Details for tenants to reach out with questions or concerns.

Legal use of the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20

The NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 is legally binding when properly executed. To ensure its legal standing, the form must meet specific requirements such as clarity in the description of expenditures and accurate identification of tenants. Compliance with local laws governing tenant contributions and common property management is essential to uphold its validity in legal contexts.

Examples of using the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20

Examples of using the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 can vary widely. For instance, a homeowners association may use this form to notify residents about upcoming maintenance costs for shared facilities, such as a pool or landscaping. Another example could be a condominium management team informing residents about costs related to emergency repairs in common areas, ensuring all tenants contribute fairly to the expenses.

Quick guide on how to complete noticetocotenantofexpenditure for benefit of commonproperty demand for contribution lampampt20

Complete NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 on any platform using airSlate SignNow apps for Android or iOS and streamline any document-driven process today.

How to modify and eSign NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 effortlessly

- Locate NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 and then click Get Form to begin.

- Utilize the tools available to submit your form.

- Highlight important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to deliver your form, whether via email, SMS, invite link, or download it to your computer.

Never worry about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20?

The NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 refers to a formal notification required by property owners to inform stakeholders about financial contributions related to common property expenses. This is essential for ensuring transparency and accountability among all property owners.

-

How can airSlate SignNow assist with the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20?

With airSlate SignNow, you can easily create, send, and eSign documents related to the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20. Our platform streamlines the entire process, making it more efficient for property managers and owners to collaborate and comply with legal requirements.

-

What are the pricing options for airSlate SignNow when dealing with NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20?

airSlate SignNow offers flexible pricing plans tailored to different business needs. For managing documents related to the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20, you can choose from our basic to advanced plans, ensuring you find the best fit for your budget and requirements.

-

What features does airSlate SignNow offer to help with property management documentation?

AirSlate SignNow provides multiple features such as customizable templates, cloud storage integration, and real-time status tracking for documents like the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20. These features enhance efficiency and ensure smooth communication among stakeholders.

-

Are there integrations available for airSlate SignNow that support the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20?

Yes, airSlate SignNow integrates seamlessly with various third-party applications that can assist with the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20. This includes popular tools for project management, accounting, and document sharing, providing a comprehensive solution for property management.

-

What are the benefits of using airSlate SignNow for my property’s documentation needs?

Using airSlate SignNow for documentation like the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 ensures that your documents are completed quickly and securely. The platform enhances collaboration, reduces turnaround times, and maintains compliance with legal standards.

-

Is airSlate SignNow user-friendly for non-technical users managing the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20?

Absolutely! AirSlate SignNow is designed to be intuitive and easy to navigate, making it ideal for non-technical users. You can quickly create and eSign documents related to the NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20 without needing any prior experience with eSignature software.

Get more for NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20

Find out other NOTICETOCOTENANTofEXPENDITURE For BENEFIT Of COMMONPROPERTY Demand For Contribution L&T20

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors