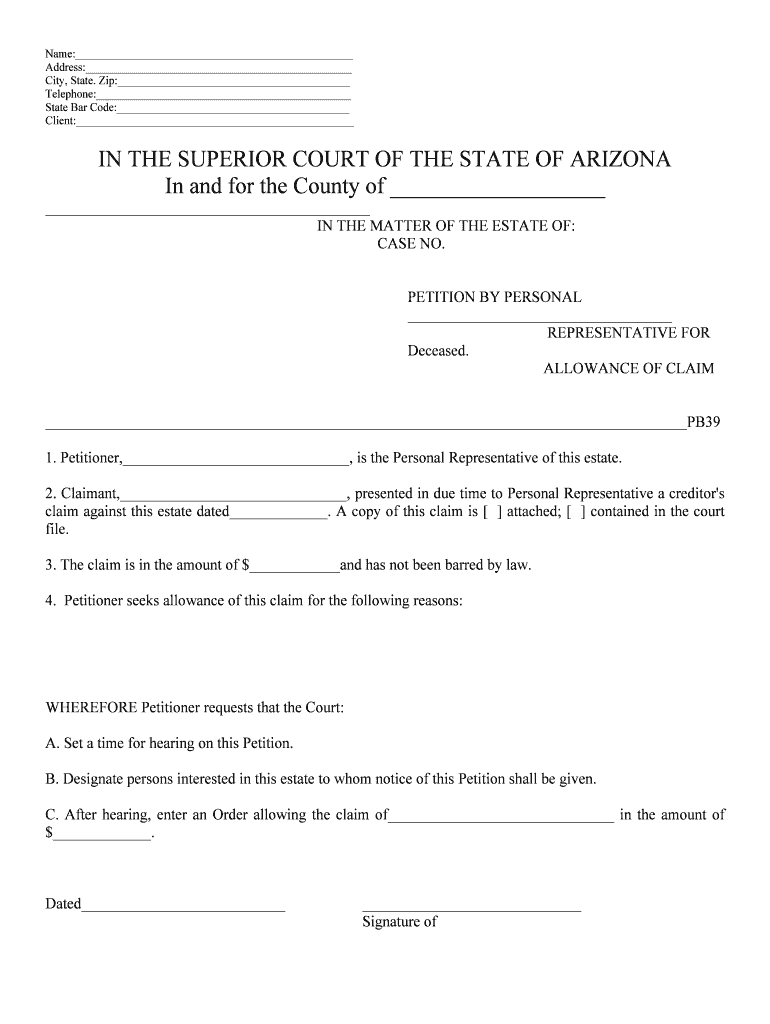

ALLOWANCE of CLAIM Form

What is the allowance of claim?

The allowance of claim is a formal document used primarily in insurance and legal contexts to request compensation or benefits. This form serves as a declaration of the claimant's rights and the basis for their request. It is essential for individuals seeking to recover losses or receive payments for covered incidents. The allowance of claim outlines the specifics of the claim, including the nature of the loss, the amount being claimed, and any relevant supporting information.

Steps to complete the allowance of claim

Completing the allowance of claim involves several critical steps to ensure accuracy and compliance. First, gather all necessary documentation, such as receipts, contracts, or police reports, that support your claim. Next, fill out the form with precise details, including your personal information, the specifics of the incident, and the amount you are claiming. Review the form thoroughly to ensure all information is accurate and complete. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the requirements of the issuing organization.

Legal use of the allowance of claim

The legal validity of the allowance of claim hinges on compliance with relevant laws and regulations. In the United States, electronic signatures can be legally binding if they meet specific criteria outlined by the ESIGN Act and UETA. It is crucial to ensure that the form is executed properly, which may include obtaining necessary signatures and maintaining a clear record of the submission. Utilizing a reliable eSigning platform can help ensure that the allowance of claim is processed legally and securely.

Key elements of the allowance of claim

Several key elements must be included in the allowance of claim to ensure it is comprehensive and effective. These elements typically include:

- Claimant Information: Full name, address, and contact details of the individual submitting the claim.

- Incident Details: A description of the event that led to the claim, including dates, locations, and circumstances.

- Claim Amount: The total amount being requested, along with a breakdown of how this figure was calculated.

- Supporting Documents: Any additional documentation that substantiates the claim, such as invoices or contracts.

Who issues the form?

The allowance of claim form is typically issued by insurance companies, government agencies, or legal entities involved in the claims process. Each organization may have its own version of the form, tailored to its specific requirements and procedures. It is important for claimants to use the correct form as specified by the entity processing their claim to avoid delays or complications.

Filing deadlines / Important dates

Filing deadlines for the allowance of claim vary depending on the type of claim and the issuing organization. It is crucial for claimants to be aware of these deadlines to ensure their claims are submitted on time. Missing a filing deadline can result in the denial of the claim. Claimants should check the specific guidelines provided by the relevant agency or organization for accurate dates and any potential extensions that may apply.

Eligibility criteria

Eligibility criteria for submitting an allowance of claim can differ based on the nature of the claim and the policies of the issuing organization. Common criteria may include:

- Proof of loss or damage related to the claim.

- Timely submission of the claim within the specified deadlines.

- Compliance with any additional requirements set forth by the insurance policy or legal framework.

Understanding these criteria is essential for ensuring that your claim is valid and has a higher chance of approval.

Quick guide on how to complete allowance of claim

Effortlessly prepare ALLOWANCE OF CLAIM on any device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents rapidly without delays. Manage ALLOWANCE OF CLAIM on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to amend and electronically sign ALLOWANCE OF CLAIM with ease

- Acquire ALLOWANCE OF CLAIM and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive data using tools that airSlate SignNow specifically supplies for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Amend and electronically sign ALLOWANCE OF CLAIM to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the allowance of claim in the context of airSlate SignNow?

The allowance of claim refers to the process of approving and processing claims within airSlate SignNow's platform. This feature allows users to manage claims efficiently, ensuring that all necessary documents are signed and stored securely. With airSlate SignNow, businesses can streamline the allowance of claim, reducing delays and enhancing productivity.

-

How does airSlate SignNow handle the allowance of claim for businesses?

AirSlate SignNow simplifies the allowance of claim by providing customizable templates and automated workflows that guide users through the entire process. This ensures that all claim documents are signed promptly and accurately, minimizing errors. Companies can easily track the status of their claims in real-time.

-

What pricing plans are available for managing the allowance of claim with airSlate SignNow?

AirSlate SignNow offers various pricing plans designed to accommodate businesses of all sizes, each including features to manage the allowance of claim. These plans provide cost-effective solutions for document signing and management, with each tier offering increasing functionality. Users can choose the plan that best fits their business needs.

-

What security features help protect the allowance of claim documents in airSlate SignNow?

AirSlate SignNow prioritizes security for the allowance of claim documents by employing industry-standard encryption and secure storage solutions. Users can rest assured that their claims data is protected from unauthorized access. Additionally, audit trails provide complete visibility into who signed what and when.

-

Can I integrate airSlate SignNow with other software for the allowance of claim?

Yes, airSlate SignNow offers seamless integrations with many popular business applications to streamline the allowance of claim process. These integrations facilitate the transfer of data across platforms, improving efficiency and accuracy. Connecting with tools like CRM systems helps automate claim management.

-

What benefits does airSlate SignNow provide when it comes to the allowance of claim?

Using airSlate SignNow for the allowance of claim offers numerous benefits, including faster claim processing and reduced paperwork. The intuitive user interface and automated workflows make it easy for teams to manage claims efficiently, leading to quicker decisions. Enhanced collaboration features further improve communication around claims.

-

Is airSlate SignNow mobile-friendly for managing the allowance of claim?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing users to manage the allowance of claim on-the-go. This capability is vital for field employees who need to send and sign documents from their mobile devices. The mobile app offers full functionality, ensuring that claims can be processed anytime, anywhere.

Get more for ALLOWANCE OF CLAIM

- Make a court claim for money court fees gov uk form

- Burnet county 911 addressing form

- Interested provider information form magellan provideramp39s home

- Sub tuum praesidium low setting in g major form

- Law society property information form ta6 4th edition pdf download

- Arizona form 352

- Client referral agreement template form

- Client confidentiality agreement template form

Find out other ALLOWANCE OF CLAIM

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now