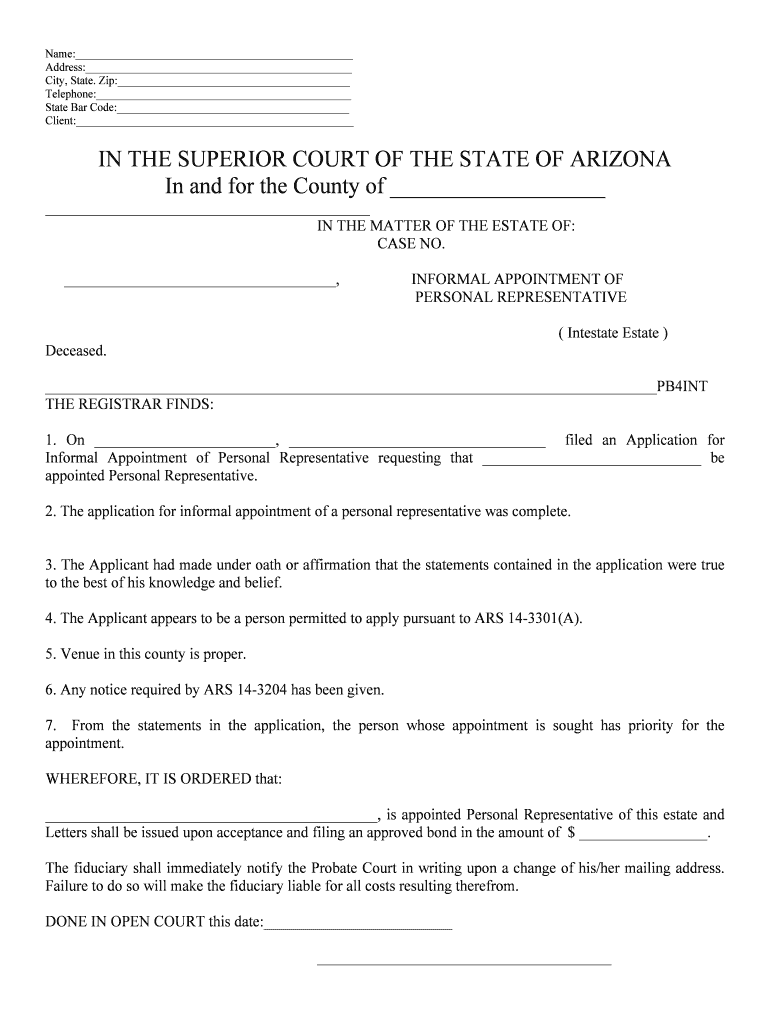

Intestate Estate Form

What is the intestate estate?

An intestate estate refers to the assets and property of an individual who passes away without a valid will. In such cases, the distribution of the deceased's estate is governed by state laws, often referred to as intestacy laws. These laws dictate how the estate will be divided among surviving relatives, typically prioritizing spouses, children, parents, and siblings. Understanding intestate estates is crucial for individuals to ensure their assets are distributed according to their wishes, rather than default state regulations.

Steps to complete the intestate estate

Completing the intestate estate process involves several key steps that must be followed to ensure proper legal compliance. First, the estate must be assessed to identify all assets and liabilities. Next, an application for probate should be filed in the appropriate court, which initiates the legal process of distributing the estate. After the probate court validates the estate, the appointed administrator can begin settling debts and distributing assets according to intestacy laws. It is important to maintain accurate records throughout this process to ensure transparency and legal compliance.

Legal use of the intestate estate

The legal use of an intestate estate involves adhering to state laws that govern the distribution of assets when someone dies without a will. Each state has its own intestacy statutes that outline how the estate should be divided among heirs. These laws ensure that the deceased's assets are allocated fairly and according to familial relationships. Understanding these legal frameworks is essential for administrators and heirs to navigate the complexities of estate distribution effectively.

State-specific rules for the intestate estate

State-specific rules for intestate estates can vary significantly, impacting how assets are distributed. Each state has its own set of intestacy laws that define the hierarchy of heirs and the portion of the estate they are entitled to receive. For example, some states may grant a larger share to a surviving spouse, while others may prioritize children. It is vital for individuals dealing with intestate estates to consult their state’s laws to understand the specific regulations that apply to their situation.

Required documents for intestate estate

To manage an intestate estate, certain documents are typically required. These may include the death certificate of the deceased, a list of all assets and debts, and any relevant court forms for filing probate. Additionally, identification documents for the appointed administrator and any heirs may be necessary. Gathering these documents in advance can streamline the probate process and help ensure compliance with legal requirements.

Penalties for non-compliance with intestate estate laws

Failure to comply with intestate estate laws can result in significant penalties. Administrators who do not follow the proper legal procedures may face fines, personal liability for debts, or even criminal charges in severe cases. Additionally, heirs may experience delays in receiving their inheritance or may be required to go through additional legal proceedings to rectify any issues caused by non-compliance. Understanding and adhering to these laws is crucial to avoid such penalties.

Examples of using the intestate estate

Examples of intestate estate scenarios can illustrate how intestacy laws function in real-life situations. For instance, if a person dies without a will and is survived by a spouse and two children, the spouse may receive a significant portion of the estate, while the remaining assets are divided among the children. In another scenario, if the deceased has no immediate family, the estate may pass to more distant relatives according to state laws. These examples highlight the importance of understanding intestate laws to ensure fair distribution of assets.

Quick guide on how to complete intestate estate

Effortlessly Prepare Intestate Estate on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Intestate Estate on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Intestate Estate with Ease

- Find Intestate Estate and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, SMS, invitation link, or by downloading it to your computer.

Eliminate the hassle of lost or misfiled documents, exhaustive form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Intestate Estate to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Intestate Estate?

An Intestate Estate refers to the assets and properties left by an individual who dies without a valid will. In such cases, state laws dictate how the estate is distributed among heirs. Understanding the implications of an Intestate Estate is crucial for effective estate planning.

-

How can airSlate SignNow help with Intestate Estate management?

airSlate SignNow streamlines the process of managing Intestate Estates by providing an easy-to-use platform for eSigning and sending relevant documents. This simplifies communication and ensures that all necessary paperwork is handled efficiently. Effective document management is essential when dealing with Intestate Estates.

-

What features does airSlate SignNow offer for Intestate Estate documentation?

With airSlate SignNow, users can create, edit, and eSign important documents related to an Intestate Estate swiftly. The platform also allows users to track document status and send reminders, ensuring that all parties stay informed and engaged throughout the process. These features help streamline estate management.

-

Is airSlate SignNow cost-effective for managing Intestate Estates?

Yes, airSlate SignNow is a cost-effective solution for managing Intestate Estates. With flexible pricing plans, businesses can choose the option that best meets their needs without overspending. This affordability makes airSlate SignNow an ideal choice for both individuals and businesses dealing with estates.

-

Can airSlate SignNow integrate with other tools for Intestate Estate management?

Absolutely! airSlate SignNow integrates seamlessly with a variety of tools and applications, making it easier to manage an Intestate Estate. These integrations enhance productivity and ensure that you can work within your preferred ecosystem while handling estate-related documents.

-

What are the benefits of using airSlate SignNow for Intestate Estates?

Using airSlate SignNow for Intestate Estates offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security for sensitive information. The ability to quickly eSign and send documents minimizes delays and helps ensure compliance with legal requirements related to Intestate Estates.

-

Is it easy to set up airSlate SignNow for Intestate Estate management?

Yes, setting up airSlate SignNow for managing Intestate Estates is straightforward. The user-friendly interface allows you to start eSigning and sending documents with minimal training. This ease of use is key to effectively managing an Intestate Estate without unnecessary complications.

Get more for Intestate Estate

- Lyft inspection form pdf

- Ccl200x climate change levy tax credit claim use this form to claim for payment of overpaid climate change levy hmrc gov

- Va form 29 357

- Dmv 34 tr form

- Avc petition form

- Pertinent vaccine information statements viss to the childs parentampnbsp odh ohio

- Self represented written answer and verification form

- Annamalai university convocation form

Find out other Intestate Estate

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT