REAL ESTATE TAX SALES and TAX DEEDS in ILLINOIS Form

What is the REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS

The real estate tax sales and tax deeds in Illinois refer to the process by which local governments sell properties to recover unpaid property taxes. When a property owner fails to pay their taxes, the county can place a lien on the property. If the taxes remain unpaid, the county may auction the property or sell a tax deed, allowing the buyer to take ownership. This process is governed by state laws and varies by county.

How to use the REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS

To effectively use the real estate tax sales and tax deeds in Illinois, interested buyers should first research available properties. This involves reviewing the list of properties scheduled for tax sale, which is typically published by the county. Once a property is identified, potential buyers must understand the bidding process, including registration requirements and payment methods. It is essential to conduct due diligence on the property, including checking for any existing liens or encumbrances.

Steps to complete the REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS

Completing the real estate tax sales and tax deeds process involves several key steps:

- Research available properties by accessing the county's tax sale list.

- Register for the tax sale, providing necessary documentation and payment of any required fees.

- Participate in the auction, placing bids on desired properties.

- If successful, complete the payment process as outlined by the county.

- Obtain the tax deed, ensuring all required paperwork is completed and submitted.

Legal use of the REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS

The legal use of real estate tax sales and tax deeds in Illinois is governed by state laws that outline the rights and responsibilities of both buyers and sellers. Buyers should ensure compliance with all legal requirements, including proper notice and adherence to bidding procedures. It is important to understand that purchasing a tax deed does not automatically grant clear title to the property; further steps may be necessary to resolve any outstanding issues.

State-specific rules for the REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS

Each county in Illinois may have specific rules regarding tax sales and deeds. These rules can include the length of the redemption period, the minimum bid amount, and the process for notifying property owners. Buyers should familiarize themselves with the regulations specific to the county where the property is located to ensure compliance and avoid potential pitfalls.

Required Documents

When participating in real estate tax sales in Illinois, certain documents are typically required. These may include:

- A valid government-issued identification.

- Proof of registration for the tax sale.

- Documentation of any required deposits or fees.

- Any additional forms specified by the county.

Penalties for Non-Compliance

Failure to comply with the regulations governing real estate tax sales and tax deeds in Illinois can result in significant penalties. These may include losing the right to the property, financial penalties, or legal action taken by the county. It is crucial for buyers to understand all requirements and adhere to them throughout the process to avoid these consequences.

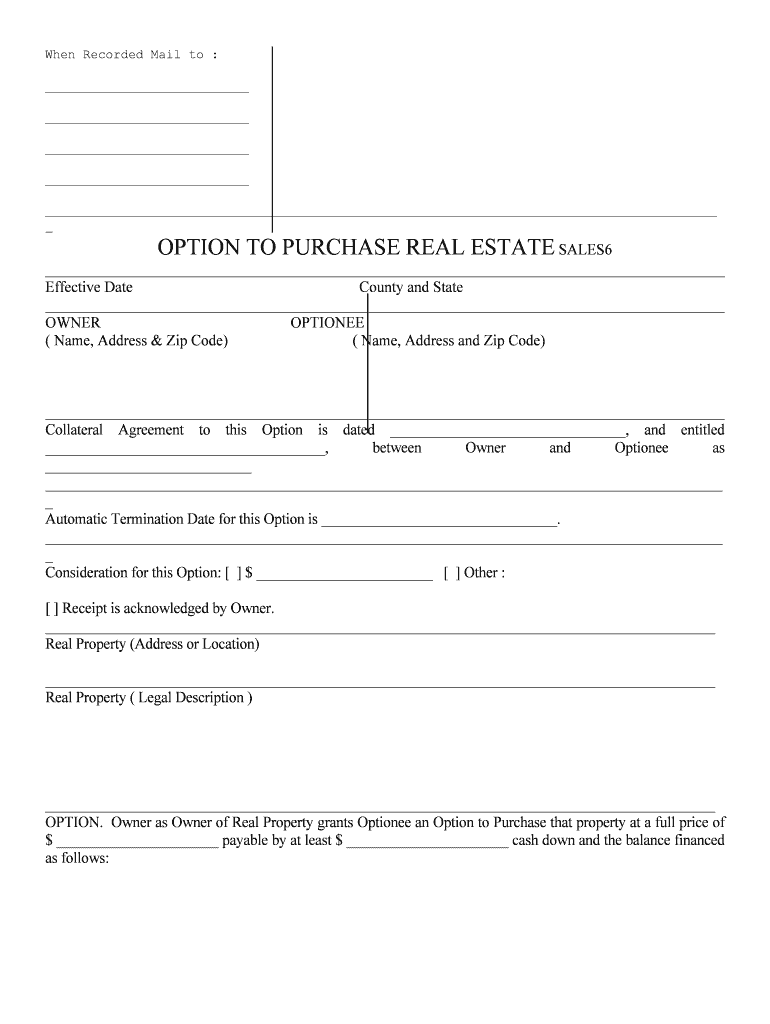

Quick guide on how to complete real estate tax sales and tax deeds in illinois

Easily Prepare REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS on Any Device

Web-based document management has gained popularity among both businesses and individuals. It presents an excellent environmentally friendly option to traditional printed and signed documents, allowing you to find the correct template and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your files promptly without any hold-ups. Manage REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Effortlessly Modify and Electronically Sign REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS

- Find REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or redact sensitive information using the instruments that airSlate SignNow specifically provides for that function.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you'd like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS refer to the process by which the state sells properties due to unpaid property taxes. Buyers can acquire tax deeds at these sales, which may secure ownership of the property once taxes are settled. It serves as a valuable investment opportunity for those looking to purchase real estate at lower costs.

-

How can I participate in REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

To participate in REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS, register with your local county tax authority and review their guidelines for the bidding process. It typically involves attending an auction and placing bids on the properties you are interested in. Ensuring that you are well-informed about the properties available is crucial to making sound investments.

-

What costs are involved in REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

Costs for participating in REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS include the bid amount, potential back taxes, interest, and auction fees. Additionally, consider costs for property inspection, maintenance, and legal advice. Being aware of all these costs upfront will help you budget accordingly for your investment.

-

What are the benefits of investing in REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

Investing in REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS can provide signNow financial returns with the potential for acquiring properties below market value. It's also a relatively quick way to increase your real estate holdings without traditional financing. Moreover, you have the opportunity to earn interest on your investments if you opt for tax lien certificates.

-

Are REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS safe investments?

While REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS can present unique risks, they are generally safe if proper due diligence is performed. Researching the property’s history, condition, and local market conditions is essential before bidding. Engaging with knowledgeable professionals can further mitigate risks involved in these investments.

-

How does airSlate SignNow assist with REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

airSlate SignNow provides a seamless solution for eSigning and managing documents related to REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS. With its intuitive platform, you can easily send, sign, and store essential real estate documents. This simplifies the transactional process, making it easier and faster to complete your deals.

-

What features does airSlate SignNow offer that relate to REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS?

airSlate SignNow offers features such as customizable templates, secure storage, and audit trails to help you manage documents for REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS effectively. The platform enhances collaboration with integrated tools, ensuring all parties can review and sign documents with ease. These features contribute to streamlining the transactional workflow.

Get more for REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS

- Children with hair loss form

- Fscs declaration amp consent form

- Health insurance exchange application form for obamacare facts

- Post event survey questions form

- 8946 form

- Kinsmen scholarship application sssad saskatoon secondary form

- Interview non disclosure agreement template form

- Obligations tracker contract template form

Find out other REAL ESTATE TAX SALES AND TAX DEEDS IN ILLINOIS

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template