Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Arizona Form

What is the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Arizona

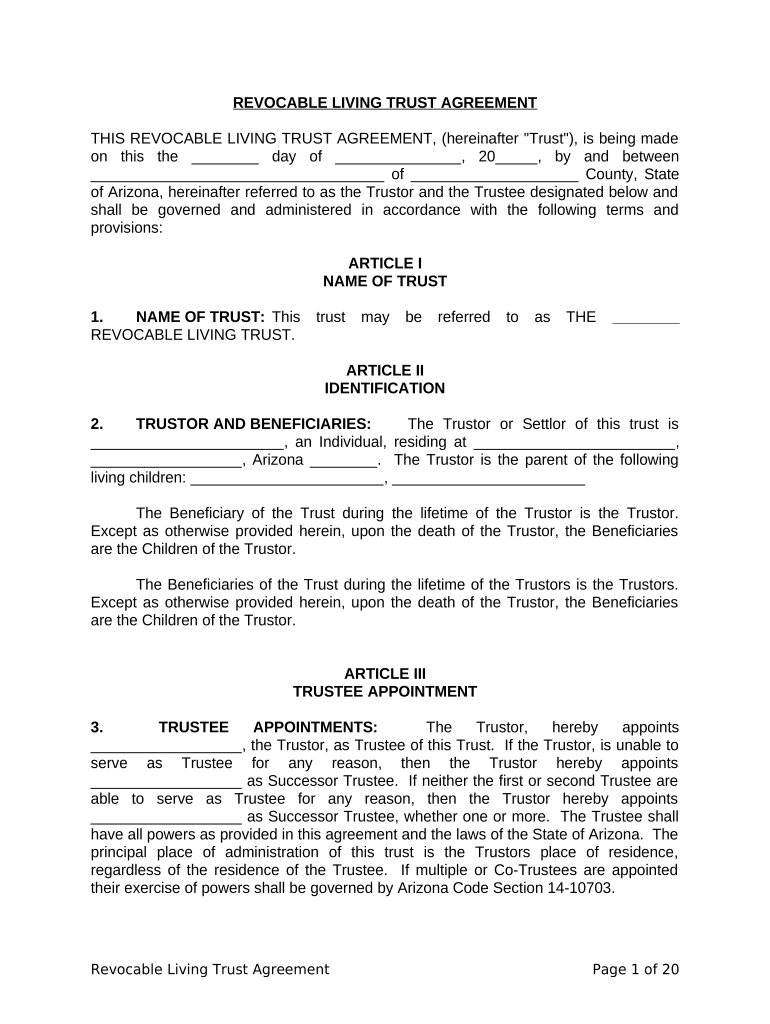

A living trust is a legal document that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. For individuals who are single, divorced, or widowed with children in Arizona, a living trust can provide a way to ensure that their children are taken care of according to their wishes. This type of trust helps avoid the probate process, which can be lengthy and expensive. It allows for a smoother transition of assets and can offer privacy, as the trust does not become a matter of public record like a will does.

How to Use the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Arizona

Using a living trust involves several key steps. First, you need to create the trust document, which outlines your wishes regarding asset distribution. Next, you should fund the trust by transferring ownership of your assets into it. This can include real estate, bank accounts, and investments. Once the trust is established and funded, you can manage it as you see fit during your lifetime. Upon your passing, the assets in the trust will be distributed to your beneficiaries according to the terms you specified, without going through probate.

Steps to Complete the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Arizona

Completing a living trust involves several important steps:

- Determine your assets: List all assets you wish to include in the trust.

- Choose a trustee: Select an individual or institution to manage the trust.

- Draft the trust document: This can be done with legal assistance or through a reliable online service.

- Fund the trust: Transfer ownership of your assets into the trust.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

Key Elements of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Arizona

Key elements of a living trust include:

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Those who will receive the assets from the trust after your passing.

- Assets: The property and financial accounts that are placed in the trust.

- Distribution instructions: Clear guidelines on how and when assets should be distributed to beneficiaries.

State-Specific Rules for the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Arizona

In Arizona, certain state-specific rules apply to living trusts. For example, the trust must be properly executed according to Arizona law, which typically requires the trust document to be signed and notarized. Additionally, Arizona recognizes the validity of living trusts created in other states, provided they comply with the laws of the state where they were created. It is advisable to consult with a legal professional familiar with Arizona estate planning laws to ensure compliance and to address any unique circumstances.

Legal Use of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in Arizona

A living trust is legally recognized in Arizona and can be used to manage and distribute assets. It allows individuals to maintain control over their assets while they are alive and provides a clear plan for distribution upon death. To ensure the trust is legally binding, it must meet specific requirements, such as being signed by the grantor and notarized. It is also important to keep the trust document updated to reflect any changes in personal circumstances or state laws.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children arizona

Effortlessly Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Arizona on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Arizona on any platform using airSlate SignNow's Android or iOS apps and enhance any document-based workflow today.

The Easiest Way to Edit and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Arizona Stress-Free

- Find Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Arizona and select Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for delivering your form—via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Arizona to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Arizona?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Arizona is a legal arrangement that allows you to manage your assets while you are alive and determine how they are distributed after your death. This type of trust can provide benefits such as avoiding probate, ensuring your children's welfare, and maintaining privacy in estate matters.

-

How does a Living Trust protect my children in Arizona?

A Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Arizona can ensure that your assets are managed for your children's benefit after your passing. You can specify ages or conditions under which your children will inherit, providing guidance for their financial future and protecting them from potential mismanagement.

-

What are the benefits of creating a Living Trust in Arizona?

Creating a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Arizona offers several benefits. It helps avoid the lengthy probate process, keeps your affairs private, and can provide clearer instructions to your loved ones, signNowly easing the burden during a difficult time.

-

What is the cost associated with setting up a Living Trust in Arizona?

The cost of creating a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Arizona can vary based on complexity and lawyer fees. Generally, you may expect costs ranging from a few hundred to a couple of thousand dollars, depending on your specific needs and circumstances.

-

Can I change my Living Trust in Arizona once it's established?

Yes, you can modify a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Arizona at any time as long as you are alive and mentally competent. Changes can include amending beneficiaries, altering terms, or even revoking the trust entirely if your situation changes.

-

What happens to my Living Trust if I move out of Arizona?

If you move out of Arizona, your Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children may still be valid, but it's advisable to consult with a legal expert in your new state. Laws regarding trusts can vary signNowly from state to state, and updates may be required to ensure compliance with the new state's regulations.

-

Is a Living Trust necessary if I have a will?

While having a will is essential for any estate plan, a Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children in Arizona offers distinct advantages such as avoiding probate and ensuring a smoother transition for your children. Many individuals find that combining both instruments provides a comprehensive strategy that addresses various aspects of estate management.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Arizona

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Arizona

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple