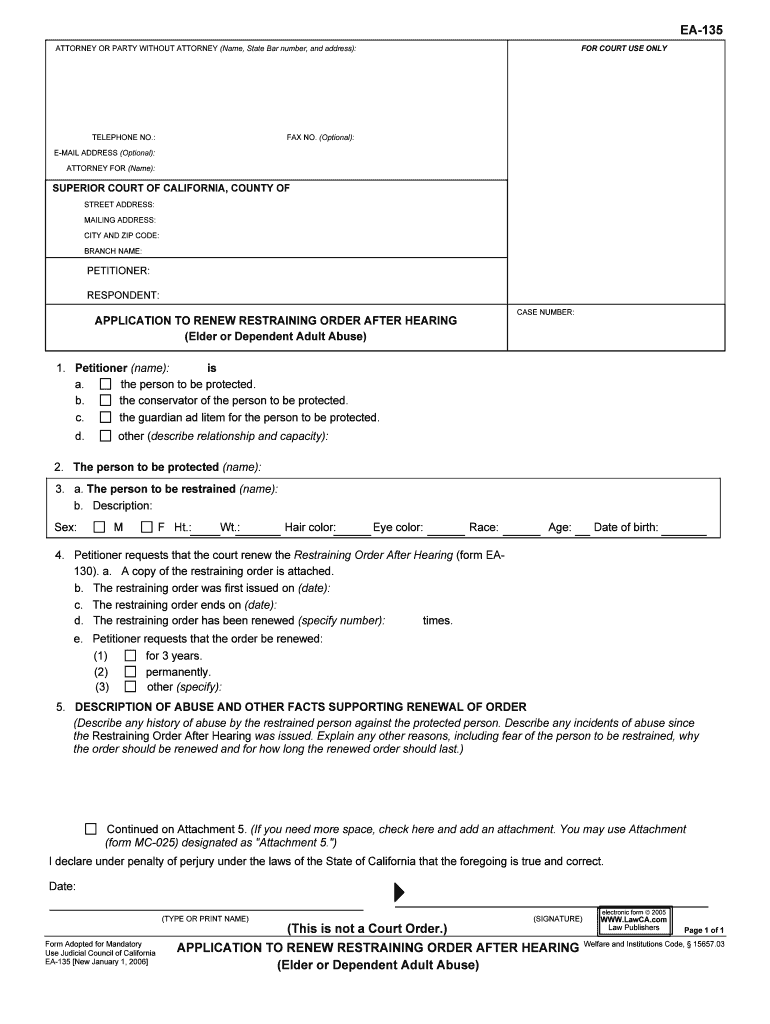

EA 135 Form

What is the EA 135

The EA 135 form is a specific document used in the context of tax compliance and reporting. It serves as a declaration of eligibility for certain tax benefits or exemptions. This form is particularly relevant for individuals and businesses seeking to clarify their tax status with the Internal Revenue Service (IRS). Understanding the purpose and requirements of the EA 135 is essential for ensuring compliance and avoiding potential penalties.

How to use the EA 135

Using the EA 135 involves several key steps to ensure accurate completion and submission. First, gather all necessary information, including your personal details and any relevant financial data. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the EA 135 as directed, either electronically or via mail, depending on your preference and the specific instructions provided by the IRS.

Steps to complete the EA 135

Completing the EA 135 requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather all required documentation, including identification and financial records.

- Fill out the form accurately, ensuring that all fields are completed.

- Double-check the information for accuracy, including names, dates, and amounts.

- Sign and date the form as required.

- Submit the form according to the IRS guidelines, either electronically or by mail.

Legal use of the EA 135

The EA 135 form is legally binding when completed and submitted according to IRS regulations. It is crucial to ensure that all information provided is truthful and accurate to avoid legal repercussions. The use of this form must comply with federal tax laws, and any discrepancies or false information can lead to penalties or audits. Understanding the legal implications of the EA 135 is vital for maintaining compliance and protecting oneself from potential legal issues.

Key elements of the EA 135

Several key elements must be included when completing the EA 135 to ensure its validity:

- Personal Information: Full name, address, and Social Security number.

- Tax Identification: Any relevant tax identification numbers associated with your business or personal tax filings.

- Eligibility Criteria: Clearly state the basis for your eligibility for the benefits or exemptions being claimed.

- Signature: A valid signature is required to authenticate the form.

Filing Deadlines / Important Dates

Filing deadlines for the EA 135 are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by a specific date each tax year, often aligning with the overall tax filing deadline. It is essential to stay informed about any changes to deadlines, as late submissions can result in penalties or loss of benefits. Mark important dates on your calendar to ensure timely filing and compliance.

Quick guide on how to complete ea 135

Complete EA 135 effortlessly on any device

Online document management has grown increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage EA 135 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign EA 135 seamlessly

- Find EA 135 and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign EA 135 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is EA 135 and how does it relate to airSlate SignNow?

EA 135 is a feature within airSlate SignNow that facilitates electronic signatures and document management. It allows users to efficiently send, sign, and store documents securely. With EA 135, businesses can streamline their workflows and enhance productivity by eliminating the need for paper-based processes.

-

What pricing options are available for EA 135 with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans for EA 135 that cater to various business needs. Pricing typically starts at competitive rates, making it accessible for small to large organizations. Users can choose from monthly or annual subscriptions, ensuring they get the best value for their investment.

-

What are the key features of the EA 135 solution?

The EA 135 solution includes features such as customizable templates, secure eSigning, and advanced document tracking. Users can collaborate in real time, ensuring all team members stay updated throughout the signing process. Additionally, EA 135 supports multiple file formats, making it versatile for different document types.

-

How does EA 135 enhance document security?

EA 135 enhances document security through encryption, compliance with regulations like ESIGN and UETA, and secure cloud storage. Users can track document activity and receive notifications for any changes made. This robust security measures give businesses peace of mind when handling sensitive information.

-

Can EA 135 integrate with other business applications?

Yes, EA 135 offers seamless integration with popular business applications like CRM platforms, cloud storage services, and project management tools. This interoperability allows for a smoother workflow and better data management. Businesses can choose to connect EA 135 with their existing systems to maximize efficiency.

-

What benefits does using EA 135 provide?

Using EA 135 provides numerous benefits, including reduced turnaround times for document signing, improved accuracy, and decreased operational costs. Businesses can enhance customer satisfaction by providing a fast and reliable eSigning process. EA 135 empowers teams to work more efficiently while staying organized.

-

Is it easy to get started with EA 135 on airSlate SignNow?

Absolutely, getting started with EA 135 on airSlate SignNow is straightforward. New users can quickly sign up, access tutorials, and find resources to guide them through the setup process. The user-friendly interface ensures that even those with little tech experience can navigate easily and begin utilizing EA 135 effectively.

Get more for EA 135

Find out other EA 135

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT