Schedule F Form 1040 Profit or Loss from Farming Irs Ustreas

What is the Schedule F Form 1040 Profit or Loss From Farming?

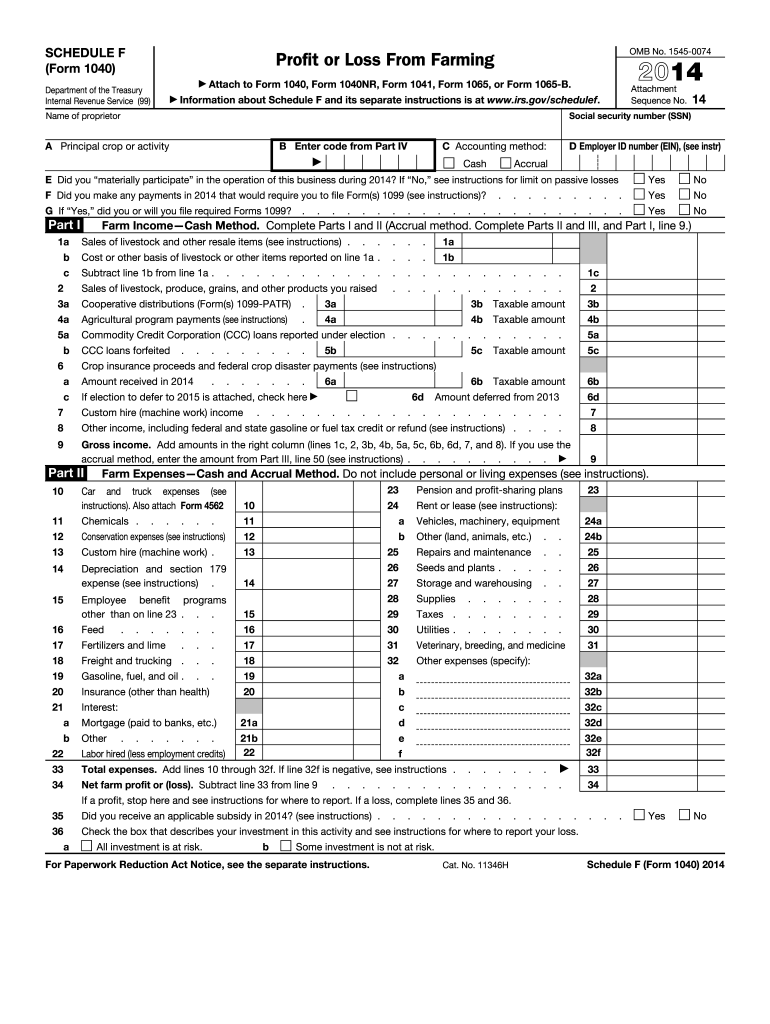

The Schedule F form, officially known as the Schedule F Form 1040, is a crucial document for farmers in the United States. It is used to report income and expenses related to farming activities. This form allows farmers to calculate their net profit or loss from their farming operations, which is then transferred to their main tax return, Form 1040. Understanding this form is essential for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Schedule F Form 1040 Profit or Loss From Farming

Completing the Schedule F form involves several steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather Financial Records: Collect all relevant documents, including income statements, expense receipts, and any other financial records associated with your farming activities.

- Fill Out Income Section: Report all income received from farming operations, including sales of livestock, crops, and any government payments.

- Detail Expenses: List all allowable farming expenses such as feed, fertilizer, labor, and equipment costs. Be sure to categorize these expenses accurately.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss for the year.

- Review and Submit: Double-check all entries for accuracy before submitting the form with your tax return.

Legal Use of the Schedule F Form 1040 Profit or Loss From Farming

The Schedule F form is legally binding when completed accurately and submitted to the IRS. It is essential for farmers to understand the legal implications of the information reported. Misreporting income or expenses can lead to penalties or audits. Therefore, ensuring that all data is truthful and substantiated by documentation is critical for compliance with IRS regulations.

IRS Guidelines for the Schedule F Form 1040

The IRS provides specific guidelines for completing the Schedule F form. These guidelines outline what constitutes allowable expenses, how to report income, and the importance of maintaining accurate records. Farmers should refer to the IRS instructions for Schedule F to ensure they are following the latest regulations and requirements. This includes understanding the nuances of what can be deducted and how to report various types of income.

Examples of Using the Schedule F Form 1040 Profit or Loss From Farming

Understanding practical examples of the Schedule F form can help clarify its use. For instance, a farmer who sells corn would report the income from sales in the income section. If they incurred costs for seeds, fertilizers, and equipment repairs, these would be listed as expenses. The net profit or loss would then reflect the financial performance of the farming operation for that tax year, providing a clear picture of the business's health.

Filing Deadlines and Important Dates for the Schedule F Form 1040

Filing deadlines for the Schedule F form align with the general tax return deadlines. Typically, individual tax returns, including Schedule F, are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for farmers to be aware of these dates to avoid late fees and penalties.

Quick guide on how to complete 2014 schedule f form 1040 profit or loss from farming irs ustreas

Complete Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly and without interruptions. Handle Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas seamlessly

- Find Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas and click on Get Form to initiate the process.

- Utilize the resources we offer to fulfill your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Edit and eSign Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

Create this form in 5 minutes!

How to create an eSignature for the 2014 schedule f form 1040 profit or loss from farming irs ustreas

How to make an electronic signature for your 2014 Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas in the online mode

How to generate an electronic signature for the 2014 Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas in Chrome

How to create an electronic signature for putting it on the 2014 Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas in Gmail

How to create an electronic signature for the 2014 Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas straight from your smart phone

How to create an electronic signature for the 2014 Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas on iOS

How to create an electronic signature for the 2014 Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas on Android

People also ask

-

What is the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas?

The Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas is a tax form used by farmers to report income and expenses related to their farming operations. This form allows farmers to calculate their net profit or loss, which is essential for tax reporting and ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas?

airSlate SignNow streamlines the process of preparing and signing the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas. With our platform, you can easily fill out, eSign, and send your forms securely, ensuring that your documents are both compliant and professionally handled.

-

What features does airSlate SignNow offer for farmers completing the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas?

airSlate SignNow offers a variety of features including customizable templates, secure eSigning, and document tracking, all designed to simplify the process of completing the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas. These features help ensure accuracy and efficiency in your documentation.

-

Is there a cost associated with using airSlate SignNow for the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas?

Yes, airSlate SignNow offers competitive pricing plans that cater to various needs, including those who need to complete the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas. We provide flexible options, ensuring you find a plan that fits your budget while giving you access to all necessary features.

-

Can I integrate airSlate SignNow with other accounting software for the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage your Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas alongside your other financial documents. This integration enhances productivity and ensures that all your data is synchronized.

-

What are the benefits of using airSlate SignNow for eSigning the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas?

Using airSlate SignNow for eSigning your Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas offers several benefits, including faster processing times, enhanced security, and a user-friendly interface. You can sign documents from anywhere, ensuring you meet deadlines without compromising on security.

-

How secure is the data when using airSlate SignNow for the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas?

Security is a top priority for airSlate SignNow. When using our platform for the Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas, your data is protected with advanced encryption protocols, ensuring that your sensitive information remains confidential and secure throughout the signing process.

Get more for Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas

- Please fill in this claim form and send it back to us as

- Espace clientla capitale form

- Request for information govuk

- E677 cross border currency or monetary instruments report form

- Cpa ontario id form

- Nursing and midwifery board of australia forms

- Fiji police clearance application inz 1185 form

- Condition inspection report rtb 27 form

Find out other Schedule F Form 1040 Profit Or Loss From Farming Irs Ustreas

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple