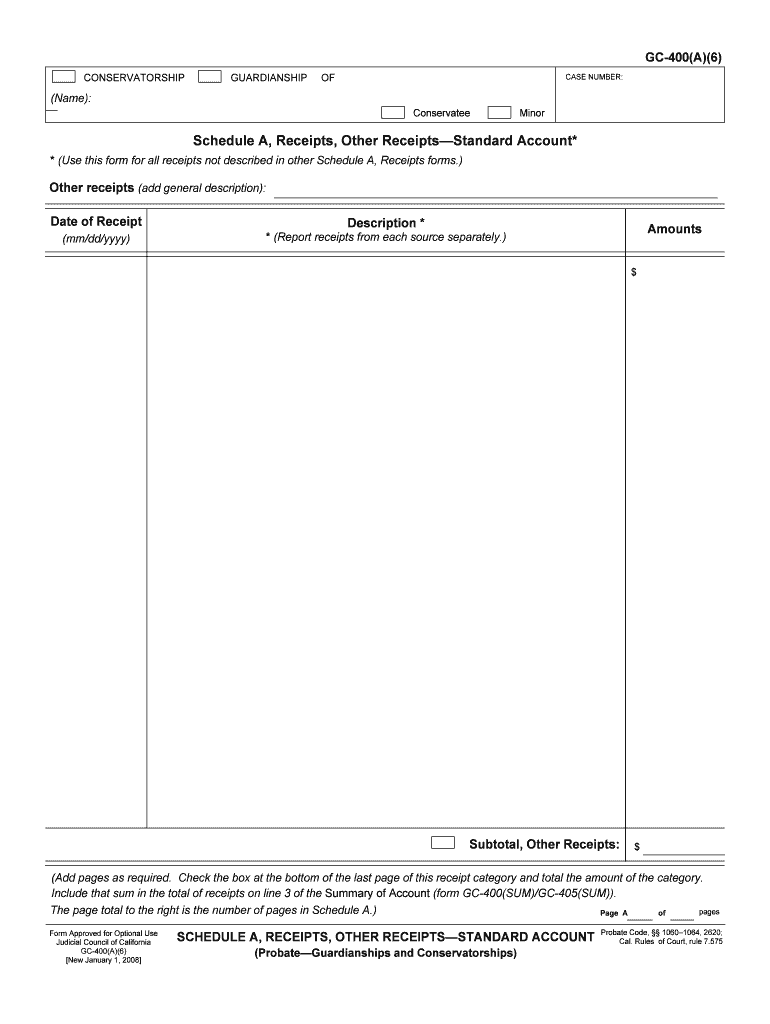

GC 400A6 Schedule A, Receipts, Other Receipts Form

What is the GC 400A6 Schedule A, Receipts, Other Receipts

The GC 400A6 Schedule A, Receipts, Other Receipts is a specific form used in the United States for reporting various types of income and receipts. This form is particularly relevant for taxpayers who need to document their income sources comprehensively. It allows individuals and businesses to provide detailed information about their receipts, ensuring compliance with tax regulations. The form plays a crucial role in the overall tax filing process, helping to clarify the financial activities of the taxpayer.

How to use the GC 400A6 Schedule A, Receipts, Other Receipts

Using the GC 400A6 Schedule A, Receipts, Other Receipts involves several straightforward steps. First, gather all relevant financial documents, including receipts and income statements. Next, accurately fill out the form by entering the required information in the designated fields. It is essential to ensure that all entries are correct and complete to avoid any discrepancies during the review process. After completing the form, it can be submitted alongside your tax return, either electronically or via mail, depending on your preference.

Steps to complete the GC 400A6 Schedule A, Receipts, Other Receipts

Completing the GC 400A6 Schedule A, Receipts, Other Receipts requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary receipts and income documentation.

- Review the form to understand the required sections.

- Enter your personal information, including name and taxpayer identification number.

- List all receipts and other income sources accurately, ensuring to categorize them correctly.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the GC 400A6 Schedule A, Receipts, Other Receipts

The legal use of the GC 400A6 Schedule A, Receipts, Other Receipts is essential for ensuring compliance with U.S. tax laws. This form must be filled out accurately to reflect all income received during the tax year. Failure to provide accurate information can lead to penalties or audits by the Internal Revenue Service (IRS). It is crucial to maintain records of all receipts and documentation submitted with the form to support your claims in case of any inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the GC 400A6 Schedule A, Receipts, Other Receipts align with the overall tax filing schedule in the United States. Typically, individual taxpayers must submit their forms by April fifteenth of each year. However, if you are unable to meet this deadline, you may apply for an extension. It is important to stay informed about any changes to deadlines, as they can vary based on specific circumstances or IRS announcements.

Examples of using the GC 400A6 Schedule A, Receipts, Other Receipts

Examples of using the GC 400A6 Schedule A, Receipts, Other Receipts include various scenarios where taxpayers need to report income. For instance, self-employed individuals may use this form to document income from freelance work or contract jobs. Additionally, businesses may utilize it to report receipts from sales or services rendered. By providing clear examples of income sources, the form helps ensure that all financial activities are accurately reported to the IRS.

Quick guide on how to complete gc 400a6 schedule a receipts other receipts

Complete GC 400A6 Schedule A, Receipts, Other Receipts effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access the suitable form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage GC 400A6 Schedule A, Receipts, Other Receipts on any platform with airSlate SignNow's Android or iOS applications and streamline any document-focused procedure today.

How to modify and electronically sign GC 400A6 Schedule A, Receipts, Other Receipts with ease

- Find GC 400A6 Schedule A, Receipts, Other Receipts and click Get Form to begin.

- Use the tools at your disposal to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign GC 400A6 Schedule A, Receipts, Other Receipts and ensure outstanding communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the GC 400A6 Schedule A, Receipts, Other Receipts?

The GC 400A6 Schedule A, Receipts, Other Receipts is a specific form used for reporting various types of receipts in Canadian tax filings. This form helps individuals and businesses itemize and document their income accurately. airSlate SignNow provides a platform that simplifies the eSigning process for these kinds of documents.

-

How can airSlate SignNow help with GC 400A6 Schedule A, Receipts, Other Receipts?

airSlate SignNow offers a user-friendly interface that allows you to easily create, send, and eSign the GC 400A6 Schedule A, Receipts, Other Receipts. By streamlining the eSigning process, it helps ensure that your receipts are handled efficiently and in compliance with tax regulations.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers a range of pricing plans that cater to different business needs, starting from a basic plan to more advanced options. Each plan includes features that support the management of documents like the GC 400A6 Schedule A, Receipts, Other Receipts. You can choose a plan based on your volume of documents and required functionalities.

-

What features does airSlate SignNow offer for managing receipts?

airSlate SignNow includes features such as custom templates, eSignature capabilities, and document tracking. These features allow users to effectively manage their GC 400A6 Schedule A, Receipts, Other Receipts and ensure that they are signed and submitted in a timely manner.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers various integrations with popular software tools such as Google Drive, Dropbox, and Salesforce. This allows you to manage your documents, including the GC 400A6 Schedule A, Receipts, Other Receipts, seamlessly across different platforms.

-

Is it safe to use airSlate SignNow for sensitive documents?

Absolutely. airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive documents like the GC 400A6 Schedule A, Receipts, Other Receipts. You can trust that your information is safe while using our services.

-

How do I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple. You can sign up for an account on our website, choose a suitable plan, and begin creating your documents, including the GC 400A6 Schedule A, Receipts, Other Receipts. Our platform offers tutorials and support to guide you through the process.

Get more for GC 400A6 Schedule A, Receipts, Other Receipts

Find out other GC 400A6 Schedule A, Receipts, Other Receipts

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney