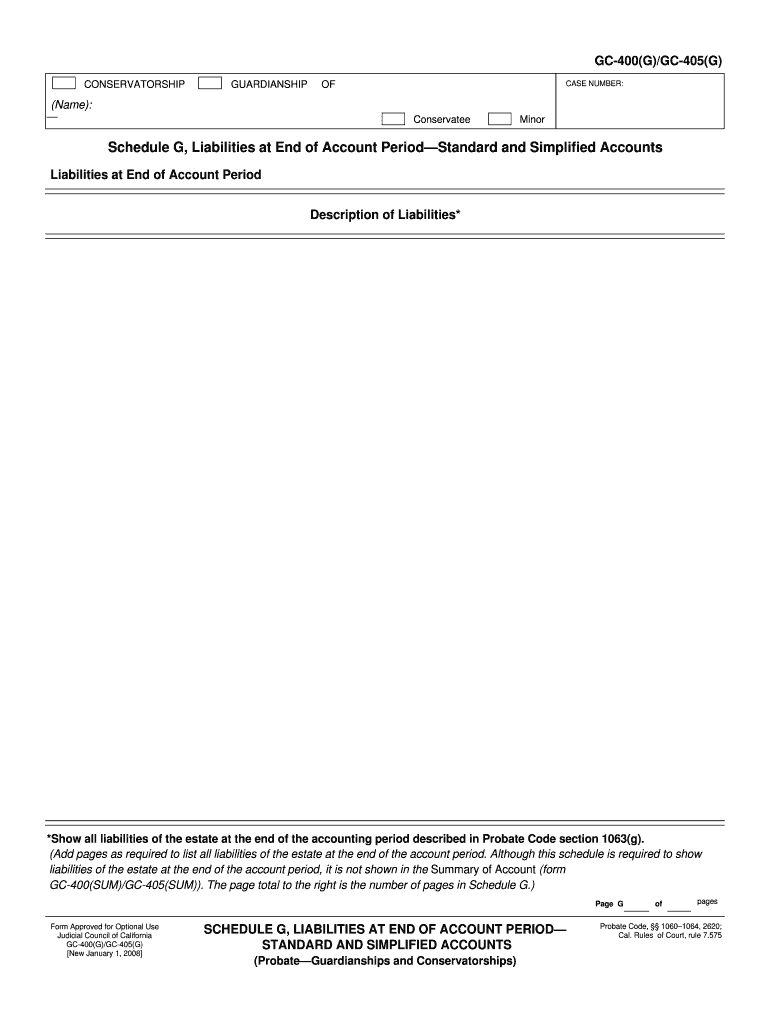

GC 400G GC 405G Schedule G, Liabilities at End of Form

What is the GC 400G GC 405G Schedule G, Liabilities At End Of

The GC 400G GC 405G Schedule G, Liabilities At End Of is a crucial form used in the context of tax reporting. It is specifically designed for businesses to disclose their liabilities at the end of a reporting period. This form helps ensure transparency and compliance with tax regulations by providing detailed information about outstanding debts and obligations. Proper completion of this form is essential for accurate financial reporting and tax assessment.

Steps to complete the GC 400G GC 405G Schedule G, Liabilities At End Of

Completing the GC 400G GC 405G Schedule G involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including previous tax returns and current financial statements. Next, identify all liabilities that need to be reported, such as loans, accounts payable, and any other outstanding obligations. Carefully fill out the form, ensuring that each liability is accurately documented with the correct amounts. Finally, review the completed form for any errors before submission to avoid potential penalties.

Legal use of the GC 400G GC 405G Schedule G, Liabilities At End Of

The legal use of the GC 400G GC 405G Schedule G is governed by federal and state tax laws. This form must be completed in accordance with the Internal Revenue Service (IRS) guidelines to ensure that all reported liabilities are valid and accurately reflect the business's financial position. Failure to comply with these legal requirements can result in penalties, including fines or audits. It is important for businesses to understand the legal implications of the information provided on this form.

Filing Deadlines / Important Dates

Filing deadlines for the GC 400G GC 405G Schedule G are critical for compliance. Typically, businesses must submit this form alongside their annual tax returns. It is essential to be aware of specific dates, as they may vary based on the business entity type and fiscal year. Missing a deadline can lead to penalties or interest on unpaid taxes, making it vital to stay informed about these important dates.

Required Documents

To complete the GC 400G GC 405G Schedule G, various documents are required. These may include financial statements, previous tax returns, and documentation of all liabilities. Accurate records are necessary to ensure that the information reported is complete and truthful. Having all required documents on hand will streamline the completion process and reduce the risk of errors.

Examples of using the GC 400G GC 405G Schedule G, Liabilities At End Of

Examples of using the GC 400G GC 405G Schedule G can help clarify its application. For instance, a small business may use this form to report outstanding loans from banks, unpaid invoices from suppliers, or accrued expenses. Each of these liabilities must be listed with precise amounts to provide an accurate financial picture. Understanding these examples can assist businesses in ensuring they report all necessary information accurately.

Quick guide on how to complete gc 400g gc 405g schedule g liabilities at end of

Complete GC 400G GC 405G Schedule G, Liabilities At End Of effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage GC 400G GC 405G Schedule G, Liabilities At End Of on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign GC 400G GC 405G Schedule G, Liabilities At End Of with ease

- Find GC 400G GC 405G Schedule G, Liabilities At End Of and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Leave behind worries of lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Edit and eSign GC 400G GC 405G Schedule G, Liabilities At End Of and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a scheduleg certificate and how can it benefit my business?

A scheduleg certificate is a powerful tool that allows businesses to streamline their document management processes. By using airSlate SignNow, you can easily create, send, and eSign documents, saving time and reducing the risk of errors. This enhances efficiency and helps you maintain compliance with relevant regulations.

-

How much does airSlate SignNow cost when using a scheduleg certificate?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses seeking a scheduleg certificate. Each plan offers a range of features to suit different needs, ensuring you get the best value for your investment. You can explore our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other tools while using a scheduleg certificate?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, enabling you to enhance your workflow while managing scheduleg certificates. This means you can connect with your existing tools like CRM systems, project management software, and much more, creating a more cohesive experience. Check our integrations page for a full list.

-

What features does airSlate SignNow offer for managing scheduleg certificates?

AirSlate SignNow provides a range of features specifically designed for managing scheduleg certificates, including customizable templates, automatic reminders, and real-time tracking. These features simplify the signing process and ensure you stay organized. By using these tools, you can ensure your documents are signed on time and stored securely.

-

Is it easy to set up and use airSlate SignNow for scheduleg certificates?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to set up and use while managing scheduleg certificates. You can quickly onboard your team with intuitive tools and straightforward instructions, allowing you to focus on your business without getting bogged down by complex software.

-

Are scheduleg certificates legally binding when using airSlate SignNow?

Yes, scheduleg certificates signed through airSlate SignNow are legally binding. Our platform complies with various electronic signature laws, including eIDAS and ESIGN, ensuring that your signed documents meet legal requirements. This provides peace of mind and security for your business transactions.

-

What benefits can I expect from using a scheduleg certificate in my workflow?

Utilizing a scheduleg certificate with airSlate SignNow can signNowly improve your workflow by enhancing efficiency and reducing turnaround times for document signing. You'll benefit from secure access to documents, improved collaboration, and increased transparency in your operations. This ultimately leads to higher productivity and better business outcomes.

Get more for GC 400G GC 405G Schedule G, Liabilities At End Of

Find out other GC 400G GC 405G Schedule G, Liabilities At End Of

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy