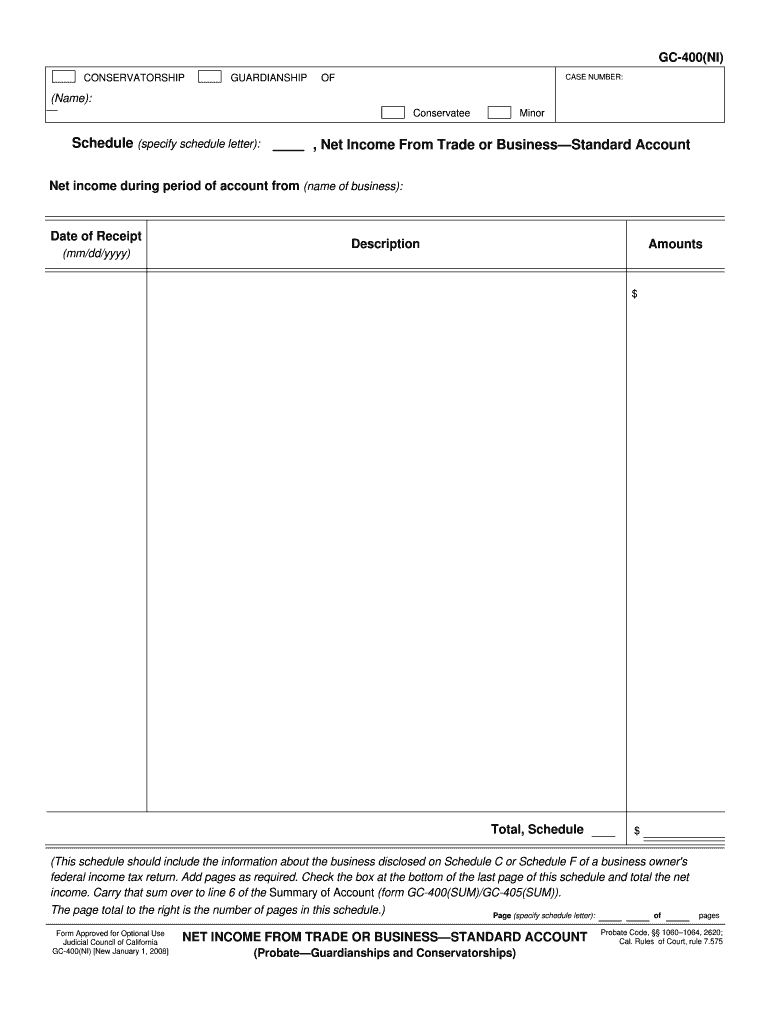

, Net Income from Trade or BusinessStandard Account Form

What is the Net Income From Trade Or Business Standard Account

The Net Income From Trade Or Business Standard Account form is a crucial document used for reporting income generated from various business activities. This form is essential for individuals and entities engaged in trade or business, as it helps in calculating the net income that is subject to taxation. The information provided in this form is used by the Internal Revenue Service (IRS) to assess tax liabilities and ensure compliance with federal tax regulations.

How to use the Net Income From Trade Or Business Standard Account

Using the Net Income From Trade Or Business Standard Account form involves several steps to ensure accurate reporting. First, gather all relevant financial documents, including income statements, expense reports, and any other records that detail your business activities. Next, fill out the form by entering your total income and deducting any allowable business expenses. Ensure that all calculations are accurate, as errors can lead to penalties or audits. Finally, submit the completed form to the appropriate tax authority, either electronically or by mail, depending on your preference and the requirements of your state.

Steps to complete the Net Income From Trade Or Business Standard Account

Completing the Net Income From Trade Or Business Standard Account form requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, including income and expense records.

- Calculate your total income from all business activities.

- List all allowable business expenses that can be deducted from your total income.

- Subtract total expenses from total income to determine net income.

- Fill in the form accurately, ensuring all figures are correct.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority by the specified deadline.

Legal use of the Net Income From Trade Or Business Standard Account

The legal use of the Net Income From Trade Or Business Standard Account form is governed by federal tax laws. This form must be completed accurately to reflect your business's financial activity. Failing to report income or misrepresenting expenses can lead to severe penalties, including fines and interest on unpaid taxes. It is essential to maintain accurate records and ensure compliance with all applicable tax regulations to avoid legal repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing the Net Income From Trade Or Business Standard Account form. These guidelines include instructions on what constitutes taxable income, allowable deductions, and the importance of maintaining proper documentation. Taxpayers should familiarize themselves with these guidelines to ensure that their filings are compliant and accurate. Additionally, the IRS offers resources and tools to assist in understanding the requirements for this form.

Filing Deadlines / Important Dates

Filing deadlines for the Net Income From Trade Or Business Standard Account form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year being reported. However, if you are self-employed or operate a business, you may need to adhere to different deadlines based on your specific tax situation. It is advisable to check the IRS website or consult a tax professional for the most current information regarding deadlines and any extensions that may apply.

Quick guide on how to complete net income from trade or businessstandard account

Complete , Net Income From Trade Or BusinessStandard Account effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly and without delays. Manage , Net Income From Trade Or BusinessStandard Account on any device with airSlate SignNow Android or iOS apps and enhance any document-related task today.

The easiest way to edit and eSign , Net Income From Trade Or BusinessStandard Account without any hassle

- Obtain , Net Income From Trade Or BusinessStandard Account and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential parts of your documents or obscure sensitive information with tools that airSlate SignNow provides for that specific need.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign , Net Income From Trade Or BusinessStandard Account and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Net Income From Trade Or BusinessStandard Account?

Net Income From Trade Or BusinessStandard Account refers to the earnings derived from business operations after deducting expenses. It is essential for business owners to understand this figure as it impacts their overall financial health and tax obligations. By accurately calculating your net income, you can make informed decisions about your business's future.

-

How does airSlate SignNow help with managing Net Income From Trade Or BusinessStandard Account?

airSlate SignNow streamlines the documentation process, allowing you to focus on analyzing your net income from trade or business activities. By eSigning and managing contracts efficiently, you can ensure accurate and timely tracking of your business transactions. This ultimately helps in maintaining a clear picture of your net income.

-

What features does airSlate SignNow offer for my Net Income From Trade Or BusinessStandard Account?

Key features of airSlate SignNow include easy document eSigning, templates for contracts, and real-time collaboration. These tools facilitate the management of your business documents, making it simple to track income and expenses related to your net income from trade or business. Additionally, the platform provides audit trails for transparency.

-

Is there a cost associated with using airSlate SignNow for my Net Income From Trade Or BusinessStandard Account?

Yes, airSlate SignNow offers multiple pricing plans to cater to different business needs, making it a cost-effective solution for managing your net income from trade or business. The pricing is flexible and competitive, ensuring that you only pay for the features that best suit your business model. You can find detailed pricing information on our website.

-

What integrations does airSlate SignNow support for accounting related to Net Income From Trade Or BusinessStandard Account?

airSlate SignNow seamlessly integrates with various accounting software solutions, making it easier to manage records related to your net income from trade or business. Popular integrations include QuickBooks, Xero, and more. This allows for automated data transfer and reduces the chances of manual errors.

-

How can I benefit from using airSlate SignNow for my Net Income From Trade Or BusinessStandard Account?

Utilizing airSlate SignNow can signNowly enhance your efficiency in managing business transactions. With fast and secure eSigning capabilities, businesses can close deals quicker and maintain better records of their net income from trade or business. This efficiency translates to better decision-making and improved cash flow management.

-

Can airSlate SignNow help me track expenses related to my Net Income From Trade Or BusinessStandard Account?

Absolutely! airSlate SignNow provides tools that allow you to organize and store receipts and invoices digitally. By maintaining a well-organized record of your expenses on the platform, you can easily calculate your net income from trade or business and ensure accurate financial reporting.

Get more for , Net Income From Trade Or BusinessStandard Account

- New brunswick declaration form

- Recertification update spectrum enterprises form

- Music therapy intake form

- Indian passport surrender certificate sample form

- Ponyexpressbsa form

- All coast guard military personnel shall complete sections 1 5 read instructions on back before starting and submit to form

- Frozen mini pizza score sheet exhibitor name form

- Protection of human subjects assurance identificationirb certificationdeclaration of form

Find out other , Net Income From Trade Or BusinessStandard Account

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word