Illinois Llc 35 15 Articles of Dissolution Form

What is the Illinois LLC 35 15 Articles of Dissolution

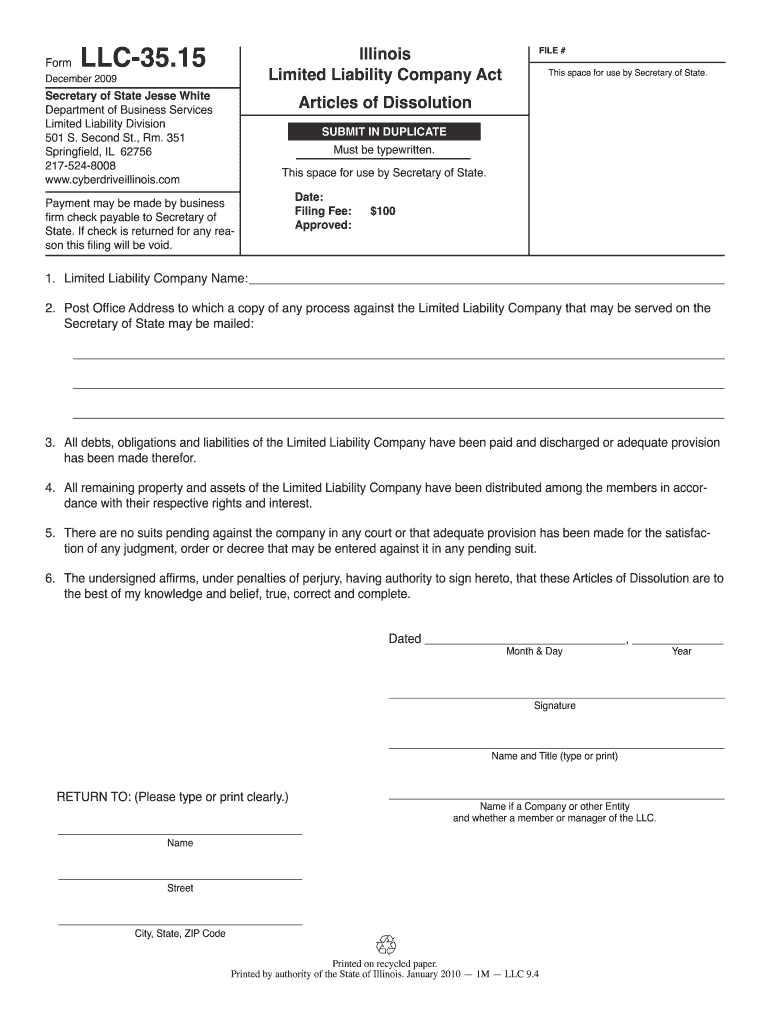

The Illinois LLC 35 15 Articles of Dissolution is a legal document used to formally dissolve a limited liability company (LLC) in the state of Illinois. This document serves as a declaration to the state that the LLC has ceased operations and is no longer conducting business. Filing this form is essential to ensure that the dissolution process is recognized legally, which helps protect the owners from future liabilities associated with the LLC.

When completing the articles of dissolution, it is important to provide accurate information about the LLC, including its name, the date of dissolution, and any other relevant details as required by state law. This form must be filed with the Illinois Secretary of State's office to finalize the dissolution process.

Steps to Complete the Illinois LLC 35 15 Articles of Dissolution

Completing the Illinois LLC 35 15 Articles of Dissolution involves several steps to ensure that the form is filled out correctly and submitted properly. Here are the essential steps:

- Gather necessary information about the LLC, including its official name, date of formation, and the reason for dissolution.

- Obtain the Illinois LLC 35 15 Articles of Dissolution form from the Illinois Secretary of State's website or office.

- Fill out the form accurately, ensuring all required fields are completed, including signatures from the LLC members or managers.

- Review the completed form for accuracy and completeness before submission.

- Submit the form either online, by mail, or in person to the appropriate office.

Legal Use of the Illinois LLC 35 15 Articles of Dissolution

The legal use of the Illinois LLC 35 15 Articles of Dissolution is crucial for ensuring that the dissolution of the LLC is recognized by state authorities. Filing this document legally terminates the existence of the LLC and protects its members from any future liabilities. It is a formal process that must comply with state regulations, including the proper completion and submission of the form.

Additionally, the articles of dissolution may be required for tax purposes, as they provide proof that the business has been officially dissolved. This can be important when filing final tax returns or addressing any outstanding debts or obligations of the LLC.

Required Documents for the Illinois LLC 35 15 Articles of Dissolution

When preparing to file the Illinois LLC 35 15 Articles of Dissolution, certain documents may be required to support the dissolution process. These documents can include:

- The completed Illinois LLC 35 15 Articles of Dissolution form.

- Any resolutions or agreements from the LLC members approving the dissolution.

- Final tax returns or documentation showing that all debts and obligations have been settled.

- Proof of payment for any associated filing fees.

Filing Deadlines for the Illinois LLC 35 15 Articles of Dissolution

Filing deadlines for the Illinois LLC 35 15 Articles of Dissolution can vary depending on specific circumstances. It is advisable to file the articles of dissolution as soon as the decision to dissolve the LLC is made. However, there are no strict deadlines imposed by the state for filing this document.

It is important to ensure that all business activities have ceased before submitting the form. Additionally, members should consider any tax implications and ensure compliance with state regulations to avoid penalties or complications in the future.

Form Submission Methods for the Illinois LLC 35 15 Articles of Dissolution

The Illinois LLC 35 15 Articles of Dissolution can be submitted through several methods, providing flexibility for business owners. The submission methods include:

- Online Submission: The form can be filed electronically through the Illinois Secretary of State's online portal.

- Mail: The completed form can be printed and mailed to the appropriate office, along with any required fees.

- In-Person: Business owners can also submit the form in person at the Secretary of State's office for immediate processing.

Quick guide on how to complete llc 3515 articles of dissolution form

Easily Arrange Illinois Llc 35 15 Articles Of Dissolution on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without hassle. Manage Illinois Llc 35 15 Articles Of Dissolution on any device using the airSlate SignNow applications for Android or iOS and enhance your document-centric workflows today.

The Simplest Way to Modify and Electronically Sign Illinois Llc 35 15 Articles Of Dissolution

- Locate Illinois Llc 35 15 Articles Of Dissolution and click on Get Form to initiate the process.

- Use the available tools to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks, from any device you choose. Modify and electronically sign Illinois Llc 35 15 Articles Of Dissolution and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out the articles of organization for an LLC in Florida?

Quoting Instructions for Articles of Organization (FL LLC) :FILING ONLINE OR BY MAILThese instructions are for the formation of a Florida Limited Liability Company pursuant to s.605.0201, F.S., and cover the minimum requirements for filing Articles of Organization.Your Articles of Organization may need to include additional items that specifically apply to your situation. The Division of Corporations strongly recommends that legal counsel reviews all documents prior to submission.The Division of Corporations is a ministerial filing agency. We cannot provide any legal, accounting, or tax advice.Limited Liability Company NameThe name must be distinguishable on the records of the Department of State.You should do a preliminary search by name before submitting your document.The name must include:Limited Liability Company, LLC or L.L.C.; ORChartered, Professional Limited Liability Company, P.L.L.C. or PLLC if forming a professional limited liability company.Do not use or assume the name is approved until you receive a filing acknowledgment from the Division of Corporations.Principal Place of Business AddressThe street address of the LLC’s principal office.Mailing AddressThe LLC’s mailing address, if different from the principal address. (P.O. Box is acceptable.)Registered Agent Name and AddressThe individual or legal entity that will accept service of process on behalf of the business entity is the registered agent.A business entity with an active Florida filing or registration may serve as a registered agent.An entity cannot serve as its own registered agent. However, an individual or principal associated with the business may serve as the registered agent.The registered agent must have a physical street address in Florida. (Do not list a P.O. Box address.)Registered Agent’s SignatureThe registered agent must sign the application.The signature confirms the agent is familiar with and accepts the obligations of s.605.0113(3), F.S.If a business entity is designated as the Agent, a principal (individual) of that entity must sign to accept the obligations.If filing online:The registered agent must type their name in the signature block.Pursuant to s.15.16, F.S., electronic signatures have the same legal effect as original signatures.NOTE: Typing someone’s name/signature without their permission constitutes forgery pursuant to s.831.06, F.S.Limited Liability Company PurposeA Professional Limited Liability Company (which is formed under both Chapter 605 and Chapter 621, F.S.) must enter a single specific professional purpose. Example: the practice of law, accounting services, practicing medicine, etc.Non-professional companies are not required to list a purpose, but may do so.Manager/Authorized RepresentativeThe names and street addresses of the authorized representatives or managers are optional.Manager: a person designated to perform the management functions of a manager-managed limited liability company. Use MGR.Authorized Representative: a person who is authorized to execute and file records with the Division of Corporations. Use AR. See 605.0102(8), F.S., for more information.A Manager or Authorized Representative may be an individual or business entity.Do not list members.NOTE: If you are applying for workers’ comp exemption or opening a bank account, Florida’s Division of Workers’ Compensation and your financial institution may require this information to be designated in the Department of State’s records.Effective DateAn LLC’s existence begins on the date the Division of Corporations receives and files your Articles unless your Articles of Organization specify an acceptable alternate “effective” date.LLCs can specify an effective date that is no more than five business days prior to, or 90 days after, the date the document is received by our office.If you are forming your LLC between October 1 and December 31st, but don’t expect to transact business until the next calendar year, avoid filing an annual report form for the upcoming calendar year by listing an effective date of January http://1st.By specifying January 1st as the effective date, your LLC’s existence will not officially begin until January 1st of the following calendar year, even though your entity is already on the Division’s records.The January 1st effective date will allow you to postpone your LLC’s requirement to file an annual report form for one calendar year.SignatureMust be signed by at least one person acting as the authorized representative.If filing online: The authorized representative must type their name in the signature block. Electronic signatures have the same legal effect as original signatures.Correspondence Name and EmailPlease provide a valid email address.If filing online: The filing acknowledgment and certification (if any) will be emailed to this address.All future email communications will be sent to this address.Keep your email address up to date.Certificate of StatusYou may request a certificate of status.This item is not required.A certificate of status certifies the status and existence of the LLC and verifies the LLC has paid all fees due to this office through a certain date.Fee: $5.00 eachCertified CopyYou may request a certified copy of your Articles of Organization.This item is not required.A certified copy will include a filed stamped copy of your Articles of Organization and will verify that the copy is a true and correct copy of the document in our records.Fee: $30.00 eachAnnual Report NoticeEvery LLC is required to file an annual report to maintain an “active” status in our records.If the limited liability company fails to file the report, it will be administratively dissolved.The filing period for annual reports is January 1st to May 1st of the calendar year following the LLC’s date of filing or, if listed, its effective date.The annual report is not a financial statement.The report is used to confirm or update the entity’s information on our records.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

What are the forms needed in Delaware for out of state LLC dissolution? I live in New Jersey but I filed an LLC in Delaware.

Filling a Certificate of Cancellation in Delaware is how you close a Delaware LLC regardless of where you reside or do business. A Delaware Registered Agent can do this for you or you can do it yourself by mail with the Delaware Division of Corporations.Alternatively, you can just let it go and the state will mark it NOT in good standing when you miss your first franchise tax payment (June 1st each year).You can also ask your Registered Agent to resign on your LLC which will put it in NOT good standing and effectively it will be forgotten. If you do this the state will not come after you for the past due Franchise Tax but some agents will require that you pay their agent fee before they will file the document for you.Keep in mind, the state of Delaware does NOT keep any record of the members of any Delaware LLC so they will not penalize you in the future if you form another LLC in the future.Be sure when you file a cancellation that you have transferred all the assets from the LLC and closed your bank account FIRST, because once you have cancelled a Delaware LLC you cannot revive it.Notify the IRS AFTER you have received your copy of the Certificate of Cancellation from the agent or Delaware, because they will want to have a copy of the filed Certificate of Cancellation.The above is simply a description of the process in Delaware and is not to be taken as legal advice. If you want legal advice before cancelling a Delaware LLC you should contact a licensed attorney who is familiar with Delaware law.

Create this form in 5 minutes!

How to create an eSignature for the llc 3515 articles of dissolution form

How to create an eSignature for your Llc 3515 Articles Of Dissolution Form in the online mode

How to generate an electronic signature for the Llc 3515 Articles Of Dissolution Form in Chrome

How to make an eSignature for putting it on the Llc 3515 Articles Of Dissolution Form in Gmail

How to create an eSignature for the Llc 3515 Articles Of Dissolution Form from your smartphone

How to generate an electronic signature for the Llc 3515 Articles Of Dissolution Form on iOS devices

How to generate an electronic signature for the Llc 3515 Articles Of Dissolution Form on Android

People also ask

-

What are articles of dissolution?

Articles of dissolution are documents that officially terminate a business entity's existence in a specific state. This process involves filing the articles of dissolution with the appropriate state authority, which signifies that the company has ceased its operations. Understanding how to properly complete and file these articles of dissolution is crucial for ensuring compliance with state regulations.

-

How can airSlate SignNow help with articles of dissolution?

airSlate SignNow simplifies the process of preparing and eSigning articles of dissolution. Our platform provides an easy-to-use interface that allows businesses to create, edit, and finalize dissolution documents quickly. With our electronic signature feature, you can ensure that all necessary parties sign the articles of dissolution efficiently and securely.

-

What is the cost of using airSlate SignNow for articles of dissolution?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring articles of dissolution. We provide a cost-effective solution designed to streamline document management without compromising on quality. Visit our pricing page to find a plan that suits your requirements.

-

Are there any integrations available for managing articles of dissolution?

Yes, airSlate SignNow integrates seamlessly with various platforms to enhance the management of articles of dissolution. You can connect with popular services like Google Drive, Dropbox, and more, allowing for easy access and storage of your documents. These integrations help keep your workflow organized and efficient.

-

What features does airSlate SignNow offer for articles of dissolution?

airSlate SignNow includes features such as document templates, secure eSignatures, and real-time tracking for articles of dissolution. These tools empower users to handle their dissolution paperwork with confidence, ensuring compliance and reducing the risk of errors. The platform also supports collaboration, allowing multiple stakeholders to review and sign documents collaboratively.

-

Can I store my articles of dissolution securely with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents, including articles of dissolution. Our solution provides encrypted storage, ensuring that all sensitive information is safely protected. You can easily manage and retrieve your dissolution documents whenever needed, giving you peace of mind.

-

Is there customer support available for questions about articles of dissolution?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions regarding articles of dissolution. Our knowledgeable team can guide you through the process of creating and filing your documents, ensuring you have the support you need. Contact our support team via chat, email, or phone for prompt assistance.

Get more for Illinois Llc 35 15 Articles Of Dissolution

- Cari form nj

- Coverage election summary for eoi form

- Texas pharmacy license application texas state board of form

- Applied behavior analysis service request form for initial

- Nazarene united soccer club doc templatepdffiller form

- Dental assistant renewal form

- Registered dental assistant renewal form tsbde texas

- Lic form

Find out other Illinois Llc 35 15 Articles Of Dissolution

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word