The Amounts Paid to Taxing Authorities on the Purchaser's Behalf If Collected Form

What is the amounts paid to taxing authorities on the purchaser's behalf if collected

The amounts paid to taxing authorities on the purchaser's behalf if collected refers to the payments made by a seller to state or local tax authorities on behalf of a buyer during a transaction. This typically occurs in real estate or business sales where sales tax, property tax, or other local taxes are applicable. Understanding this concept is crucial for both buyers and sellers to ensure compliance with tax regulations and to avoid potential penalties.

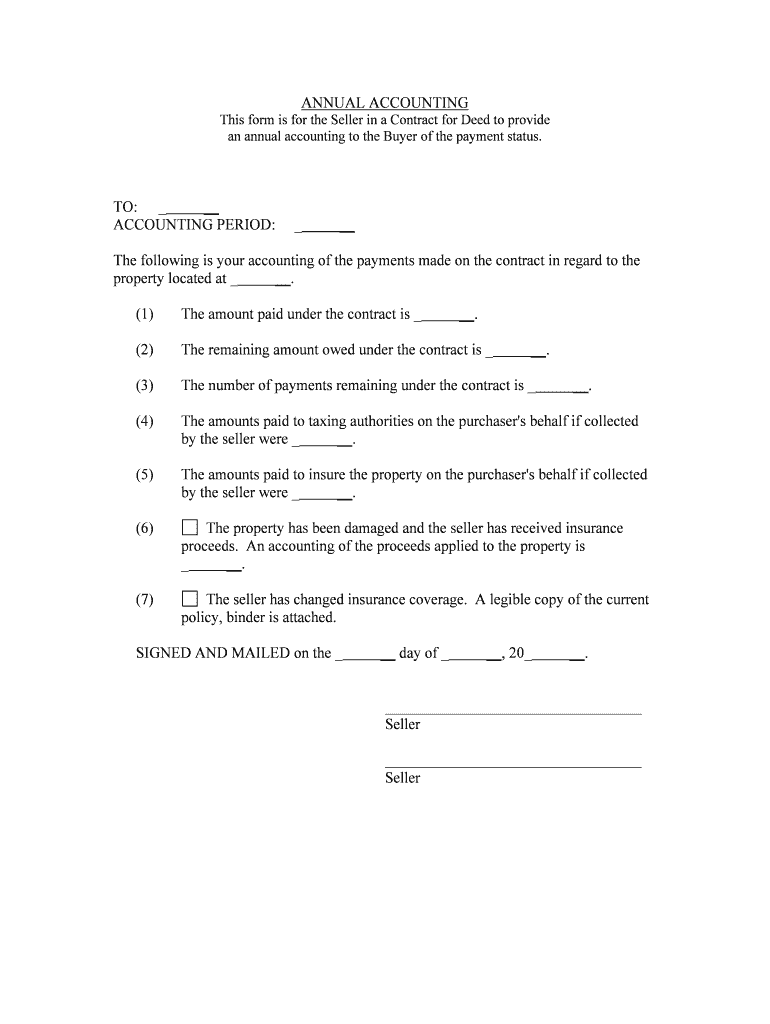

Steps to complete the amounts paid to taxing authorities on the purchaser's behalf if collected

Completing the amounts paid to taxing authorities on the purchaser's behalf if collected form involves several key steps:

- Gather necessary information, including the transaction details and the amount of tax collected.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the appropriate taxing authority by the specified deadline.

Legal use of the amounts paid to taxing authorities on the purchaser's behalf if collected

The legal use of the amounts paid to taxing authorities on the purchaser's behalf if collected form is essential for maintaining compliance with tax laws. This form serves as a record of tax payments made on behalf of the purchaser, which can be crucial in case of audits or disputes. Proper completion and submission of this form help protect both parties involved in the transaction from legal repercussions.

Key elements of the amounts paid to taxing authorities on the purchaser's behalf if collected

Key elements of the amounts paid to taxing authorities on the purchaser's behalf if collected include:

- The name and address of the purchaser and seller involved in the transaction.

- The specific type of tax being collected and the applicable tax rate.

- The total amount of tax collected and the date of the transaction.

- Signature lines for both parties to acknowledge the accuracy of the information provided.

Filing deadlines / important dates

Filing deadlines for the amounts paid to taxing authorities on the purchaser's behalf if collected form can vary by state and type of tax. It is important to be aware of these deadlines to avoid penalties. Generally, forms should be submitted by the end of the month following the transaction, but specific dates should be verified with the local taxing authority.

Examples of using the amounts paid to taxing authorities on the purchaser's behalf if collected

Examples of using the amounts paid to taxing authorities on the purchaser's behalf if collected form include:

- A real estate transaction where the seller collects property tax on behalf of the buyer.

- A business sale where sales tax is collected and remitted to the state.

- Any situation where a seller is responsible for remitting taxes on behalf of the purchaser as part of the sale agreement.

Quick guide on how to complete the amounts paid to taxing authorities on the purchasers behalf if collected

Complete The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to edit and electronically sign The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected with ease

- Obtain The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate creating new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are 'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected'?

'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected' refers to the payments a business makes to local, state, or federal taxing authorities when it collects taxes on behalf of the purchaser. Understanding these amounts is crucial for compliance and financial reporting.

-

How does airSlate SignNow facilitate tracking 'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected'?

airSlate SignNow simplifies tracking 'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected' through its integrated document management features. Users can store and access payment records and tax documentation in one place, making it easier to prepare for audits and ensure compliance.

-

Is there a pricing model that includes assistance for handling 'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected'?

Yes, airSlate SignNow offers various pricing plans that can be customized to meet the needs of businesses handling 'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected.' Our plans provide comprehensive support and tools to help you manage your tax obligations efficiently.

-

What features in airSlate SignNow assist with eSigning related to tax payments?

airSlate SignNow includes features that support eSigning for documents related to tax payments and 'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected.' With secure eSigning, users can ensure that all tax-related agreements are legally binding and easily accessible.

-

Can airSlate SignNow integrate with other financial software for tax management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, which can further assist in managing 'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected.' This integration ensures that you can track and report these amounts accurately within your existing systems.

-

What benefits does airSlate SignNow provide for managing tax-related documents?

airSlate SignNow offers multiple benefits for managing tax-related documents, including enhanced organization, quick access, and improved compliance. By utilizing our platform for 'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected,' businesses can streamline their document workflows and reduce the risk of errors.

-

How secure is airSlate SignNow when handling tax documents?

Security is a top priority at airSlate SignNow. When dealing with 'The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected,' our platform employs encryption and compliance with industry standards to protect sensitive tax documents, ensuring that both your data and your clients’ information remain safe.

Get more for The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected

- Business certificate dba form city of somerville

- Form 1615 0047

- Wpa form 8b

- Vehicle title informationmike fasanoofficial site

- Application form to apply fo a nsw single status certificate nsw single status certificate application form

- Renters agreement template form

- Founder shares agreement template form

- Renter agreement template form

Find out other The Amounts Paid To Taxing Authorities On The Purchaser's Behalf If Collected

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now