Chart for Determining Amount of Wages Subject to 15 Form

What is the Chart For Determining Amount Of Wages Subject To 15

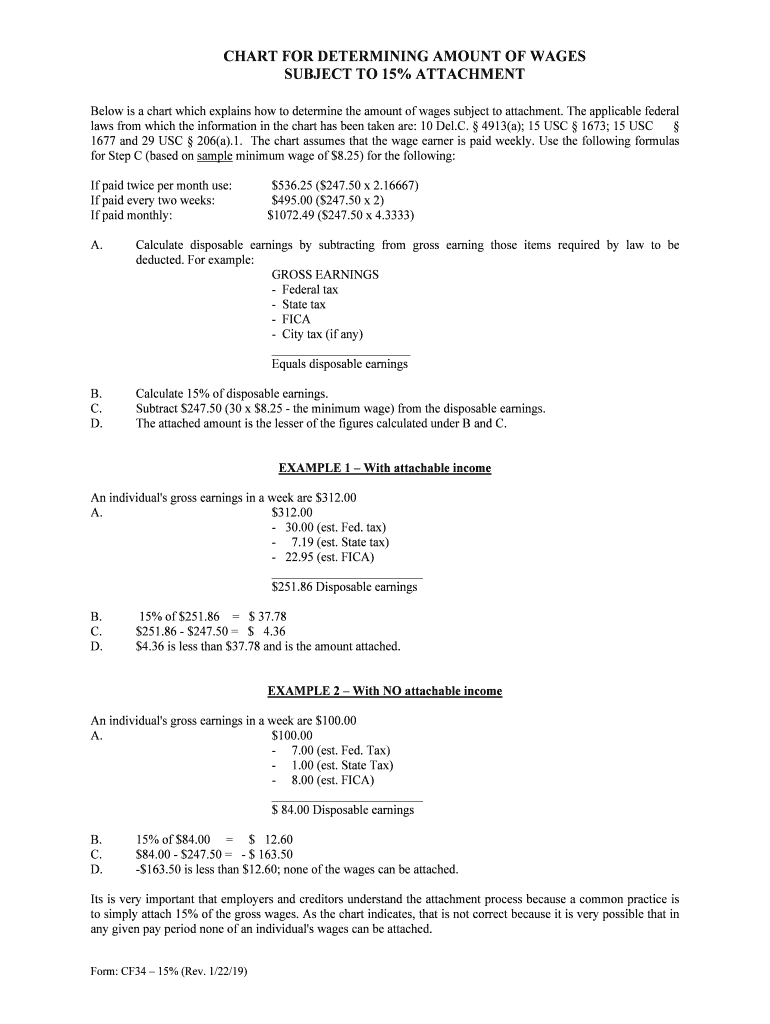

The Chart For Determining Amount Of Wages Subject To 15 is a crucial tool used in the United States to ascertain the specific amount of wages that are subject to a fifteen percent withholding rate. It is often utilized by employers to ensure compliance with federal tax regulations. This chart helps in determining the correct withholding amount based on various factors, including employee earnings and applicable tax laws. Understanding this chart is essential for accurate payroll processing and tax compliance.

How to use the Chart For Determining Amount Of Wages Subject To 15

Using the Chart For Determining Amount Of Wages Subject To 15 involves a few straightforward steps. First, identify the employee's gross wages for the pay period. Next, reference the chart to find the corresponding withholding amount based on the gross wages. It is important to consider any additional factors, such as exemptions or deductions, that may affect the final withholding amount. Employers should ensure they are using the most current version of the chart to maintain compliance with tax regulations.

Steps to complete the Chart For Determining Amount Of Wages Subject To 15

Completing the Chart For Determining Amount Of Wages Subject To 15 requires careful attention to detail. Follow these steps:

- Gather the employee's gross wages for the relevant pay period.

- Locate the appropriate section of the chart that corresponds to the gross wage amount.

- Identify the withholding amount indicated in the chart.

- Consider any applicable deductions or exemptions that may alter the withholding amount.

- Document the final withholding amount for payroll records.

Legal use of the Chart For Determining Amount Of Wages Subject To 15

The legal use of the Chart For Determining Amount Of Wages Subject To 15 is essential for employers to avoid penalties and ensure compliance with federal tax laws. This chart is recognized by the Internal Revenue Service (IRS) as a valid method for determining withholding amounts. Employers must ensure that they are using the chart correctly and keeping accurate records of the withholding amounts calculated. Failure to comply with IRS guidelines may result in fines or other legal repercussions.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Chart For Determining Amount Of Wages Subject To 15. Employers are advised to refer to the IRS publications and updates to ensure they are using the most current information. The IRS outlines the parameters for wage determination, including the conditions under which the fifteen percent withholding applies. Adhering to these guidelines is crucial for maintaining compliance and avoiding potential audits or penalties.

Penalties for Non-Compliance

Employers who fail to comply with the withholding requirements associated with the Chart For Determining Amount Of Wages Subject To 15 may face significant penalties. These can include fines imposed by the IRS, back taxes owed, and interest on unpaid amounts. Additionally, non-compliance can lead to increased scrutiny during audits, which may result in further legal complications. It is vital for employers to understand their responsibilities and ensure accurate payroll processing to mitigate these risks.

Quick guide on how to complete chart for determining amount of wages subject to 15

Complete Chart For Determining Amount Of Wages Subject To 15 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Chart For Determining Amount Of Wages Subject To 15 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Chart For Determining Amount Of Wages Subject To 15 with ease

- Obtain Chart For Determining Amount Of Wages Subject To 15 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Alter and eSign Chart For Determining Amount Of Wages Subject To 15 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Chart For Determining Amount Of Wages Subject To 15?

The Chart For Determining Amount Of Wages Subject To 15 is a tool that helps businesses understand how to calculate the appropriate wages that fall under tax regulations. By utilizing this chart, companies can ensure compliance and avoid unexpected tax liabilities. It provides clear guidelines for categorizing wages subject to the 15% tax rate.

-

How can airSlate SignNow help me manage documents related to the Chart For Determining Amount Of Wages Subject To 15?

airSlate SignNow allows you to easily send and eSign documents related to wage calculations. With our digital solution, you can manage all related paperwork securely and efficiently, ensuring that all documents are compliant with the Chart For Determining Amount Of Wages Subject To 15. This makes tracking and storing records much simpler.

-

What features does airSlate SignNow offer for handling wage documentation?

Our platform offers features like customizable templates, automated workflows, and secure electronic signatures, which streamline the management of wage documentation. These tools enhance your ability to adhere to the Chart For Determining Amount Of Wages Subject To 15 while improving overall efficiency. Our solution allows for easy tracking and organization of relevant documents.

-

Is airSlate SignNow cost-effective for small businesses needing wage calculations?

Yes, airSlate SignNow provides a cost-effective solution for small businesses looking to handle wage calculations and documentation. The pricing plans are designed to accommodate various business sizes, ensuring you can manage your documents related to the Chart For Determining Amount Of Wages Subject To 15 without straining your budget. Quality service does not have to break the bank.

-

Can I integrate airSlate SignNow with other tools to help with wage calculations?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and payroll software that can help streamline calculations related to the Chart For Determining Amount Of Wages Subject To 15. This means you can automate workflows between applications, saving you time and reducing the risk of errors in wage documentation.

-

What are the benefits of using airSlate SignNow for calculating wages?

Using airSlate SignNow for wage calculations provides several benefits, including increased efficiency, enhanced accuracy, and secure document handling. By utilizing our platform in conjunction with the Chart For Determining Amount Of Wages Subject To 15, you ensure compliance with tax regulations while reducing administrative burdens. Your team can focus more on strategic tasks rather than paperwork.

-

How secure is the information shared through airSlate SignNow, especially regarding wage data?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and secure storage to protect all document and wage data exchanged through our platform. This ensures that your sensitive information related to the Chart For Determining Amount Of Wages Subject To 15 remains confidential and safe from unauthorized access.

Get more for Chart For Determining Amount Of Wages Subject To 15

Find out other Chart For Determining Amount Of Wages Subject To 15

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF