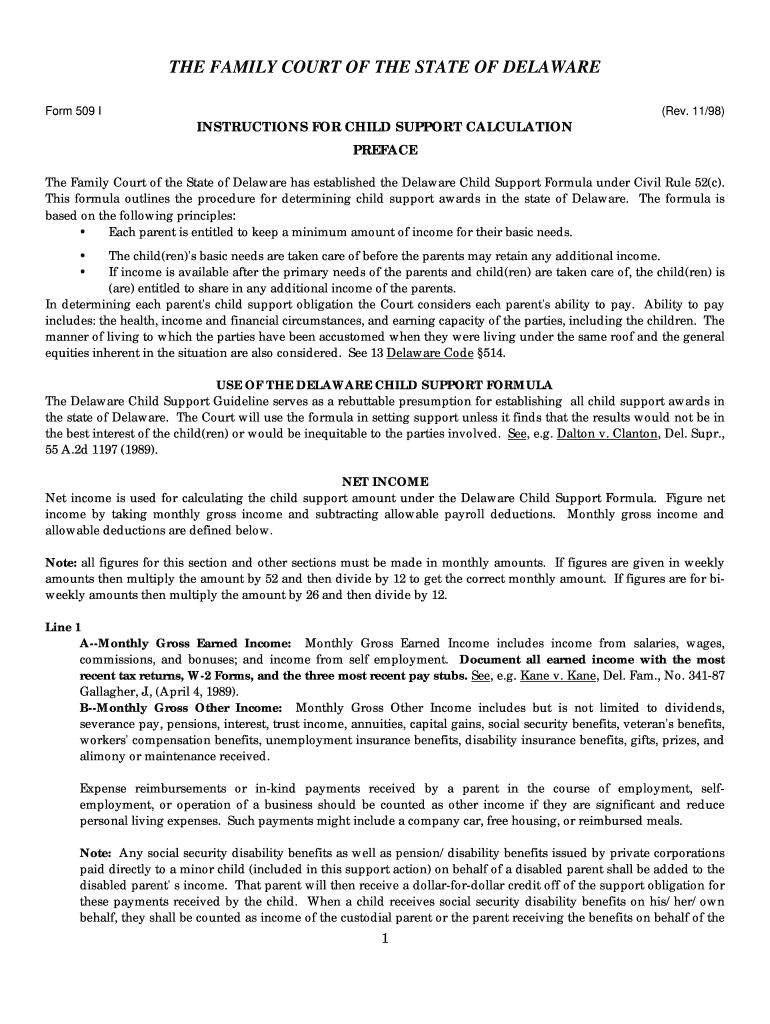

Form 509 I

What is the Form 509 I

The Form 509 I is an official document used primarily for tax-related purposes in the United States. It serves as a means for individuals and businesses to report specific information to the Internal Revenue Service (IRS). This form is crucial for ensuring compliance with federal tax regulations and is often required in various financial transactions or filings. Understanding its purpose and requirements is essential for accurate reporting and avoiding potential penalties.

How to use the Form 509 I

Using the Form 509 I involves several key steps to ensure it is completed accurately. First, gather all necessary information, including personal identification details and financial data relevant to the form. Next, fill out the form carefully, ensuring that all sections are completed as required. After completing the form, review it for accuracy before submission. Depending on the specific requirements, the form may need to be filed electronically or submitted via mail.

Steps to complete the Form 509 I

Completing the Form 509 I can be broken down into a series of systematic steps:

- Gather required documents, such as previous tax returns and financial statements.

- Obtain the latest version of the Form 509 I from the IRS website or authorized sources.

- Carefully fill in your personal information, including your name, address, and Social Security number.

- Provide the necessary financial details as specified in the form.

- Review the completed form for any errors or omissions.

- Submit the form according to the instructions provided, either electronically or by mail.

Legal use of the Form 509 I

The legal use of the Form 509 I is governed by IRS regulations. It is essential to ensure that the information reported on the form is accurate and truthful. Misrepresentation or errors can lead to penalties or legal repercussions. The form must be submitted within the deadlines established by the IRS to maintain compliance with tax laws. Understanding the legal implications of using this form is vital for both individuals and businesses.

Filing Deadlines / Important Dates

Filing deadlines for the Form 509 I are critical to ensure compliance with IRS regulations. Typically, this form must be submitted by the annual tax filing deadline, which is usually April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances or changes in tax law. It is important to stay informed about any updates from the IRS regarding filing dates to avoid late submission penalties.

Required Documents

When preparing to complete the Form 509 I, certain documents are typically required to provide accurate information. These may include:

- Previous tax returns for reference.

- Financial statements that reflect income and expenses.

- Identification documents, such as a Social Security card or taxpayer identification number.

- Any supporting documentation related to deductions or credits claimed.

Form Submission Methods (Online / Mail / In-Person)

The Form 509 I can be submitted through various methods, depending on the preferences of the filer and the requirements set by the IRS. Common submission methods include:

- Online submission through the IRS e-filing system, which is often the fastest method.

- Mailing a paper copy of the form to the appropriate IRS address, as specified in the form instructions.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete form 509 i

Effortlessly Create Form 509 I on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, edit, and eSign your documents quickly without delays. Handle Form 509 I on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and eSign Form 509 I with Ease

- Obtain Form 509 I and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Indicate relevant portions of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 509 I and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 509 I and how can it be used with airSlate SignNow?

Form 509 I is a standard document used for specific administrative processes. With airSlate SignNow, you can easily create, send, and eSign Form 509 I, streamlining your workflow and ensuring compliance with legal requirements.

-

How much does it cost to use airSlate SignNow for Form 509 I?

airSlate SignNow offers various pricing plans that are cost-effective and tailored to fit different business needs. By choosing a plan that includes features for handling Form 509 I, businesses can benefit from signNow savings and improved efficiency.

-

What features does airSlate SignNow provide for managing Form 509 I?

airSlate SignNow includes features such as document templates, customizable workflows, and real-time tracking specifically designed for Form 509 I. These tools help streamline the signing process, reduce errors, and enhance overall productivity.

-

Can I integrate airSlate SignNow with other software for Form 509 I processing?

Yes, airSlate SignNow integrates seamlessly with various software platforms, allowing you to automate the processing of Form 509 I within your existing workflows. This integration capability enhances productivity and ensures a smoother document management experience.

-

Is airSlate SignNow compliant with regulations regarding Form 509 I?

Absolutely. airSlate SignNow is designed to meet legal and regulatory standards for digital signatures, making it fully compliant for processing Form 509 I. This compliance ensures that your documents are legally binding and secure.

-

How can airSlate SignNow improve the efficiency of handling Form 509 I?

By utilizing airSlate SignNow, businesses can signNowly reduce the time spent on traditional paperwork related to Form 509 I. The platform automates the signing process, enabling faster turnaround times and allowing teams to focus on other important tasks.

-

What support does airSlate SignNow offer for users handling Form 509 I?

airSlate SignNow provides robust customer support, including tutorials and live assistance, to help users effectively manage Form 509 I. This support ensures that users can resolve any issues quickly and optimize their use of the platform.

Get more for Form 509 I

Find out other Form 509 I

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF