Credit Applications NACM Form

What is the Credit Applications NACM

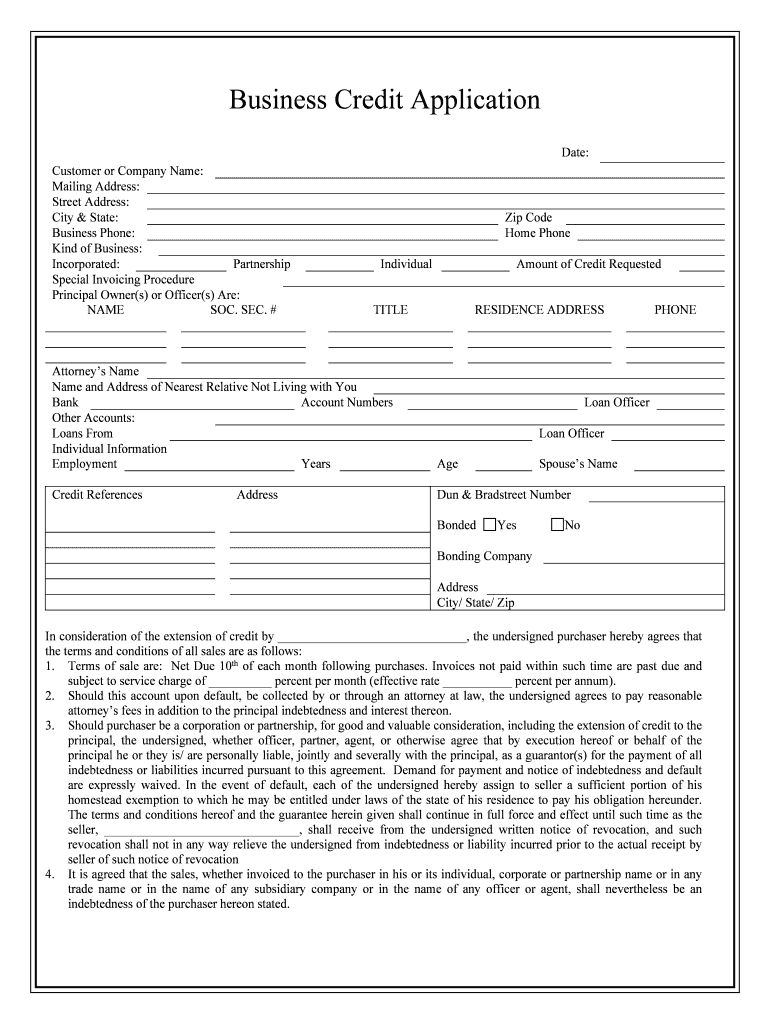

The Credit Applications NACM form is a crucial document used by businesses to assess the creditworthiness of potential clients. This form is designed to collect essential information regarding a business's financial history, credit references, and payment practices. By utilizing this form, companies can make informed decisions about extending credit, thereby minimizing financial risk. The NACM (National Association of Credit Management) provides a standardized format that helps ensure consistency and reliability in credit evaluations across various industries.

How to use the Credit Applications NACM

Using the Credit Applications NACM form involves several straightforward steps. First, businesses should download the form from a reliable source or access it through their credit management software. Next, fill out the required fields, which typically include the applicant's business name, address, contact information, and financial details. Once completed, the form should be submitted to the credit department for review. It is essential to ensure that all information is accurate and up-to-date to facilitate a smooth credit evaluation process.

Steps to complete the Credit Applications NACM

Completing the Credit Applications NACM form requires attention to detail. Follow these steps for a comprehensive submission:

- Gather necessary financial documents, such as balance sheets and profit and loss statements.

- Provide accurate business information, including the legal business name and structure.

- List all owners or partners and their respective ownership percentages.

- Include trade references that can verify your credit history.

- Review the completed form for accuracy before submission.

Once the form is filled out, it can be submitted electronically or printed and sent via mail, depending on the specific requirements of the credit department.

Legal use of the Credit Applications NACM

The legal use of the Credit Applications NACM form is governed by various regulations that ensure the protection of both the applicant's and the lender's rights. It is essential that the form is completed accurately and honestly, as any misrepresentation can lead to legal repercussions. Furthermore, businesses must comply with relevant state and federal laws concerning credit and privacy, including the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA). These laws help protect consumers and ensure fair treatment in credit transactions.

Key elements of the Credit Applications NACM

Several key elements are essential to the Credit Applications NACM form. These include:

- Business Information: Basic details about the business, including its legal name, address, and type of entity.

- Financial Information: A summary of the business's financial health, including revenue, liabilities, and assets.

- Trade References: Contact information for suppliers or creditors who can provide insights into the applicant's payment history.

- Signature: A declaration that the information provided is accurate and complete, often requiring a signature from an authorized representative.

Examples of using the Credit Applications NACM

The Credit Applications NACM form can be utilized in various scenarios. For instance, a wholesaler may require this form from a retailer before extending credit terms for inventory purchases. Similarly, a service provider might request the form from a new client to evaluate their ability to pay for ongoing services. In both cases, the form serves as a tool to assess risk and establish trust between businesses.

Quick guide on how to complete credit applications nacm

Prepare Credit Applications NACM with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Credit Applications NACM on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The optimal method to alter and electronically sign Credit Applications NACM effortlessly

- Obtain Credit Applications NACM and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key parts of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Credit Applications NACM and guarantee exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Credit Applications NACM?

Credit Applications NACM refer to standardized credit application forms that businesses use to assess the creditworthiness of potential customers. These applications provide essential information needed to make informed credit decisions, ensuring that the process is both efficient and effective. Using airSlate SignNow, you can easily manage and eSign these documents, streamlining your credit application workflow.

-

How can airSlate SignNow help with processing Credit Applications NACM?

airSlate SignNow allows businesses to create, send, and securely eSign Credit Applications NACM in a fraction of the time compared to traditional methods. With our user-friendly interface, you can quickly gather necessary information, track the application status, and reduce paperwork. This not only speeds up the processing time but also enhances the customer experience.

-

What are the key features of airSlate SignNow for Credit Applications NACM?

Some key features of airSlate SignNow include customizable templates for Credit Applications NACM, document tracking, secure eSignature, and integration capabilities with other software. These features help eliminate manual errors, improve efficiency, and allow for seamless collaboration among your team members. Additionally, the platform ensures that all documents comply with industry standards.

-

Is there a cost associated with using airSlate SignNow for Credit Applications NACM?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including solutions specifically tailored for handling Credit Applications NACM. Pricing is flexible and designed to be competitive, ensuring that even small businesses can benefit from an efficient eSigning process. You can explore different plans on our website to find the best fit for your organization.

-

Can airSlate SignNow integrate with existing systems for Credit Applications NACM?

Absolutely! airSlate SignNow offers robust integration capabilities with various CRM and accounting systems, making it easy to incorporate Credit Applications NACM into your existing workflows. This integration ensures that all your data is connected and up to date, reducing redundancy and improving productivity across your organization.

-

What are the benefits of using electronic Credit Applications NACM?

Using electronic Credit Applications NACM can signNowly reduce the time and resources spent on manual paperwork and data entry. It enhances accuracy, allows for real-time tracking of application status, and provides a better experience for both customers and your staff. Additionally, electronic forms are easily accessible and can be stored securely in the cloud.

-

Is airSlate SignNow secure for handling Credit Applications NACM?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect sensitive information in Credit Applications NACM. We employ encryption, secure access controls, and regular audits to ensure that your data is safe and confidential. You can trust our platform to manage your critical documents securely.

Get more for Credit Applications NACM

Find out other Credit Applications NACM

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors