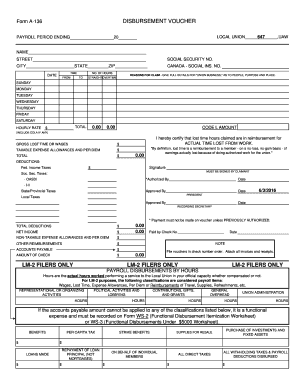

Form 136

What is the Form 136

The Form 136, commonly referred to as the i 136 form, is an essential document used primarily for tax-related purposes in the United States. It is often required by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is crucial for compliance and accurate tax reporting.

How to use the Form 136

Using the Form 136 involves several steps to ensure that all necessary information is accurately reported. Start by gathering relevant financial documents, such as income statements and expense records. Next, fill out the form carefully, ensuring that all required fields are completed. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific requirements of the IRS.

Steps to complete the Form 136

Completing the Form 136 can be broken down into a few straightforward steps:

- Collect necessary documentation, including income and expense records.

- Download the Form 136 from the IRS website or obtain a physical copy.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form electronically or mail it to the appropriate IRS address.

Legal use of the Form 136

The legal use of the Form 136 is critical for ensuring that your tax filings are compliant with IRS regulations. When filled out correctly, this form serves as a legal document that can be used to support your financial claims. It is important to adhere to the guidelines set forth by the IRS to avoid potential penalties or legal issues related to tax reporting.

Key elements of the Form 136

Understanding the key elements of the Form 136 is essential for accurate completion. Some of the most important components include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Details of all income sources.

- Expense Reporting: Documentation of deductible expenses.

- Signature: Required to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 136 are crucial for compliance. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special tax situations. It is important to stay informed about these dates to avoid late fees or penalties.

Quick guide on how to complete form 136 393072067

Prepare Form 136 effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional paper documents requiring signatures, allowing you to acquire the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without complications. Manage Form 136 across any platform with the airSlate SignNow mobile applications for Android or iOS, and enhance any document-driven process today.

How to modify and eSign Form 136 with ease

- Obtain Form 136 and click on Get Form to commence.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive details with the tools specially designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form 136 to guarantee seamless communication at every step of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 136 393072067

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 136 and how can it be used with airSlate SignNow?

Form 136 is a document used in various business processes. With airSlate SignNow, you can easily upload, edit, and eSign form 136, ensuring that all necessary signatures are collected efficiently.

-

How much does it cost to use airSlate SignNow for handling form 136?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your budget, allowing you to efficiently manage form 136 without compromising on features.

-

What features does airSlate SignNow provide for managing form 136?

airSlate SignNow offers features such as customizable templates, team collaboration, and secure storage. These features make it easier to handle form 136 while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other tools to manage form 136?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, including CRM and project management tools. This allows you to streamline the process of managing form 136 across your existing workflows.

-

What are the benefits of using airSlate SignNow for form 136?

Using airSlate SignNow for form 136 simplifies the signing process, reduces turnaround time, and enhances document security. You can track the status of your forms in real-time, ensuring timely responses.

-

Is it easy to get started with airSlate SignNow for form 136?

Absolutely! Getting started with airSlate SignNow is simple and user-friendly. You can sign up for an account and begin uploading your form 136 within minutes, thanks to the intuitive interface.

-

How does airSlate SignNow ensure the security of my form 136?

airSlate SignNow prioritizes security by employing bank-grade encryption and complying with legal standards. Your form 136 and all associated data are protected to ensure confidentiality and integrity.

Get more for Form 136

- Place your w 2 wage and tax statements and attach here with form

- Irs form 8965 2018

- Downloads dfa form

- A name of disqualified person form

- 1120 s 2016 2018 form

- Dhs 1643 psychotropic medication informed consent for children in foster care andor juvenile justice psychotropic medication

- Claim for dependent relative tax credit dependent relative tax credit form

- 3966 taxpayer report of personal property ampquotmove insampquot of used equipment occurring during form

Find out other Form 136

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe