Garnishment Calculation Worksheet Hawaii State Judiciary Form

What is the Garnishment Calculation Worksheet Hawaii State Judiciary

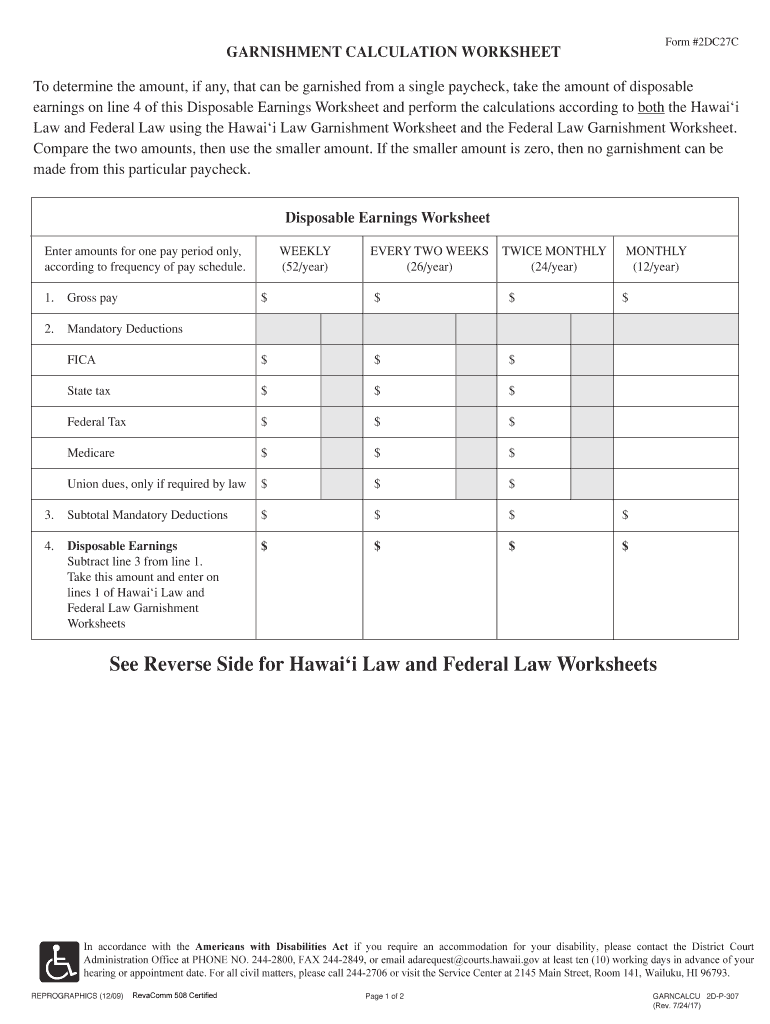

The Garnishment Calculation Worksheet Hawaii State Judiciary is a legal document used to determine the amount of wages that can be garnished from an employee's paycheck to satisfy a debt. This form is essential for employers and creditors to ensure compliance with state laws regarding wage garnishment. It provides a structured approach to calculate the permissible garnishment amount based on the employee's disposable income, which is the income remaining after mandatory deductions such as taxes and Social Security. Understanding this worksheet is crucial for both employers and employees to navigate the garnishment process effectively.

How to use the Garnishment Calculation Worksheet Hawaii State Judiciary

Using the Garnishment Calculation Worksheet involves several steps. First, gather the necessary financial information, including the employee's gross wages and any applicable deductions. Next, input this data into the worksheet, following the provided guidelines to calculate the disposable income. Once the disposable income is determined, apply the appropriate garnishment limits as specified by Hawaii state law. This ensures that the calculation is accurate and compliant with legal requirements. It is important to keep a copy of the completed worksheet for your records and for any future reference.

Steps to complete the Garnishment Calculation Worksheet Hawaii State Judiciary

Completing the Garnishment Calculation Worksheet requires careful attention to detail. Begin by entering the employee's gross wages at the top of the form. Next, list all mandatory deductions, such as federal and state taxes, health insurance, and retirement contributions. Subtract these deductions from the gross wages to find the disposable income. After calculating the disposable income, refer to the Hawaii state guidelines to determine the maximum allowable garnishment amount. Fill in the worksheet accordingly, ensuring all calculations are accurate. Finally, review the completed worksheet for any errors before submission.

Legal use of the Garnishment Calculation Worksheet Hawaii State Judiciary

The legal use of the Garnishment Calculation Worksheet is crucial for ensuring compliance with Hawaii's wage garnishment laws. This worksheet helps employers calculate the correct amount to withhold from an employee's paycheck, thereby protecting both the employer and the employee from potential legal issues. Proper use of the worksheet can prevent over-garnishment, which could lead to legal penalties. It is important for employers to familiarize themselves with the legal requirements and to use the worksheet as a tool to maintain compliance throughout the garnishment process.

Key elements of the Garnishment Calculation Worksheet Hawaii State Judiciary

Key elements of the Garnishment Calculation Worksheet include the employee's gross wages, mandatory deductions, and the calculated disposable income. Additionally, the worksheet outlines the maximum allowable garnishment amounts based on state law, which varies depending on the type of debt being collected. Understanding these elements is essential for accurately completing the worksheet and ensuring that the garnishment process adheres to legal standards. Employers should also be aware of any specific instructions included on the worksheet to avoid common mistakes.

State-specific rules for the Garnishment Calculation Worksheet Hawaii State Judiciary

Hawaii has specific rules governing the garnishment process that are reflected in the Garnishment Calculation Worksheet. These rules dictate the maximum percentage of disposable income that can be garnished, which is typically limited to a certain percentage based on the employee's income level and the type of debt. Additionally, Hawaii law provides protections for employees, such as exemptions for certain types of income and limits on the total amount that can be garnished. Familiarizing oneself with these state-specific rules is vital for ensuring compliance and protecting employee rights during the garnishment process.

Quick guide on how to complete garnishment calculation worksheet hawaii state judiciary

Effortlessly Prepare Garnishment Calculation Worksheet Hawaii State Judiciary on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Garnishment Calculation Worksheet Hawaii State Judiciary on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and eSign Garnishment Calculation Worksheet Hawaii State Judiciary with Ease

- Find Garnishment Calculation Worksheet Hawaii State Judiciary and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Select important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Garnishment Calculation Worksheet Hawaii State Judiciary to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Garnishment Calculation Worksheet Hawaii State Judiciary?

The Garnishment Calculation Worksheet Hawaii State Judiciary is a tool designed to help individuals and businesses accurately determine garnishment amounts based on established state guidelines. This worksheet simplifies the process, ensuring compliance with Hawaii’s legal requirements for wage garnishments.

-

How do I access the Garnishment Calculation Worksheet Hawaii State Judiciary?

You can easily access the Garnishment Calculation Worksheet Hawaii State Judiciary through the official Hawaii State Judiciary website or by using documents provided by airSlate SignNow. Our platform streamlines document access and eSigning, making it convenient for users.

-

Is the Garnishment Calculation Worksheet Hawaii State Judiciary free to use?

The Garnishment Calculation Worksheet Hawaii State Judiciary is typically available at no cost through the Hawaii State Judiciary’s resources. However, if you choose to utilize airSlate SignNow for document management and eSigning, there may be associated fees depending on the plan you select.

-

What features does airSlate SignNow offer for managing the Garnishment Calculation Worksheet Hawaii State Judiciary?

airSlate SignNow provides features such as easy document uploading, eSigning, real-time collaboration, and secure storage specifically for forms like the Garnishment Calculation Worksheet Hawaii State Judiciary. These features enhance efficiency, making it easy to manage legal documents seamlessly.

-

Can airSlate SignNow integrate with other software for processing the Garnishment Calculation Worksheet Hawaii State Judiciary?

Yes, airSlate SignNow offers integration capabilities with various software solutions to streamline processes related to the Garnishment Calculation Worksheet Hawaii State Judiciary. This allows users to connect their document workflows with popular applications, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for the Garnishment Calculation Worksheet Hawaii State Judiciary?

Using airSlate SignNow for the Garnishment Calculation Worksheet Hawaii State Judiciary provides a cost-effective and efficient solution for document signing and management. This not only saves time but also ensures compliance with legal requirements, providing peace of mind to users.

-

How can I ensure compliance when using the Garnishment Calculation Worksheet Hawaii State Judiciary?

To ensure compliance when using the Garnishment Calculation Worksheet Hawaii State Judiciary, it’s important to stay informed about Hawaii's garnishment laws and guidelines. airSlate SignNow aids in this process by providing up-to-date templates that align with legal standards.

Get more for Garnishment Calculation Worksheet Hawaii State Judiciary

- Dos 1509 barber shop owner or area renter application dos ny form

- Sample expulsion letter from school form

- Putting the pieces together the discovery of dna structure and replication answer key form

- Request for driver review instructions georgia dds ga form

- Bridgeport ct personal property declaration form

- Rsw exemption form bristol bay borough

- Missouri forage and grassland councilgrazing lands form

- Youth baseball softball sponsorship forms poplarbluff mo

Find out other Garnishment Calculation Worksheet Hawaii State Judiciary

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself