The Interest Rate Required by This Section 2 is the Rate I Will Form

What is the Interest Rate Required By This Section 2 Is The Rate I Will

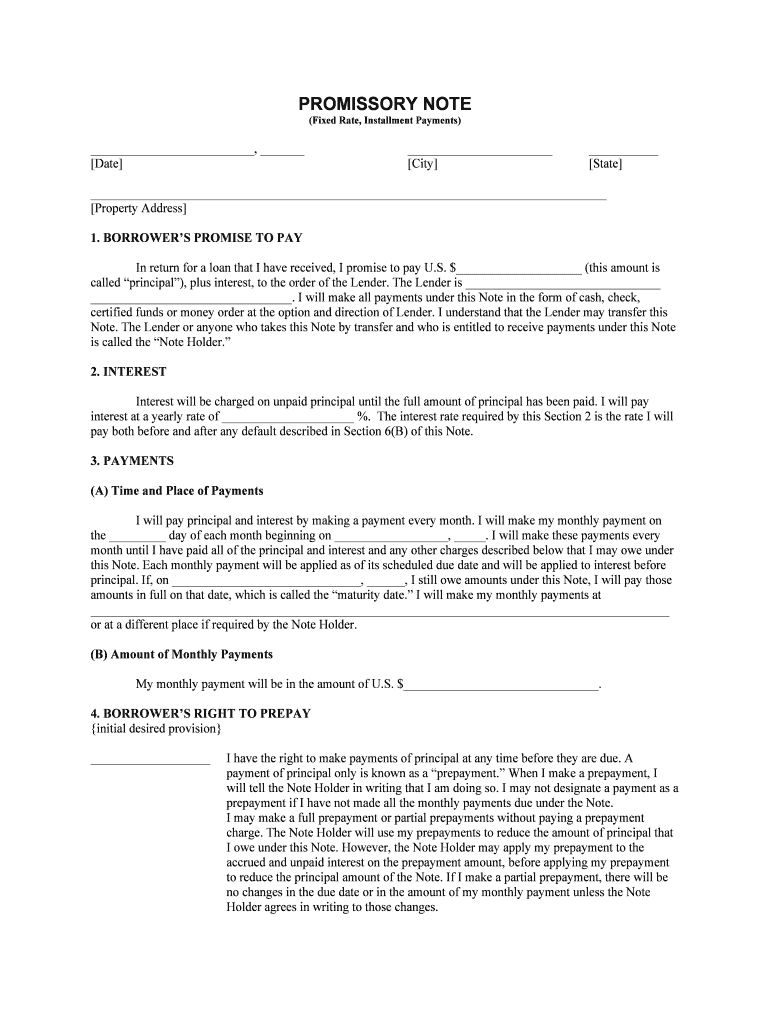

The Interest Rate Required By This Section 2 Is The Rate I Will form is a crucial document often used in financial agreements. It specifies the interest rate applicable to a loan or financial obligation under certain conditions. Understanding this form is essential for both lenders and borrowers to ensure clarity and compliance with the terms outlined. The form typically includes details such as the principal amount, the interest rate, and the duration of the loan, which are vital for calculating the total repayment amount.

How to use the Interest Rate Required By This Section 2 Is The Rate I Will

Using the Interest Rate Required By This Section 2 Is The Rate I Will form involves several steps. First, gather all necessary information regarding the loan or financial agreement, including the principal amount and any specific terms related to the interest rate. Next, fill out the form accurately, ensuring that all details are correct to avoid future disputes. Once completed, both parties should review the document before signing to confirm mutual understanding and agreement on the terms.

Steps to complete the Interest Rate Required By This Section 2 Is The Rate I Will

Completing the Interest Rate Required By This Section 2 Is The Rate I Will form requires careful attention to detail. Follow these steps:

- Collect relevant financial information, including the principal amount and interest rate.

- Fill in the borrower and lender's details accurately.

- Specify the terms of the loan, including repayment schedules and any penalties for late payments.

- Review the completed form for accuracy.

- Have both parties sign the document to finalize the agreement.

Legal use of the Interest Rate Required By This Section 2 Is The Rate I Will

The Interest Rate Required By This Section 2 Is The Rate I Will form is legally binding when executed correctly. For it to hold up in court, the document must comply with applicable laws governing financial agreements. This includes ensuring that both parties have the legal capacity to enter into the agreement, that the terms are clear and unambiguous, and that the form is signed voluntarily without any coercion. Adhering to these legal standards protects both parties and reinforces the document's validity.

Key elements of the Interest Rate Required By This Section 2 Is The Rate I Will

Several key elements must be included in the Interest Rate Required By This Section 2 Is The Rate I Will form to ensure its effectiveness:

- Principal Amount: The total amount borrowed or financed.

- Interest Rate: The percentage charged on the principal amount, which can be fixed or variable.

- Loan Term: The duration over which the loan will be repaid.

- Repayment Schedule: Details on when payments are due and how they will be made.

- Signatures: Both parties must sign to validate the agreement.

Examples of using the Interest Rate Required By This Section 2 Is The Rate I Will

Examples of the Interest Rate Required By This Section 2 Is The Rate I Will form can be found in various financial contexts. For instance, a homeowner may use this form when applying for a mortgage, detailing the interest rate and repayment terms. Similarly, small businesses might utilize it for loans to finance operations or expansion. Each scenario requires careful consideration of the interest rate and terms to ensure they align with the borrower's financial capabilities and the lender's requirements.

Quick guide on how to complete the interest rate required by this section 2 is the rate i will

Complete The Interest Rate Required By This Section 2 Is The Rate I Will effortlessly on any device

Managing documents online has gained traction among companies and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can acquire the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, alter, and eSign your documents quickly without delays. Handle The Interest Rate Required By This Section 2 Is The Rate I Will on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to alter and eSign The Interest Rate Required By This Section 2 Is The Rate I Will effortlessly

- Locate The Interest Rate Required By This Section 2 Is The Rate I Will and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign The Interest Rate Required By This Section 2 Is The Rate I Will and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the interest rate stated in Section 2 of the agreement?

The interest rate required by this Section 2 is the rate I will apply to any overdue payments. It's crucial for understanding the financial obligations outlined in the contract, ensuring that you are aware of all potential charges.

-

How does airSlate SignNow handle pricing for its services?

Our pricing structure is designed to be transparent and affordable. By clearly stating that the interest rate required by this Section 2 is the rate I will use, you can anticipate all costs without any hidden fees.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow boasts a range of features, including secure eSignatures, template creation, and document tracking. It's essential to note that the interest rate required by this Section 2 is the rate I will enforce if there are issues with contract execution.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various platforms like CRM and accounting software. This ensures that you can manage your documents and financial obligations, including understanding that the interest rate required by this Section 2 is the rate I will apply if necessary.

-

What security measures does airSlate SignNow implement?

Security is a top priority at airSlate SignNow. We utilize encryption and secure cloud storage to protect your documents, so you can confidently sign, knowing that the interest rate required by this Section 2 is the rate I will adhere to in case of financial disputes.

-

Is there customer support available for airSlate SignNow users?

Absolutely, we provide dedicated customer support to assist users with any queries or issues. Whether you have questions about how the interest rate required by this Section 2 is the rate I will charge or any other concerns, our team is here to help.

-

Can airSlate SignNow help streamline my document workflow?

Yes, airSlate SignNow is designed to enhance your document workflow efficiency. By automating processes and clearly indicating that the interest rate required by this Section 2 is the rate I will apply, you can minimize delays and improve productivity.

Get more for The Interest Rate Required By This Section 2 Is The Rate I Will

- Vendor form carroll county health department

- Auction757 form

- Living environment regents review form

- Patient medical history advanced orthopaedic and sports medicine form

- Skrmbriller rekvisition form

- St tammany parish mobile home ordinance form

- Gala sponsor payment form updated pdf

- Form 3586 payment voucher for corps and exempt orgs e filed returns ftb ca

Find out other The Interest Rate Required By This Section 2 Is The Rate I Will

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple