Bond Renewals Surety1 Explains Friendly Service Form

Understanding the Bond Renewals Surety1 Explains Friendly Service

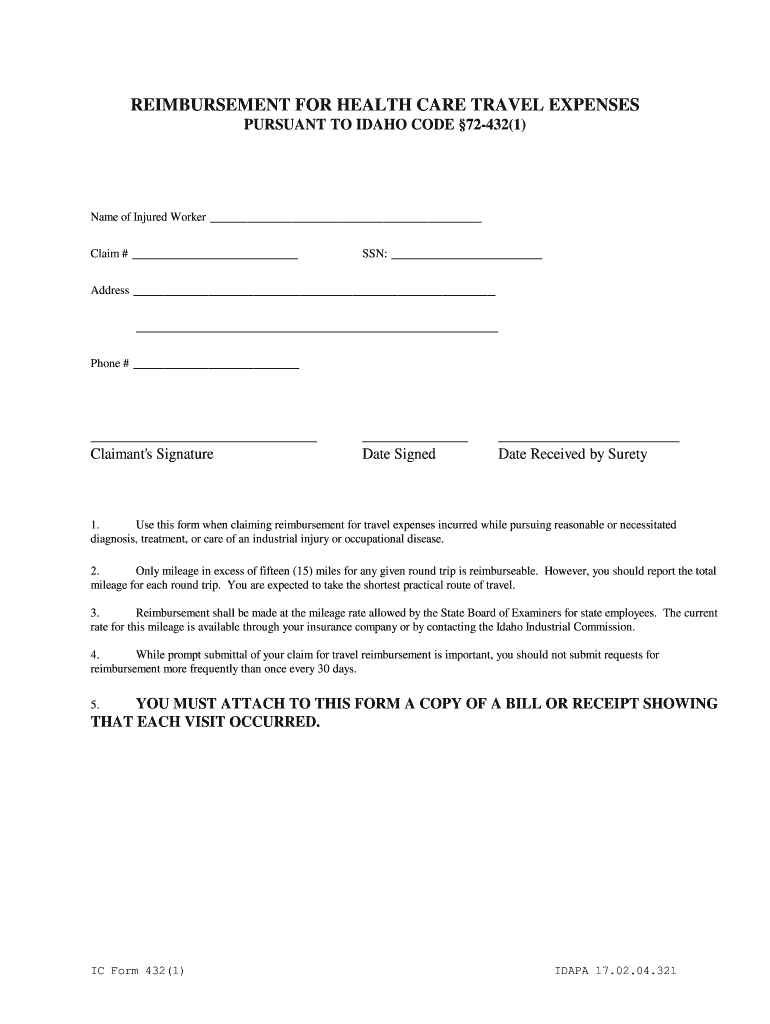

The Bond Renewals Surety1 Explains Friendly Service form is essential for businesses looking to maintain their surety bonds. This form serves as a request for the renewal of existing bonds, which are crucial for ensuring compliance with various contractual obligations. A surety bond guarantees that a business will fulfill its commitments, whether in construction, service contracts, or other agreements. Understanding the specifics of this form helps businesses navigate the renewal process smoothly.

Steps to Complete the Bond Renewals Surety1 Explains Friendly Service

Completing the Bond Renewals Surety1 Explains Friendly Service form involves several straightforward steps:

- Gather necessary information about your current bond, including the bond number and details of the original agreement.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through a secure platform, ensuring that you receive confirmation of submission.

Legal Use of the Bond Renewals Surety1 Explains Friendly Service

The legal validity of the Bond Renewals Surety1 Explains Friendly Service form hinges on compliance with relevant laws governing electronic signatures and document submissions. In the United States, the ESIGN Act and UETA provide the legal framework for eSignatures, ensuring that electronic submissions are recognized as legally binding. Using a trusted platform for submission enhances the form's legal standing, as it typically includes features like digital certificates and audit trails.

Required Documents for Bond Renewals Surety1 Explains Friendly Service

To successfully complete the Bond Renewals Surety1 Explains Friendly Service form, certain documents are typically required:

- Current surety bond details, including the bond number.

- Proof of compliance with any contractual obligations related to the bond.

- Financial statements or other documentation that may be requested by the surety company.

Who Issues the Bond Renewals Surety1 Explains Friendly Service

The Bond Renewals Surety1 Explains Friendly Service form is typically issued by surety companies that provide bonding services. These companies assess the risk associated with renewing a bond and determine the terms of renewal based on the applicant's financial stability and compliance history. Understanding the role of the surety company is vital for businesses seeking renewal, as it influences the overall process and requirements.

State-Specific Rules for Bond Renewals Surety1 Explains Friendly Service

Each state may have specific rules and regulations governing the renewal of surety bonds. It is important for businesses to be aware of these state-specific requirements, as they can vary significantly. Factors such as bond amounts, renewal periods, and additional documentation may differ based on state law. Consulting with a legal expert or the issuing surety company can help ensure compliance with local regulations.

Quick guide on how to complete bond renewals surety1 explains friendly service

Complete Bond Renewals Surety1 Explains Friendly Service effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Bond Renewals Surety1 Explains Friendly Service on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The easiest way to alter and electronically sign Bond Renewals Surety1 Explains Friendly Service effortlessly

- Obtain Bond Renewals Surety1 Explains Friendly Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Bond Renewals Surety1 Explains Friendly Service to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are bond renewals, and why are they important?

Bond renewals are the process of extending the validity of a surety bond. They are crucial for maintaining compliance and ensuring ongoing coverage in business transactions. With Bond Renewals, Surety1 explains friendly service ensures that your operations remain uninterrupted and legally sound.

-

How does airSlate SignNow simplify the bond renewal process?

airSlate SignNow streamlines the bond renewal process by allowing easy document preparation and electronic signatures. This efficiency reduces turnaround times, making renewals faster and hassle-free. With Bond Renewals, Surety1 explains friendly service, you can complete your tasks confidently and promptly.

-

What costs should I expect for bond renewals?

The costs for bond renewals can vary depending on the bond type and the premium rates set by surety providers. It's important to factor in potential increases in premiums due to changes in risk. With Bond Renewals, Surety1 explains friendly service, you can discuss pricing transparently, ensuring no hidden fees.

-

What features does airSlate SignNow offer for managing bond renewals?

airSlate SignNow offers various features including customizable templates, automated reminders, and secure storage for all your bond documents. These features help keep your bond renewals organized and timely. With Bond Renewals, Surety1 explains friendly service, you can take advantage of these tools to stay ahead.

-

How can I integrate airSlate SignNow with other tools for bond management?

airSlate SignNow offers seamless integrations with popular tools such as CRM systems, project management software, and accounting platforms. This functionality allows for a more cohesive approach to bond management. With Bond Renewals, Surety1 explains friendly service, you can ensure that all your business processes work together efficiently.

-

What are the benefits of using airSlate SignNow for my bond renewals?

Using airSlate SignNow for your bond renewals provides a secure, time-saving solution that enhances productivity. The platform is cost-effective and user-friendly, enabling quick completion of bond-related tasks. With Bond Renewals, Surety1 explains friendly service, you gain peace of mind knowing your documents are handled with care.

-

Is support available during the bond renewal process?

Absolutely! With airSlate SignNow, customer support is readily available to assist at any stage of the bond renewal process. Staff can provide expert guidance and address any concerns you might have, ensuring a smooth experience. With Bond Renewals, Surety1 explains friendly service, you are never alone in your document management journey.

Get more for Bond Renewals Surety1 Explains Friendly Service

- Complete these sixteen questions to score your knowledge of present continuous form

- Live scan form a0522

- Qfx club form

- Legal residence 4 special assessment bapplicationb assessorcasc form

- Ny surrogate court forms

- Parents potel form

- Public rewards from public lands colorado blm form

- View full report ets ets form

Find out other Bond Renewals Surety1 Explains Friendly Service

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document