DEMAND for FILING of RELEASE Form

What is the demand for filing of release

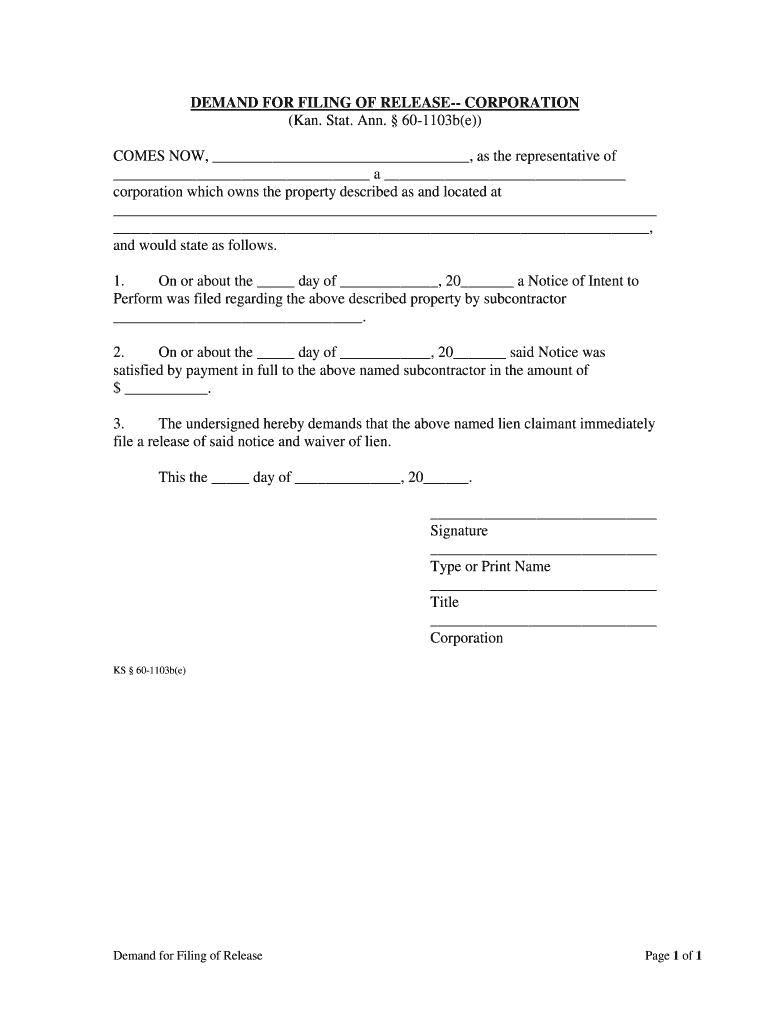

The demand for filing of release is a formal request used primarily in legal contexts, allowing individuals or entities to seek the release of certain obligations or claims. This document serves as a crucial tool in various legal proceedings, enabling parties to clarify their intentions regarding the release of rights or claims against another party. It is essential for ensuring that all involved parties understand the implications of the release and that the document adheres to legal standards to be considered valid.

Steps to complete the demand for filing of release

Completing the demand for filing of release involves several key steps to ensure accuracy and compliance with legal requirements. Begin by gathering all necessary information, including the names of the parties involved and the specific claims being released. Next, fill out the form clearly and accurately, ensuring that all sections are completed. It is important to include any relevant dates and signatures. Once completed, review the document for any errors before submitting it to the appropriate authority or party. This careful attention to detail helps prevent delays or complications in the release process.

Legal use of the demand for filing of release

The legal use of the demand for filing of release is governed by specific laws and regulations that vary by state. This document is typically utilized in situations involving settlements, debt forgiveness, or other legal agreements where one party agrees to relinquish claims against another. To ensure its enforceability, the demand must meet certain legal standards, including proper signatures and adherence to state-specific rules. Understanding these legal frameworks is crucial for anyone looking to use this form effectively.

Key elements of the demand for filing of release

Several key elements must be included in the demand for filing of release to ensure its validity. These elements typically include:

- Identification of Parties: Clearly state the names and addresses of all parties involved.

- Description of Claims: Provide a detailed account of the claims being released.

- Effective Date: Include the date when the release becomes effective.

- Signatures: Ensure that all parties sign the document to acknowledge their agreement.

Including these elements helps to create a comprehensive and legally binding document.

Form submission methods

The demand for filing of release can be submitted through various methods, depending on the requirements of the receiving party or authority. Common submission methods include:

- Online Submission: Many organizations allow for electronic submission through secure portals.

- Mail: Physical copies can be mailed to the designated address, ensuring that they are sent via a reliable service.

- In-Person Delivery: Some situations may require delivering the document directly to the relevant office or individual.

Choosing the appropriate submission method is important for ensuring timely processing and compliance with any specific requirements.

Examples of using the demand for filing of release

There are various scenarios in which the demand for filing of release may be used. For instance, it can be utilized in personal injury cases where a claimant agrees to release a defendant from further claims in exchange for a settlement. Another example is in financial agreements, where a lender may require a borrower to file a release upon full payment of a loan. These examples highlight the versatility of the demand for filing of release across different legal contexts.

Quick guide on how to complete demand for filing of release

Effortlessly prepare DEMAND FOR FILING OF RELEASE on any device

Digital document management has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, as you can easily find the necessary document and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without complications. Manage DEMAND FOR FILING OF RELEASE on any platform with the airSlate SignNow apps available for Android or iOS and simplify any document-related process today.

Edit and electronically sign DEMAND FOR FILING OF RELEASE with ease

- Find DEMAND FOR FILING OF RELEASE and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign DEMAND FOR FILING OF RELEASE and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'DEMAND FOR FILING OF RELEASE' feature in airSlate SignNow?

The 'DEMAND FOR FILING OF RELEASE' feature in airSlate SignNow allows users to efficiently manage and eSign release documents. This feature streamlines the filing process, ensuring that all necessary signatures are obtained quickly and securely. With this tool, users can easily navigate through complex paperwork, reducing the time spent on document management.

-

How does airSlate SignNow ensure the security of the 'DEMAND FOR FILING OF RELEASE' documents?

AirSlate SignNow prioritizes security with advanced encryption and authentication measures in place for all documents, including those related to the 'DEMAND FOR FILING OF RELEASE.' Users can trust that their sensitive information is protected throughout the signing process. Additionally, compliance with industry standards further enhances document safety.

-

What are the costs associated with using airSlate SignNow for 'DEMAND FOR FILING OF RELEASE'?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes needing services like 'DEMAND FOR FILING OF RELEASE.' Users can choose from various subscription options, making it accessible for startups as well as established enterprises. The cost-effective nature of the platform ensures you get the best value for your investment in document management.

-

Can I customize templates for 'DEMAND FOR FILING OF RELEASE' in airSlate SignNow?

Yes, airSlate SignNow allows users to customize templates for 'DEMAND FOR FILING OF RELEASE' according to their specific needs. This feature provides flexibility in document preparation, enabling you to include personalized fields, branding, and more. Custom templates help streamline the signing process and enhance professionalism.

-

What integration options does airSlate SignNow provide for 'DEMAND FOR FILING OF RELEASE'?

AirSlate SignNow offers robust integration options with popular applications and software that can enhance the process of 'DEMAND FOR FILING OF RELEASE.' Integrate with CRM, project management tools, and workflow systems to keep all your documents coordinated. This interoperability boosts productivity and saves time when dealing with multiple applications.

-

How quickly can I send a 'DEMAND FOR FILING OF RELEASE' using airSlate SignNow?

Sending a 'DEMAND FOR FILING OF RELEASE' through airSlate SignNow is quick and efficient, often requiring only a few clicks. The user-friendly interface ensures that even users with minimal technical expertise can navigate the system smoothly. Most documents can be sent within minutes, expediting the entire signing and filing process.

-

Does airSlate SignNow offer support for 'DEMAND FOR FILING OF RELEASE' users?

Absolutely! AirSlate SignNow provides dedicated customer support for all users, including those utilizing the 'DEMAND FOR FILING OF RELEASE' feature. Whether you have questions about the signing process, template customization, or integrations, their support team is available to assist you promptly and effectively.

Get more for DEMAND FOR FILING OF RELEASE

- Fda form 2359c

- Letter of indebtedness form

- Medipass florida form

- Download flyer california housing finance agency calhfa ca form

- Ccma form lra 4 9 download 322875375

- Consulate general of india san francisco o affix p form

- Extension of lease agreement template form

- Facility lease agreement template form

Find out other DEMAND FOR FILING OF RELEASE

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online