KS DO 1 Form

What is the KS DO 1

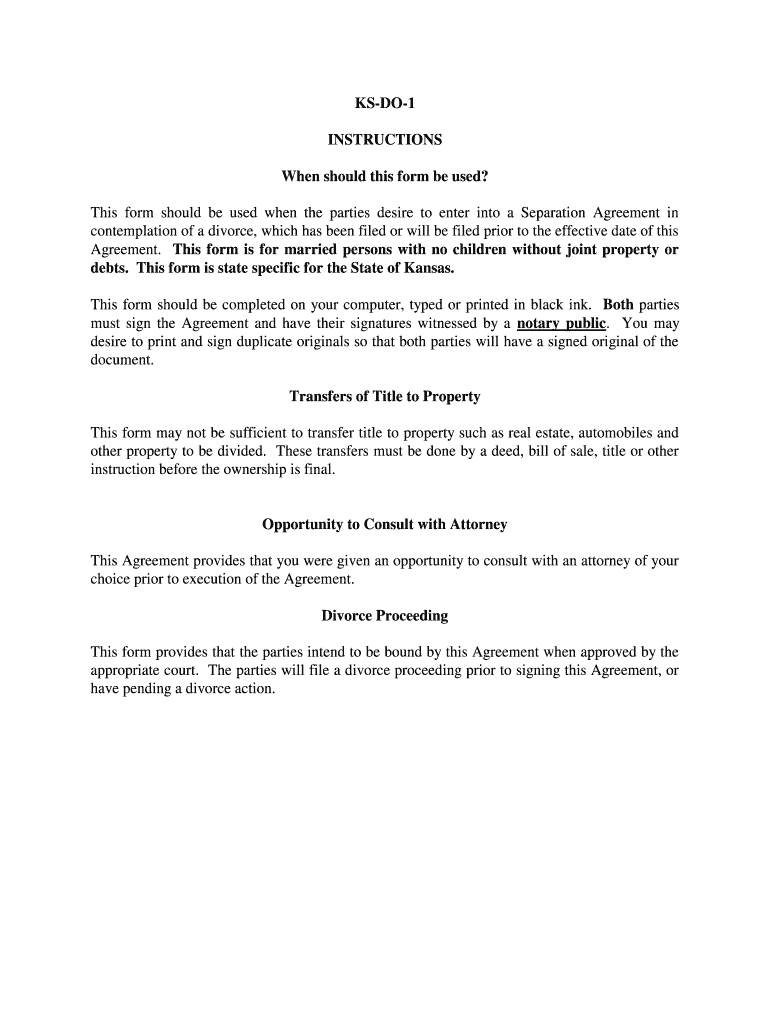

The KS DO 1 form is a specific document used primarily for tax purposes in the United States. It serves as a declaration for various financial activities and is essential for individuals and businesses to report income accurately. Understanding the purpose of this form is crucial for compliance with tax regulations.

How to use the KS DO 1

Using the KS DO 1 form involves several steps to ensure that all required information is accurately provided. First, gather all necessary financial documents, including income statements and relevant tax records. Next, fill out the form by entering your personal information, income details, and any deductions you may be eligible for. Finally, review the completed form for accuracy before submitting it according to the specified guidelines.

Steps to complete the KS DO 1

Completing the KS DO 1 form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Provide your personal information, including name, address, and Social Security number.

- List all sources of income accurately.

- Include any deductions or credits applicable to your situation.

- Review the form for completeness and accuracy.

- Submit the form through the appropriate channels, whether online or by mail.

Legal use of the KS DO 1

The KS DO 1 form is legally binding when completed and submitted in accordance with IRS guidelines. It is important to ensure that all information provided is truthful and accurate to avoid penalties. Compliance with tax laws not only protects individuals and businesses but also contributes to the overall integrity of the tax system.

Filing Deadlines / Important Dates

Filing deadlines for the KS DO 1 form are critical to ensure compliance with tax regulations. Typically, the deadline coincides with the annual tax filing date, which is usually April fifteenth for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing requirements. It is essential to stay informed about these dates to avoid late penalties.

Required Documents

To successfully complete the KS DO 1 form, certain documents are required. These typically include:

- Income statements (W-2s, 1099s, etc.)

- Previous year’s tax return for reference

- Documentation for any deductions or credits

- Identification documents, such as a driver’s license or Social Security card

Who Issues the Form

The KS DO 1 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. This form is an essential tool for taxpayers to report their financial activities and ensure compliance with federal tax laws.

Quick guide on how to complete ks do 1

Complete KS DO 1 effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the correct form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your papers quickly without delays. Handle KS DO 1 on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign KS DO 1 without hassle

- Obtain KS DO 1 and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from a device of your choice. Modify and eSign KS DO 1 and guarantee excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is KS DO 1 and how does it relate to airSlate SignNow?

KS DO 1 refers to a versatile solution for document signing and management. With airSlate SignNow, businesses can utilize KS DO 1 to streamline their eSignature processes, making it easier to send, sign, and manage documents efficiently.

-

What features does airSlate SignNow offer within KS DO 1?

airSlate SignNow offers various features under the KS DO 1 umbrella, including customizable templates, automated workflows, and secure cloud storage. These features facilitate a seamless document signing experience for users and enhance overall productivity.

-

Is airSlate SignNow pricing competitive for users interested in KS DO 1?

Yes, airSlate SignNow offers competitive pricing for the KS DO 1 service. Businesses can access cost-effective plans that provide excellent value for the range of features included, making it an attractive option for organizations of all sizes.

-

What are the benefits of using KS DO 1 with airSlate SignNow?

Using KS DO 1 with airSlate SignNow provides several benefits, such as increasing efficiency in document handling, reducing turnaround time, and ensuring compliance with legal standards. This empowers businesses to focus on their core operations while relying on a trusted eSigning solution.

-

Can KS DO 1 integrate with other software in my organization?

Yes, airSlate SignNow supports integrations with various software and applications, making it easy to incorporate KS DO 1 into your existing workflows. This interoperable approach helps streamline processes and enhances overall productivity across departments.

-

How secure is the document signing process with KS DO 1?

The document signing process with KS DO 1 in airSlate SignNow is highly secure, employing advanced encryption protocols and compliance with eSignature laws. This ensures that your documents are protected throughout the signing process, giving you peace of mind.

-

What types of documents can I send and sign using KS DO 1?

With KS DO 1, users can send and sign a variety of document types, including contracts, agreements, and forms. airSlate SignNow's flexibility allows businesses to cater to their specific document needs without compromising on speed or security.

Get more for KS DO 1

- Dog health record owner information name kennel vet address phone groomer city state zip email trainer dog information name

- Revised 8 1 16 form

- Patient registration attadmin form

- Mayo clinic forms

- Tb risk assessment minnesota department of health form

- Phone 1 800 829 7110 form

- Rule 21 assessment minnesota form

- Letter of intent loi templatehow to write with sample form

Find out other KS DO 1

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement