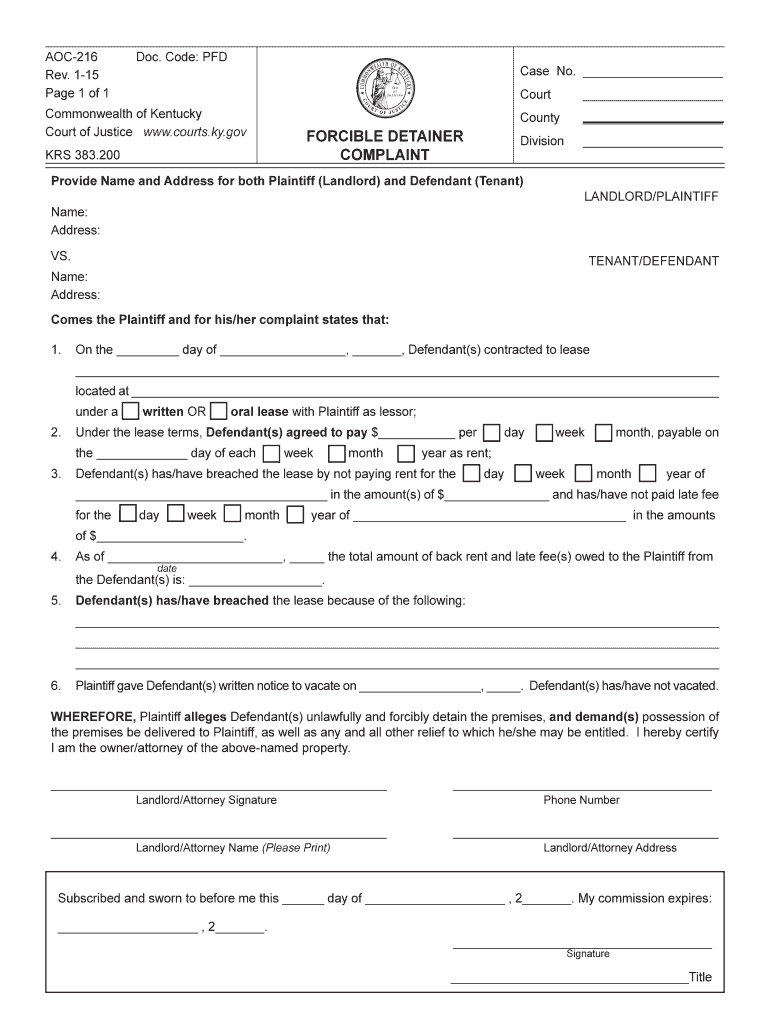

Code PFD Form

What is the Code PFD

The Code PFD is a specific form used primarily for tax-related purposes in the United States. It serves as a declaration for certain tax exemptions or deductions, allowing individuals or entities to report their eligibility for specific tax benefits. Understanding the Code PFD is essential for ensuring compliance with IRS regulations and for optimizing tax filings. This form is particularly relevant for self-employed individuals, businesses, and other taxpayers seeking to navigate the complexities of the tax system.

How to use the Code PFD

Using the Code PFD involves several key steps to ensure accurate and compliant completion. Initially, gather all necessary documentation related to your tax situation, including income statements and any relevant deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once the form is filled, review it for any errors, and then submit it according to the specified guidelines, either electronically or via mail. Familiarity with the form's requirements will help streamline the process and reduce the risk of errors.

Steps to complete the Code PFD

Completing the Code PFD requires a systematic approach:

- Gather necessary documents, including income statements and previous tax returns.

- Obtain the latest version of the Code PFD from the IRS website or relevant tax authority.

- Fill out the form accurately, ensuring all sections are completed as required.

- Double-check all entries for accuracy, including names, numbers, and signatures.

- Submit the completed form according to the provided submission methods, either online or by mail.

Legal use of the Code PFD

The legal use of the Code PFD hinges on compliance with IRS regulations. To ensure that the form is considered valid, it must be filled out accurately and submitted within the designated timeframes. Additionally, the information provided must be truthful and substantiated by supporting documents. Misrepresentation or errors can lead to penalties or audits, highlighting the importance of understanding the legal implications of the Code PFD.

Key elements of the Code PFD

Key elements of the Code PFD include:

- Identification Information: This includes the taxpayer's name, address, and identification number.

- Tax Year: The specific tax year for which the form is being submitted.

- Claimed Deductions or Exemptions: Detailed information on the deductions or exemptions being claimed.

- Signature: A signature is required to validate the form, affirming that the information is accurate and complete.

Who Issues the Form

The Code PFD is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS provides guidelines and resources for taxpayers to understand how to properly use the form, including instructions on eligibility and submission. It is crucial to refer to the IRS for the most current version of the form and any updates to the regulations surrounding its use.

Quick guide on how to complete code pfd

Easily Prepare Code PFD on Any Device

The management of documents online has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly and without delays. Manage Code PFD across any platform using the airSlate SignNow applications for Android or iOS and enhance your document-centric processes today.

Effortlessly Modify and eSign Code PFD

- Find Code PFD and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Code PFD to guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Code PFD in airSlate SignNow?

Code PFD refers to the unique identification system in airSlate SignNow for various document types, ensuring efficient processing and retrieval of electronic signatures. It streamlines the online signing process, enhancing user experience by making document management more intuitive.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution compared to traditional signing methods. Each plan provides access to features that utilize the Code PFD system for seamless document management.

-

What features does airSlate SignNow offer?

airSlate SignNow offers numerous features including document creation, electronic signing, and integrations with popular third-party applications. The functionality is further enhanced by the use of Code PFD, which ensures that each document type is clearly identifiable and easily managed.

-

How can Code PFD benefit my business?

Using Code PFD within airSlate SignNow enhances your business’s document management by providing clarity and efficiency in tracking and signing documents. This not only saves time but also helps reduce errors, making the signing process faster and more reliable.

-

What types of documents can be signed using Code PFD?

With airSlate SignNow, you can sign a variety of documents including contracts, agreements, and forms all utilizing the Code PFD system for quick identification. This versatility allows businesses to handle diverse document needs in a single platform.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow supports integrations with numerous popular applications, enhancing its functionality. The Code PFD framework ensures these integrations work seamlessly, allowing easy access to documents across platforms.

-

Is airSlate SignNow secure for signing sensitive documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption methods to protect your documents. The Code PFD system helps maintain the integrity and confidentiality of the signed documents, providing peace of mind for sensitive transactions.

Get more for Code PFD

- Bioidentical hormone replacement therapy female consent form

- Visitor visa tourist stream subclass 600 application checklist form

- The new 990 and its relationship to california law form

- Understanding schedule m 3 on irs form 1065

- Delaware income taxes and de state tax forms

- Get a sample irs determination letter form

- Tree cutt contract template form

- Tree removal contract template form

Find out other Code PFD

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online