Flood Prone as Defined by the National Flood Insurance Act of 1968 Form

What is the Flood Prone As Defined By The National Flood Insurance Act Of 1968

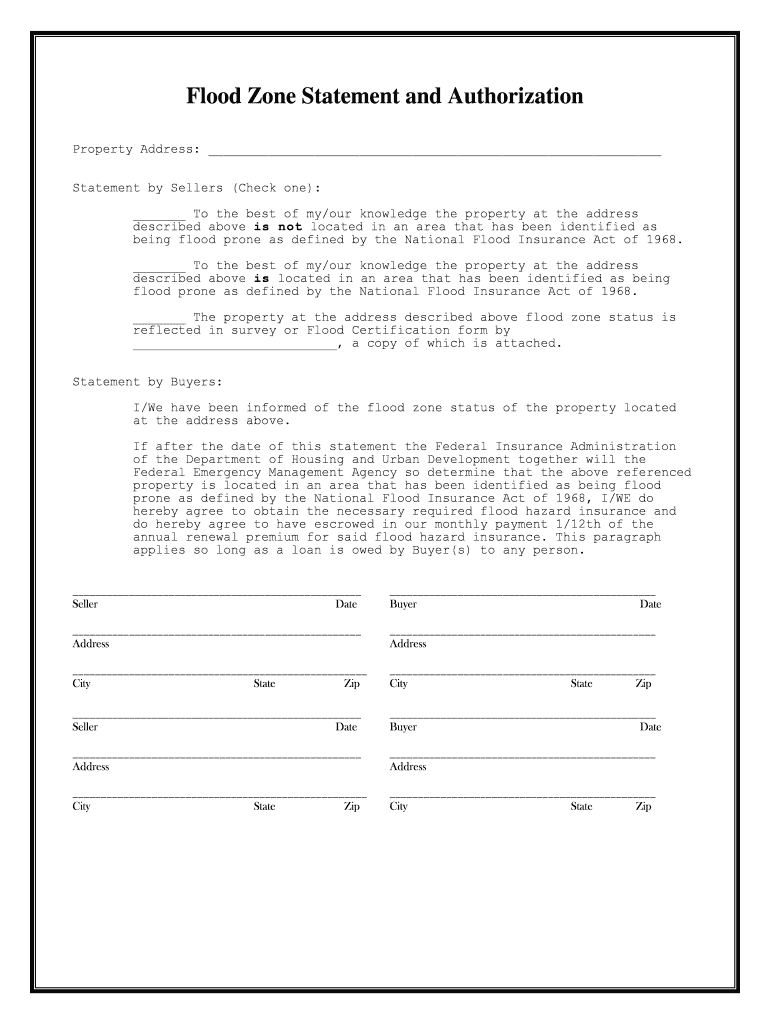

The term "flood prone," as defined by the National Flood Insurance Act of 1968, refers to areas that are at risk of flooding due to various environmental factors. This definition is crucial for determining eligibility for federal flood insurance programs. The Act was established to provide affordable flood insurance to property owners and to encourage communities to adopt floodplain management regulations. Understanding whether a property is in a flood-prone area can help owners make informed decisions about insurance and risk management.

Steps to Complete the Flood Prone As Defined By The National Flood Insurance Act Of 1968

Completing the form related to flood-prone areas involves several key steps. First, gather all necessary information about the property, including its location and any previous flood history. Next, consult local flood maps to verify if the property is classified as flood prone. Once you have confirmed this, fill out the form accurately, ensuring that all sections are completed. After filling out the form, review it for any errors before submission. This thorough process helps ensure that your application is processed smoothly.

Legal Use of the Flood Prone As Defined By The National Flood Insurance Act Of 1968

The legal use of the flood-prone designation is primarily for determining eligibility for federal flood insurance. Properties identified as flood prone must adhere to specific regulations and guidelines outlined in the National Flood Insurance Act. This designation can impact property values, insurance rates, and the requirements for obtaining loans. It is essential for property owners to understand the legal implications of their flood-prone status to ensure compliance with local and federal laws.

Key Elements of the Flood Prone As Defined By The National Flood Insurance Act Of 1968

Several key elements define flood-prone areas under the National Flood Insurance Act. These include the elevation of the property, proximity to water bodies, and historical data on flooding events. The Act also outlines the responsibilities of local governments to manage flood risks effectively. Understanding these elements is vital for property owners to assess their risk and secure appropriate insurance coverage.

How to Obtain the Flood Prone As Defined By The National Flood Insurance Act Of 1968

To obtain information regarding the flood-prone status of a property, individuals can access flood maps through the Federal Emergency Management Agency (FEMA) website or local government offices. These maps provide detailed information about flood zones and risk levels. Additionally, property owners can request a flood determination from their insurance provider or a qualified professional to ensure they have accurate and up-to-date information.

Examples of Using the Flood Prone As Defined By The National Flood Insurance Act Of 1968

Examples of using the flood-prone designation include property owners seeking federal flood insurance for homes in designated flood zones. Additionally, local governments may use this information to implement zoning regulations and floodplain management strategies. Understanding the implications of being in a flood-prone area can also guide homeowners in making decisions about property improvements and disaster preparedness.

Quick guide on how to complete flood prone as defined by the national flood insurance act of 1968

Manage Flood Prone As Defined By The National Flood Insurance Act Of 1968 effortlessly on any device

Digital document administration has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Flood Prone As Defined By The National Flood Insurance Act Of 1968 on any platform using airSlate SignNow Android or iOS applications, and streamline any document-related operation today.

How to modify and electronically sign Flood Prone As Defined By The National Flood Insurance Act Of 1968 with ease

- Locate Flood Prone As Defined By The National Flood Insurance Act Of 1968 and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, be it by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Flood Prone As Defined By The National Flood Insurance Act Of 1968 to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is considered 'Flood Prone As Defined By The National Flood Insurance Act Of 1968'?

Flood Prone As Defined By The National Flood Insurance Act Of 1968 refers to areas at signNow risk of flooding that are identified by federal standards. This definition is crucial for individuals and businesses in these zones to understand their insurance requirements and potential liabilities associated with flood risk.

-

How does airSlate SignNow help with flood insurance documentation?

airSlate SignNow streamlines the signing and management of documents related to flood insurance claims and applications. By utilizing our service, users can easily eSign contracts and submit necessary paperwork efficiently, ensuring compliance with Flood Prone As Defined By The National Flood Insurance Act Of 1968.

-

What features does airSlate SignNow offer to assist flood-prone business sectors?

airSlate SignNow offers features such as customizable templates, secure e-signatures, and automated workflows that cater to businesses in Flood Prone As Defined By The National Flood Insurance Act Of 1968 areas. These tools enhance the efficiency of signing essential documents while ensuring your business meets compliance standards.

-

Are there any specific integrations for flood insurance agencies?

Yes, airSlate SignNow integrates seamlessly with various document management systems and CRMs, making it an ideal choice for flood insurance agencies. These integrations help streamline the processing of documents related to clients in Flood Prone As Defined By The National Flood Insurance Act Of 1968.

-

How affordable is airSlate SignNow for small businesses dealing with flood insurance?

airSlate SignNow is a cost-effective solution designed for businesses of all sizes, including small enterprises managing flood insurance. With flexible pricing plans, it's an accessible tool for those who need efficient solutions in areas defined as Flood Prone As Defined By The National Flood Insurance Act Of 1968.

-

What are the benefits of using e-signatures for flood insurance documents?

Using e-signatures with airSlate SignNow provides security, speed, and convenience for flood insurance documents. As insurance operations often involve time-sensitive materials in Flood Prone As Defined By The National Flood Insurance Act Of 1968, e-signatures signNowly reduce turnaround times and enhance overall efficiency.

-

Can airSlate SignNow assist in compliance with FEMA flood risk assessments?

Absolutely, airSlate SignNow can assist users in managing documentation related to FEMA flood risk assessments. By ensuring that all documents required under Flood Prone As Defined By The National Flood Insurance Act Of 1968 are easily accessible and eSigned, we promote better compliance and management of flood risk data.

Get more for Flood Prone As Defined By The National Flood Insurance Act Of 1968

Find out other Flood Prone As Defined By The National Flood Insurance Act Of 1968

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free