Subdivision of the State, or a Lien or Charge Upon Any Form

What is the Subdivision Of The State, Or A Lien Or Charge Upon Any

The subdivision of the state, or a lien or charge upon any, refers to legal claims placed on property or assets by governmental entities or creditors. These claims can arise due to unpaid taxes, legal judgments, or other financial obligations. Such liens serve as a public record of the debt and can impact the property owner's ability to sell or refinance their assets. Understanding the implications of these liens is crucial for property owners, as they can affect credit ratings and financial stability.

Key elements of the Subdivision Of The State, Or A Lien Or Charge Upon Any

Several key elements define the subdivision of the state or a lien or charge upon any. These include:

- Legal Authority: The entity imposing the lien must have the legal right to do so, typically established through statutory provisions.

- Public Record: Liens are recorded in public registries, making them accessible for verification by potential buyers or lenders.

- Impact on Ownership: A lien may restrict the owner's ability to sell or transfer the property until the debt is resolved.

- Duration: Liens can have specific time frames, after which they may expire if not enforced.

Steps to complete the Subdivision Of The State, Or A Lien Or Charge Upon Any

Completing the subdivision of the state or a lien or charge upon any involves several important steps:

- Gather Information: Collect all relevant details about the property, including ownership documents and any outstanding debts.

- Determine Jurisdiction: Identify the appropriate governmental authority responsible for processing the lien.

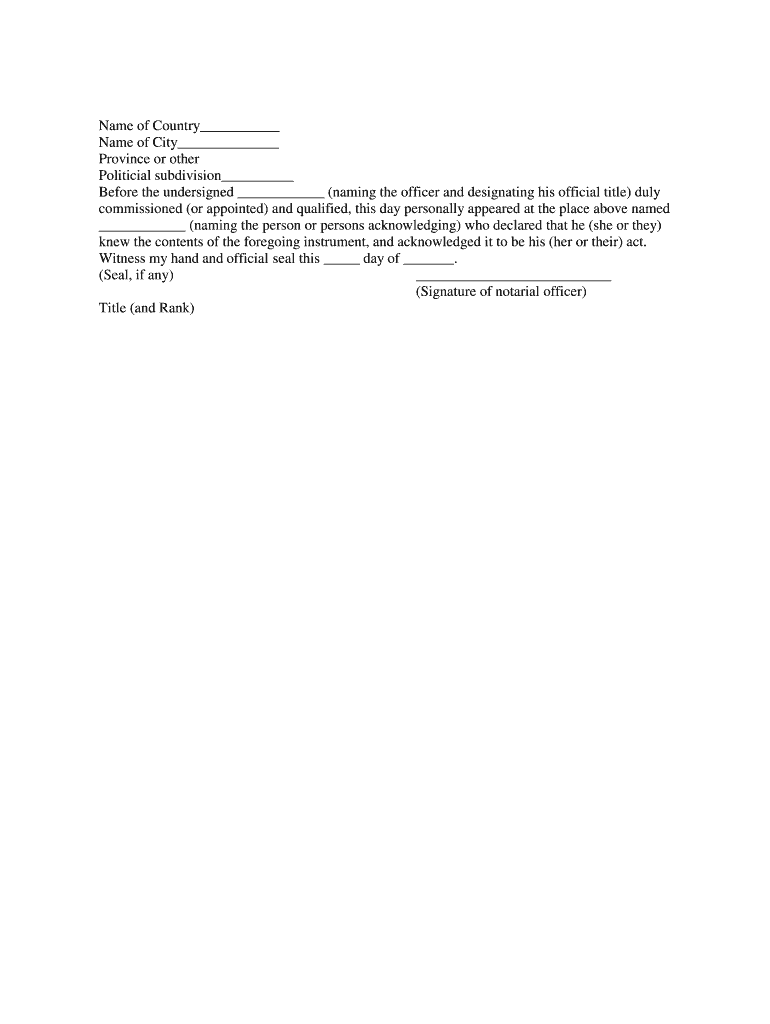

- Complete Required Forms: Fill out the necessary forms accurately, ensuring all information is correct to avoid delays.

- Submit Documentation: Provide the completed forms along with any required supporting documents to the designated office.

- Pay Applicable Fees: Be prepared to pay any fees associated with filing the lien.

Legal use of the Subdivision Of The State, Or A Lien Or Charge Upon Any

The legal use of the subdivision of the state or a lien or charge upon any is primarily to secure debts owed to governmental entities or creditors. This legal mechanism ensures that creditors have a claim on the property, which can be enforced through legal means if necessary. It is essential for property owners to understand their rights and obligations concerning these liens, as they can significantly affect property transactions and financial planning.

State-specific rules for the Subdivision Of The State, Or A Lien Or Charge Upon Any

Each state in the U.S. has specific rules governing the subdivision of the state or a lien or charge upon any. These rules may dictate:

- Filing Procedures: The process for filing a lien can vary by state, including the forms required and the offices to which they must be submitted.

- Time Limits: States may impose different time limits for how long a lien remains valid if not enforced.

- Priority of Liens: The order in which liens are filed can affect their priority in claims against the property.

Examples of using the Subdivision Of The State, Or A Lien Or Charge Upon Any

Examples of the subdivision of the state or a lien or charge upon any include:

- Tax Liens: A government may place a lien on a property for unpaid property taxes, which must be settled before the property can be sold.

- Mechanic's Liens: Contractors may file a lien against a property if they are not paid for work performed, ensuring they have a claim to the property until the debt is resolved.

- Judgment Liens: Creditors can obtain a lien following a court judgment against a debtor, allowing them to claim the property if the debt is not paid.

Quick guide on how to complete subdivision of the state or a lien or charge upon any

Complete Subdivision Of The State, Or A Lien Or Charge Upon Any effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Subdivision Of The State, Or A Lien Or Charge Upon Any on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

How to alter and eSign Subdivision Of The State, Or A Lien Or Charge Upon Any with ease

- Obtain Subdivision Of The State, Or A Lien Or Charge Upon Any and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet signature.

- Review the information and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Subdivision Of The State, Or A Lien Or Charge Upon Any and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to the Subdivision Of The State, Or A Lien Or Charge Upon Any?

airSlate SignNow is a digital solutions platform that enables businesses to send and eSign documents efficiently. It serves as a crucial tool for handling documents related to the Subdivision Of The State, Or A Lien Or Charge Upon Any by ensuring legal compliance and providing a secure signature process.

-

How can airSlate SignNow help my business address the Subdivision Of The State, Or A Lien Or Charge Upon Any?

With airSlate SignNow, your business can streamline the handling of documents associated with the Subdivision Of The State, Or A Lien Or Charge Upon Any. Our platform allows for quick eSignatures and document management, reducing the risk of errors and ensuring legal validity in your agreements.

-

What pricing options does airSlate SignNow offer for businesses dealing with the Subdivision Of The State, Or A Lien Or Charge Upon Any?

airSlate SignNow provides a variety of pricing plans tailored to meet the needs of businesses dealing with documents concerning the Subdivision Of The State, Or A Lien Or Charge Upon Any. Our plans include features like document templates, customizable workflows, and real-time tracking at competitive rates.

-

Are there integrations available with airSlate SignNow for managing the Subdivision Of The State, Or A Lien Or Charge Upon Any?

Yes, airSlate SignNow integrates seamlessly with various third-party applications to enhance document management related to the Subdivision Of The State, Or A Lien Or Charge Upon Any. You can connect it with CRM, email, and project management tools to streamline your workflow further.

-

What features does airSlate SignNow offer specifically for documents related to the Subdivision Of The State, Or A Lien Or Charge Upon Any?

Our platform offers features such as customizable templates, automated reminders, and audit trails that are essential for handling documents associated with the Subdivision Of The State, Or A Lien Or Charge Upon Any. These features ensure that you can manage agreements efficiently and maintain compliance with legal standards.

-

Is airSlate SignNow secure for handling sensitive documents regarding the Subdivision Of The State, Or A Lien Or Charge Upon Any?

Absolutely! airSlate SignNow is built with top-notch security features that safeguard your documents linked to the Subdivision Of The State, Or A Lien Or Charge Upon Any. We employ encryption, secure data storage, and compliance with regulations to protect sensitive information.

-

Can airSlate SignNow improve the turnaround time for eSigning documents related to the Subdivision Of The State, Or A Lien Or Charge Upon Any?

Yes, airSlate SignNow signNowly accelerates the turnaround time for eSigning documents concerning the Subdivision Of The State, Or A Lien Or Charge Upon Any. Our platform allows users to sign documents from anywhere at any time, which speeds up the approval process.

Get more for Subdivision Of The State, Or A Lien Or Charge Upon Any

- Msde occ medication administration authorization form msde maryland

- Form a 1 131

- Meiosis foldable activity answer key form

- Craft 12 contractor application welcome to dryden mutual form

- City of indianapolisbusiness neighborhood servi form

- Waitsfield workers comp hold harmless form town of waitsfield

- Forms and publications for barbers and cosmetologists

- Permit no office use only form

Find out other Subdivision Of The State, Or A Lien Or Charge Upon Any

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement