American Funds Ira Forms

What are the American Funds IRA Forms?

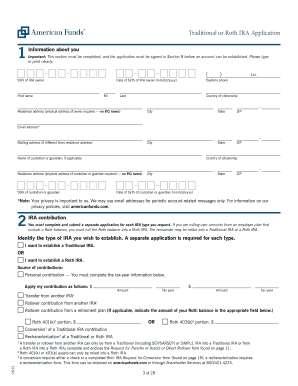

The American Funds IRA forms are essential documents used to establish and manage Individual Retirement Accounts (IRAs) with American Funds. These forms facilitate various transactions, including opening accounts, making contributions, and initiating rollovers. The primary types of IRA forms include the American Funds Traditional IRA application, the American Funds Roth IRA application, and the American Funds enrollment form. Each form is tailored to meet specific requirements based on the type of IRA and the individual's financial goals.

Steps to Complete the American Funds IRA Forms

Completing the American Funds IRA forms involves several key steps to ensure accuracy and compliance. Start by selecting the appropriate form based on the type of IRA you wish to open. Next, gather necessary personal information, including your Social Security number, employment details, and financial information. Carefully fill out each section of the form, ensuring that all information is complete and accurate. After completing the form, review it for any errors before submitting it. It's advisable to keep a copy for your records.

Legal Use of the American Funds IRA Forms

The legal use of the American Funds IRA forms is governed by various regulations, including the Employee Retirement Income Security Act (ERISA) and Internal Revenue Service (IRS) guidelines. To ensure that your forms are legally binding, it is crucial to follow the specific requirements outlined by these regulations. This includes providing accurate information, obtaining necessary signatures, and adhering to submission deadlines. Using a compliant eSignature platform, like signNow, can enhance the legal validity of your forms by ensuring that they meet electronic signature laws.

Eligibility Criteria for American Funds IRA Forms

Eligibility criteria for using the American Funds IRA forms depend on the type of IRA being established. Generally, individuals must be under the age of seventy and a half to contribute to a Traditional IRA. For a Roth IRA, there are income limits that determine eligibility for contributions. Additionally, individuals must have earned income to contribute to either type of IRA. Understanding these criteria is essential for ensuring that you qualify for the benefits associated with your chosen IRA.

Required Documents for American Funds IRA Applications

When completing the American Funds IRA application, several documents may be required to verify your identity and financial status. Commonly required documents include a government-issued photo ID, Social Security card, and proof of income, such as recent pay stubs or tax returns. Additionally, if you are rolling over funds from another retirement account, documentation from the previous account may be necessary. Having these documents ready can streamline the application process.

Form Submission Methods for American Funds IRA Forms

The American Funds IRA forms can be submitted through various methods, including online, by mail, or in person. Submitting online is often the quickest method, allowing for immediate processing. If you prefer to submit by mail, ensure that you send the forms to the correct address and consider using a trackable mailing option. In-person submissions may be available at designated American Funds locations or financial institutions that offer their services. Each method has its advantages, so choose the one that best fits your needs.

Quick guide on how to complete american funds ira forms

Manage American Funds Ira Forms effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers a flawless eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle American Funds Ira Forms on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign American Funds Ira Forms with ease

- Find American Funds Ira Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or mask sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign American Funds Ira Forms and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the american funds ira forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is azsmartsave and how does it work with airSlate SignNow?

azsmartsave is a powerful feature within airSlate SignNow that allows users to streamline document management by securely storing and quickly retrieving important documents. With azsmartsave, businesses can enhance their eSigning experience, ensuring that all vital documents are easily accessible and organized.

-

How does azsmartsave affect pricing for airSlate SignNow?

airSlate SignNow offers competitive pricing that includes the benefits of azsmartsave. Users can take advantage of the efficient document management capabilities without incurring additional costs, making it a cost-effective solution for businesses of all sizes.

-

What are the key features of azsmartsave within airSlate SignNow?

azsmartsave offers features like automated document storage, quick retrieval, and integration with popular cloud services. These features help users simplify their workflow, save time, and enhance their eSigning process while using airSlate SignNow.

-

Can azsmartsave integrate with other software platforms?

Yes, azsmartsave is designed to seamlessly integrate with various software platforms, enhancing the overall functionality of airSlate SignNow. This allows users to combine different tools and apps, making document management and eSigning more efficient and effective.

-

What benefits does azsmartsave provide to businesses?

The azsmartsave feature within airSlate SignNow provides numerous benefits, including improved organization of documents, faster access to essential forms, and enhanced security for sensitive information. This empowers businesses to operate more efficiently and confidently manage their eSigning processes.

-

Is azsmartsave user-friendly for new users of airSlate SignNow?

Absolutely! azsmartsave is designed with user-friendliness in mind, ensuring that even new users can navigate its functionalities with ease. The intuitive interface of airSlate SignNow makes it simple for anyone to utilize azsmartsave effectively.

-

How does azsmartsave enhance collaboration within airSlate SignNow?

azsmartsave enhances collaboration by providing an organized platform where teams can access and share signed documents easily. This feature ensures that all members involved in the signing process can retrieve necessary documents without delay, fostering a more collaborative work environment.

Get more for American Funds Ira Forms

Find out other American Funds Ira Forms

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF