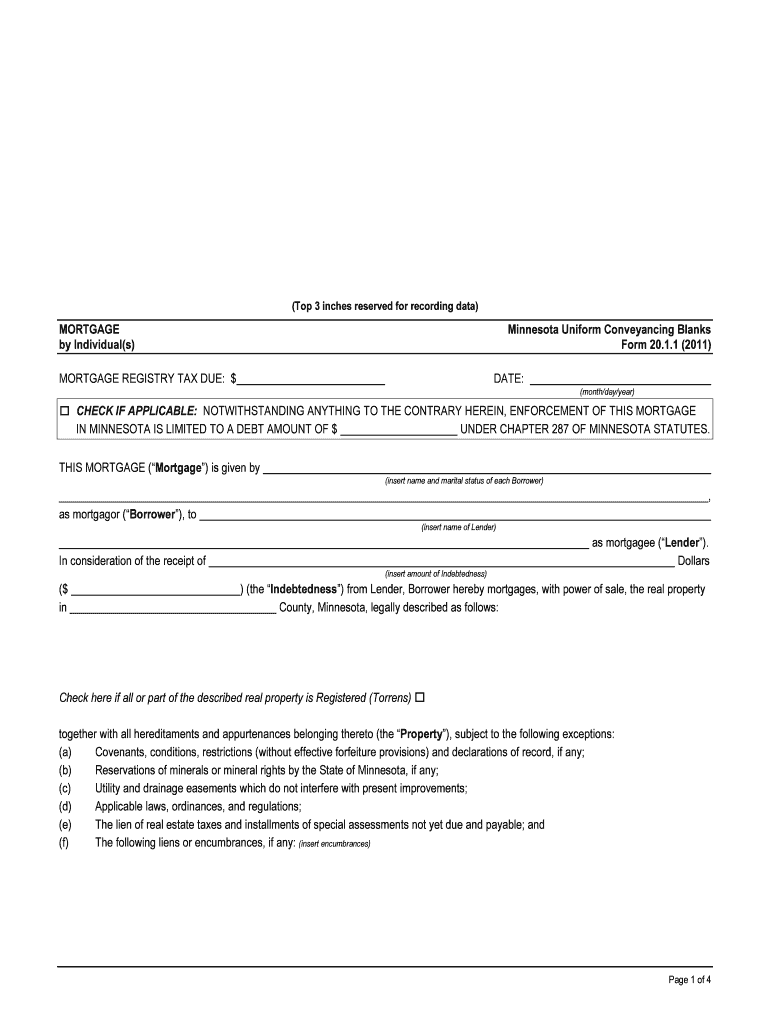

MORTGAGE REGISTRY TAX DUE $ Form

What is the mortgage registry tax due?

The mortgage registry tax due is a financial obligation imposed by state or local governments on property transactions involving mortgages. This tax is typically calculated as a percentage of the mortgage amount and is required to be paid at the time of recording the mortgage with the appropriate government office. The funds collected from this tax are often used to support local infrastructure and public services.

How to use the mortgage registry tax due?

Using the mortgage registry tax due involves understanding the specific requirements of your state or locality. When you secure a mortgage, you will need to calculate the tax based on the mortgage amount. This tax must then be paid, often at the time of closing, to ensure that the mortgage is properly recorded. Failure to pay this tax can result in delays in the mortgage process or potential legal issues regarding the property.

Steps to complete the mortgage registry tax due

Completing the mortgage registry tax due involves several key steps:

- Determine the mortgage amount and the applicable tax rate in your state.

- Calculate the total tax due based on the mortgage amount.

- Prepare the necessary documentation, including the mortgage agreement.

- Submit the payment along with the required documents to the appropriate government office.

- Ensure that you receive confirmation of the tax payment and the recording of the mortgage.

Key elements of the mortgage registry tax due

Key elements of the mortgage registry tax due include:

- Tax Rate: The percentage applied to the mortgage amount, which varies by jurisdiction.

- Payment Timing: Typically due at closing or when the mortgage is recorded.

- Documentation: Requires submission of specific forms and payment receipts.

- Compliance: Essential for legal recording of the mortgage to avoid penalties.

State-specific rules for the mortgage registry tax due

Each state has its own regulations regarding the mortgage registry tax due. These rules can dictate the tax rate, payment procedures, and deadlines. It is crucial to consult your state’s department of revenue or local government offices to ensure compliance with all applicable laws. Some states may also offer exemptions or reductions for certain types of transactions or property owners.

Penalties for non-compliance

Failure to comply with the mortgage registry tax due can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal complications regarding the mortgage itself. Additionally, non-compliance can delay the recording of the mortgage, impacting the property owner's ability to access financing or transfer ownership in the future. It is essential to stay informed about your obligations to avoid these consequences.

Quick guide on how to complete mortgage registry tax due

Complete MORTGAGE REGISTRY TAX DUE $ effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without interruption. Manage MORTGAGE REGISTRY TAX DUE $ on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign MORTGAGE REGISTRY TAX DUE $ with ease

- Obtain MORTGAGE REGISTRY TAX DUE $ and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign MORTGAGE REGISTRY TAX DUE $ and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the MORTGAGE REGISTRY TAX DUE $?

The MORTGAGE REGISTRY TAX DUE $ is a fee imposed by local governments when a mortgage is recorded. This tax varies by jurisdiction and is typically calculated as a percentage of the mortgage amount. Understanding this tax is crucial for homeowners and investors to ensure compliance and avoid unexpected costs.

-

How can airSlate SignNow assist with managing MORTGAGE REGISTRY TAX DUE $?

airSlate SignNow offers efficient eSigning features that streamline the documentation required for mortgage transactions. By utilizing our platform, you can manage and store important documents securely, which helps keep track of any MORTGAGE REGISTRY TAX DUE $. This organization ensures all paperwork is accurate and compliant with local regulations.

-

Are there any features specifically for tracking MORTGAGE REGISTRY TAX DUE $?

While airSlate SignNow does not specifically track taxes, it provides tools to manage related documents and workflows efficiently. Users can create custom templates for mortgage-related documents, ensuring that the details about MORTGAGE REGISTRY TAX DUE $ are easily accessible. This feature facilitates better preparation for these expenses.

-

Is there a cost associated with airSlate SignNow for managing MORTGAGE REGISTRY TAX DUE $ documentation?

Yes, airSlate SignNow comes with a subscription fee. However, the cost of our service is very competitive, especially considering the savings achieved by streamlining the eSigning and documentation process related to MORTGAGE REGISTRY TAX DUE $. Our pricing plans are designed to offer signNow value to both individuals and businesses.

-

Can I integrate airSlate SignNow with other financial tools to manage MORTGAGE REGISTRY TAX DUE $?

Absolutely! airSlate SignNow integrates seamlessly with various financial and accounting tools. This allows you to synchronize data related to MORTGAGE REGISTRY TAX DUE $ effectively, ensuring that all your financial documents are well organized and easily accessible.

-

How does airSlate SignNow improve the efficiency of managing MORTGAGE REGISTRY TAX DUE $?

By using airSlate SignNow, you can eliminate the hassles of printing and mailing documents. Our electronic signature solution speeds up the mortgage documentation process, ensuring that all forms related to MORTGAGE REGISTRY TAX DUE $ are completed and filed in a timely manner. This increased efficiency helps you meet deadlines and avoid penalties.

-

What are the benefits of using airSlate SignNow for mortgage-related paperwork?

The primary benefits include a user-friendly interface, secure document management, and cost savings. Utilizing airSlate SignNow helps you easily navigate through complex paperwork related to MORTGAGE REGISTRY TAX DUE $, ensuring that everything is done efficiently and accurately. You'll spend less time on administrative tasks and more time focusing on your real estate investments.

Get more for MORTGAGE REGISTRY TAX DUE $

- Wsu education form

- Jjc veterans form

- Rcuog employment application final pdf university of guam form

- Official transcript request the university of toledo form

- Petition template form fill out and sign printable pdf templatesignnow

- Volunteer waiver form template

- Satisfactory academic progress appeal form pdf radford radford

- Authorization to release confidential information university of unlv

Find out other MORTGAGE REGISTRY TAX DUE $

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template