Payroll Deduction Authorization Agreement Form

What is the Payroll Deduction Authorization Agreement Form

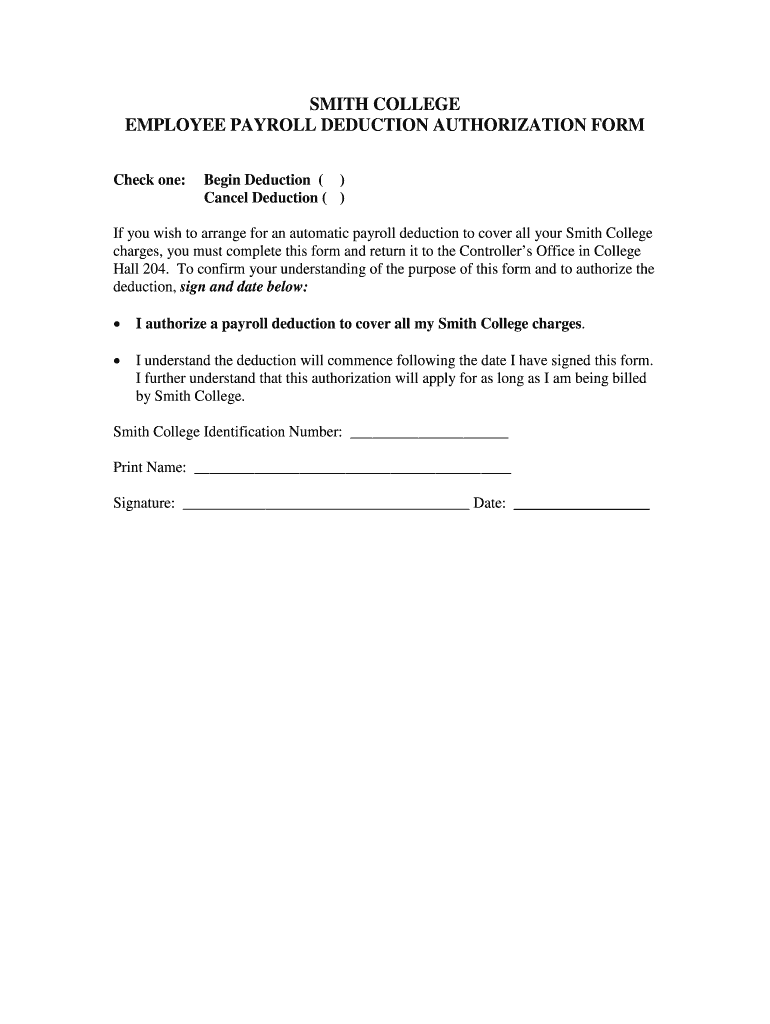

The Payroll Deduction Authorization Agreement Form is a legal document that allows an employee to authorize their employer to deduct specific amounts from their paycheck. This form is often used for various purposes, including contributions to retirement plans, health insurance premiums, or other voluntary deductions. By completing this form, employees ensure that their deductions are processed accurately and consistently.

How to use the Payroll Deduction Authorization Agreement Form

To use the Payroll Deduction Authorization Agreement Form, an employee must first obtain the form from their employer or human resources department. Once in possession of the form, the employee should fill in their personal details, including their name, employee ID, and the specific amounts to be deducted. It is crucial to specify the purpose of each deduction clearly. After completing the form, the employee must sign and date it to validate the authorization.

Steps to complete the Payroll Deduction Authorization Agreement Form

Completing the Payroll Deduction Authorization Agreement Form involves several straightforward steps:

- Obtain the form from your employer or HR.

- Fill in your personal information, such as name and employee ID.

- Specify the deduction amounts and their purposes.

- Review the information for accuracy.

- Sign and date the form to confirm your authorization.

- Submit the completed form to your HR department or payroll office.

Legal use of the Payroll Deduction Authorization Agreement Form

The Payroll Deduction Authorization Agreement Form must be used in compliance with federal and state laws. Employers are required to honor the deductions authorized by employees as long as they comply with applicable regulations. It is essential for both parties to retain copies of the signed form for their records, ensuring transparency and legal protection in case of disputes regarding deductions.

Key elements of the Payroll Deduction Authorization Agreement Form

Key elements of the Payroll Deduction Authorization Agreement Form include:

- Employee's full name and identification number.

- Details of the deductions being authorized, including amounts and purposes.

- Employee's signature and date of authorization.

- Employer's acknowledgment of the authorization.

Examples of using the Payroll Deduction Authorization Agreement Form

Common examples of using the Payroll Deduction Authorization Agreement Form include:

- Contributions to a 401(k) retirement plan.

- Health insurance premiums deducted from paychecks.

- Union dues or other professional organization fees.

- Charitable contributions directed from payroll.

Eligibility Criteria

Eligibility to use the Payroll Deduction Authorization Agreement Form typically requires that the employee is an active employee of the organization offering the deductions. Specific criteria may vary by employer, but generally, all employees should have the opportunity to authorize deductions for benefits offered by their employer. It is advisable for employees to consult their HR department for any additional eligibility requirements.

Quick guide on how to complete employee payroll deduction authorization form smith college smith

The optimal method to discover and endorse Payroll Deduction Authorization Agreement Form

At the level of an entire organization, ineffective procedures related to paper approvals can take up considerable working hours. Authorizing documents like Payroll Deduction Authorization Agreement Form is a fundamental aspect of operations in any organization, which is why the effectiveness of each agreement's lifecycle signNowly impacts the company’s overall productivity. With airSlate SignNow, endorsing your Payroll Deduction Authorization Agreement Form can be as straightforward and rapid as possible. You will discover with this platform the latest version of virtually any document. Even better, you can endorse it on-site without the need for installing external applications on your device or printing anything as physical copies.

Steps to obtain and endorse your Payroll Deduction Authorization Agreement Form

- Browse our collection by category or utilize the search bar to find the document you require.

- View the document preview by clicking on Learn more to confirm it’s the correct one.

- Select Get form to start editing immediately.

- Fill out your document and incorporate any essential information using the toolbar.

- Once completed, click the Sign tool to endorse your Payroll Deduction Authorization Agreement Form.

- Pick the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documentation efficiently. You can find, complete, edit, and even share your Payroll Deduction Authorization Agreement Form in a single tab without any trouble. Enhance your workflows by employing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

How will the suit Smith v Obama turn out in which Army captain Nathan Smith is trying to force Congress to authorize force against ISIL?

Captain Smith will inevitably lose this case. The decision to declare or not declare war is a political determination that goes to the heart of the discretion of the legislators. They have access to better and more thorough information than the courts ever will in the case. The hesitancy to answer political questions, hence the existence of the Political Question Doctrine, would control in this case, and leave the decisions within the political process.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

Which are the colleges to do research in mathematics and how do I fill out the forms?

The answer depends on the following.The area of research you are interested in. Not all colleges support research in both Pure an Applied Mathematics. Most Universities usually encourage research in both areas. Your choice is influenced by the city you are in and your preference to travel and stay away from home.The availability of a Research Supervisor willing to oversee your research work. Visiting the department’s website will give you on who’s taking in students under his/her research group.The financial support you hope to receive from your family. If you need to support yourself, you’d wish to enter get recruited as a Junior research fellow. Such Research Assistants get a monthly stipend which may be good enough to support you through your research period. This demands that you qualify as a JRF in the bi-annual Eligibility test conducted by CSIR.Good Luck!!!

-

How do I take admission in a B.Tech without taking the JEE Mains?

Admissions into B.Tech courses offered by engineering colleges in India is based on JEE Mains score and 12th percentile. Different private and government universities have already started B Tech admission 2019 procedure. However many reputed Private Colleges in India and colleges not affiliated with the Government colleges conduct state/region wise exams for admission or have their eligibility criterion set for admission.1. State Sponsored Colleges: These colleges have their state entrance exams for entry in such colleges. These colleges follow a particular eligibility criterion2. Private Colleges: These colleges either take admission on the basis of 10+2 score of the candidate or their respective entrance exam score. These colleges generally require students with Physics and Mathematics as compulsory subjects with minimum score requirement in each subject, as prescribed by them.3. Direct Admission: This lateral entry is introduced for students who want direct admission in 2nd year of their Bachelor’s course. However, there is an eligibility criterion for the same.Students should give as many entrance exams, to widen their possibility. College preference should always be based on certain factors like placement, faculty etc.

Create this form in 5 minutes!

How to create an eSignature for the employee payroll deduction authorization form smith college smith

How to generate an eSignature for your Employee Payroll Deduction Authorization Form Smith College Smith in the online mode

How to make an eSignature for the Employee Payroll Deduction Authorization Form Smith College Smith in Google Chrome

How to make an electronic signature for signing the Employee Payroll Deduction Authorization Form Smith College Smith in Gmail

How to make an electronic signature for the Employee Payroll Deduction Authorization Form Smith College Smith right from your smartphone

How to make an eSignature for the Employee Payroll Deduction Authorization Form Smith College Smith on iOS

How to create an eSignature for the Employee Payroll Deduction Authorization Form Smith College Smith on Android

People also ask

-

What is an authority to deduct template?

An authority to deduct template is a document that allows organizations to obtain permission from individuals for automatic deductions from their accounts. This template streamlines the process of managing deductions and ensures compliance with regulations. It simplifies documentation while safeguarding both parties' interests.

-

How can I create an authority to deduct template using airSlate SignNow?

Creating an authority to deduct template with airSlate SignNow is quick and straightforward. You can use our user-friendly platform to customize a template that meets your specific needs. Simply upload your document, add required fields, and send it for eSignature to initiate the deduction process.

-

Is there a cost associated with the authority to deduct template on airSlate SignNow?

AirSlate SignNow offers various pricing plans to accommodate different business needs, including the use of the authority to deduct template. We provide a cost-effective solution that enhances productivity. You can choose a plan that suits your organization’s size and workflow requirements.

-

What features come with the authority to deduct template?

The authority to deduct template includes features like customizable fields, eSignature capabilities, and tracking functionalities. These features facilitate smoother transactions and ensure that documents remain secure and legally binding. Additionally, you can easily manage and store completed templates within our platform.

-

Can I integrate the authority to deduct template with other applications?

Yes, airSlate SignNow allows seamless integration of the authority to deduct template with various applications, such as CRM tools and financial software. This enhances your workflow by connecting different systems, making it easier to manage deductions and client information. Check out our integration options for more details.

-

What are the benefits of using the airSlate SignNow authority to deduct template?

Using the airSlate SignNow authority to deduct template offers numerous benefits, including increased efficiency and reduced manual errors. Automating the deduction process saves time and helps maintain accurate records. Additionally, it enhances customer satisfaction with prompt and reliable service.

-

Is the authority to deduct template legally valid?

Yes, the authority to deduct template created with airSlate SignNow is legally valid when completed according to applicable regulations. Our platform ensures compliance with eSignature laws, which are recognized in many jurisdictions. Always consult legal counsel to ensure that your specific usage complies with local laws.

Get more for Payroll Deduction Authorization Agreement Form

- Kansal forest permission form

- Montana amend parenting form

- Motion to amend parenting plan montana form

- Headstartphysicalexamdoc chw form

- Human scavenger hunt for adults pdf form

- New patient intake form childrens healthcare of atlanta choa

- Stray animal intake form

- 2019 trcf 1000 tax formxlsx pocono mountain school

Find out other Payroll Deduction Authorization Agreement Form

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF