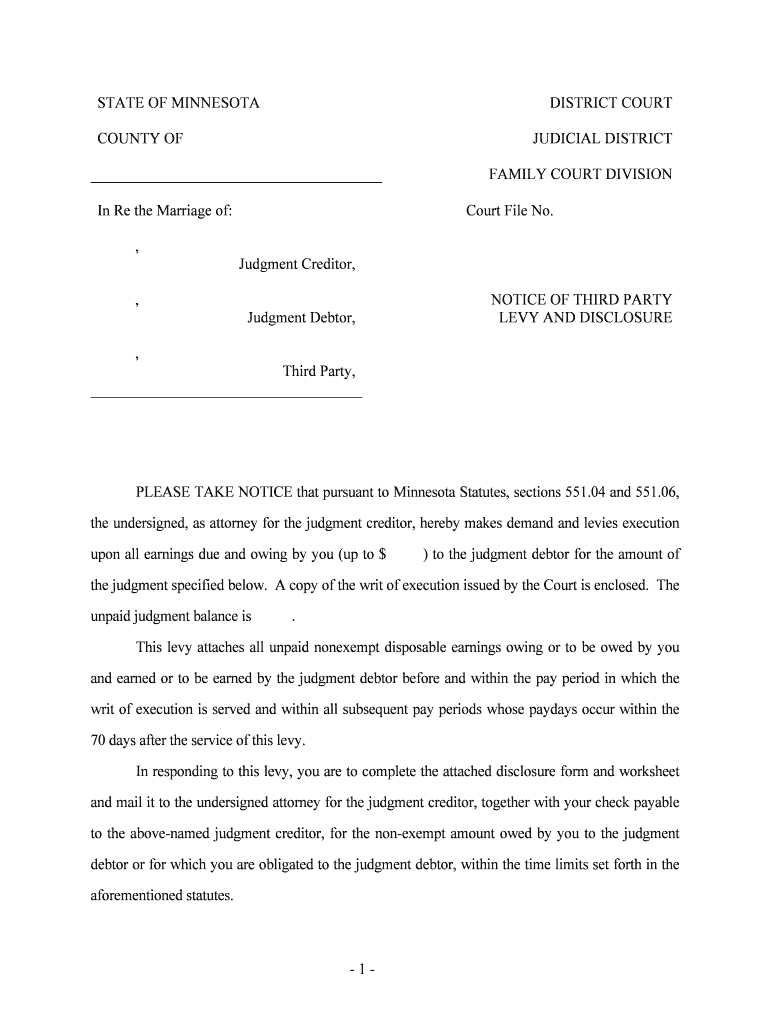

Execution Levy on Earnings Minnesota Judicial Branch Form

What is the Execution Levy On Earnings Minnesota Judicial Branch

The Execution Levy on Earnings is a legal mechanism utilized by the Minnesota Judicial Branch to collect debts owed by individuals. This process allows creditors to garnish wages directly from a debtor's paycheck, ensuring that debts are repaid in a structured manner. It is essential for both creditors and debtors to understand the implications and procedures involved in this process, as it can significantly affect an individual's financial situation.

How to use the Execution Levy On Earnings Minnesota Judicial Branch

To utilize the Execution Levy on Earnings, creditors must first obtain a judgment against the debtor in court. Once the judgment is secured, the creditor can file the necessary forms with the Minnesota Judicial Branch to initiate the garnishment process. This form must include details such as the debtor's employer information and the amount owed. Proper completion of these forms is crucial to ensure compliance with legal requirements and to facilitate the garnishment effectively.

Steps to complete the Execution Levy On Earnings Minnesota Judicial Branch

Completing the Execution Levy on Earnings involves several key steps:

- Obtain a judgment against the debtor in the appropriate court.

- Gather necessary information about the debtor's employer and earnings.

- Fill out the Execution Levy on Earnings form accurately, including all required details.

- Submit the completed form to the court for processing.

- Serve the form to the debtor's employer to initiate the wage garnishment.

Following these steps carefully will help ensure that the process is executed smoothly and legally.

Legal use of the Execution Levy On Earnings Minnesota Judicial Branch

The Execution Levy on Earnings is governed by specific legal statutes in Minnesota, which outline the rights and responsibilities of both creditors and debtors. It is crucial for creditors to adhere to these regulations to avoid potential legal repercussions. Debtors also have rights during this process, including the ability to contest the garnishment under certain circumstances. Understanding these legal frameworks can help both parties navigate the process more effectively.

State-specific rules for the Execution Levy On Earnings Minnesota Judicial Branch

In Minnesota, there are specific rules that govern the Execution Levy on Earnings. These rules dictate the maximum amount that can be garnished from a debtor's wages, which is typically a percentage of disposable earnings. Additionally, certain types of income, such as Social Security benefits, may be exempt from garnishment. Familiarity with these state-specific regulations is essential for both creditors and debtors to ensure compliance and protect their rights.

Required Documents

To initiate the Execution Levy on Earnings, several documents are required:

- The judgment obtained against the debtor.

- The completed Execution Levy on Earnings form.

- Employer information for the debtor.

- Any additional documentation required by the court.

Having these documents prepared and organized will facilitate a smoother process when filing for wage garnishment.

Quick guide on how to complete execution levy on earnings minnesota judicial branch

Finalize Execution Levy On Earnings Minnesota Judicial Branch effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct version and securely archive it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Execution Levy On Earnings Minnesota Judicial Branch on any system with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Execution Levy On Earnings Minnesota Judicial Branch with ease

- Obtain Execution Levy On Earnings Minnesota Judicial Branch and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to finalize your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Execution Levy On Earnings Minnesota Judicial Branch and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Execution Levy On Earnings in the context of the Minnesota Judicial Branch?

An Execution Levy On Earnings is a legal process used by creditors within the Minnesota Judicial Branch to collect debts directly from a debtor's wages. This remedy allows creditors to intercept a portion of the debtor’s income until the debt is fully paid. Understanding this process can help individuals manage their financial responsibilities effectively.

-

How can airSlate SignNow assist in managing Execution Levy On Earnings documents?

airSlate SignNow streamlines the process of managing Execution Levy On Earnings documents by allowing users to easily create, sign, and store important legal documents securely. With its user-friendly interface, businesses can implement the necessary documentation for wage garnishments efficiently. This simplifies the compliance process under the Minnesota Judicial Branch.

-

Are there any costs associated with initiating an Execution Levy On Earnings through the Minnesota Judicial Branch?

Yes, there may be fees involved in initiating an Execution Levy On Earnings through the Minnesota Judicial Branch, including court filing fees and other related costs. It's vital to review these potential expenses when considering taking action. Utilizing airSlate SignNow can help minimize additional costs through its affordable eSigning solutions.

-

What features does airSlate SignNow offer for document management related to Execution Levy On Earnings?

airSlate SignNow offers several features tailored for Execution Levy On Earnings management, including customizable templates, secure storage, and automated workflows. These features ensure that documents are processed quickly and securely, enhancing efficiency for both creditors and debtors. Additionally, eSigning capabilities help expedite the approval process.

-

Can airSlate SignNow integrate with other systems to manage Execution Levy On Earnings effectively?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing for efficient management of Execution Levy On Earnings processes. This integration ensures that your document workflows are streamlined and consistent across different platforms, empowering businesses to work their way without unnecessary disruptions.

-

What are the benefits of using airSlate SignNow for Execution Levy On Earnings documentation?

Using airSlate SignNow for Execution Levy On Earnings documentation provides numerous benefits, including improved accuracy, enhanced speed in document processing, and reduced operational costs. These benefits allow businesses to focus on their core operations while ensuring compliance with the Minnesota Judicial Branch. Additionally, its user-friendly interface makes it accessible for all staff members.

-

How does airSlate SignNow ensure the security of documents related to Execution Levy On Earnings?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like those related to Execution Levy On Earnings. The platform utilizes advanced encryption protocols and secure cloud storage to protect all user data. Regular audits and compliance checks are in place to ensure adherence to the highest security standards required by the Minnesota Judicial Branch.

Get more for Execution Levy On Earnings Minnesota Judicial Branch

- Florida probate forms florida bar

- 59form

- Worksheet for the connecticut child support and arrearage guidelines jud ct form

- Minori ichikawa form

- Yismach yisrael form

- Iccpp form

- Forms northplainfield nj govfirefood truckmobile enclosed cooking permit application

- Fillable online merit badge counselor application pdffiller form

Find out other Execution Levy On Earnings Minnesota Judicial Branch

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online