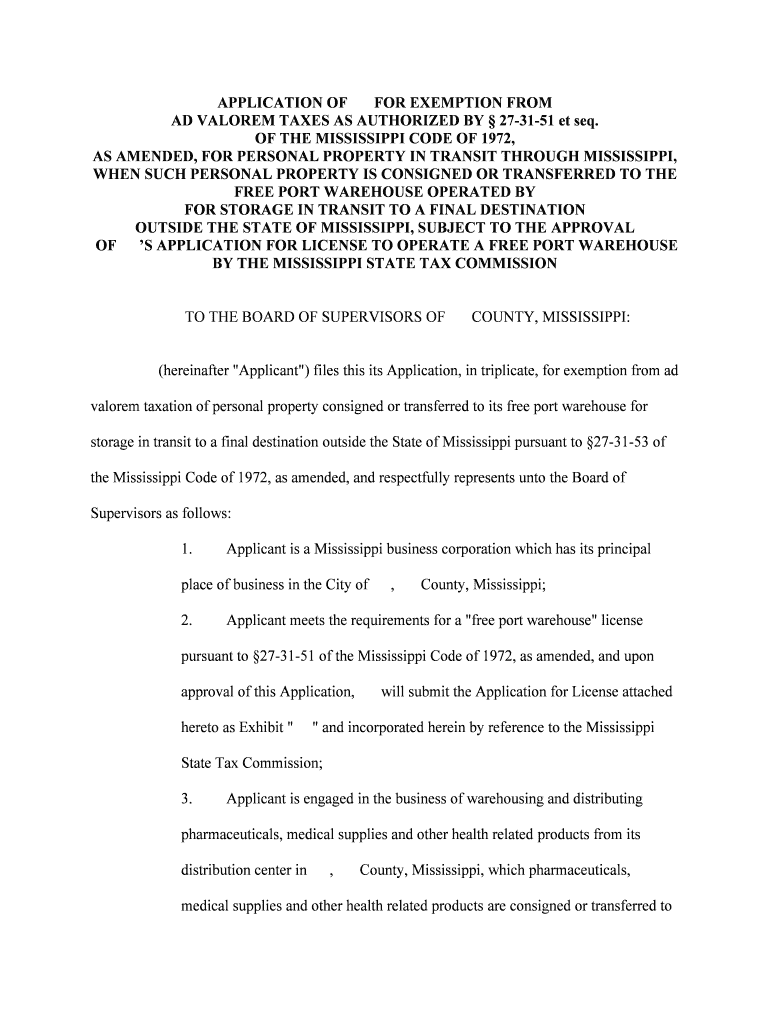

Application for Ad Valorem Tax Exemption Mississippi Form

What is the Application For Ad Valorem Tax Exemption Mississippi

The Application For Ad Valorem Tax Exemption in Mississippi is a formal request submitted by property owners seeking exemption from certain property taxes. This application is crucial for individuals or entities that qualify for tax relief based on specific criteria set forth by state law. The exemption can significantly reduce the financial burden on eligible applicants, allowing them to retain more of their resources for personal or business use.

Steps to Complete the Application For Ad Valorem Tax Exemption Mississippi

Completing the Application For Ad Valorem Tax Exemption involves several key steps to ensure accuracy and compliance with state regulations. The process typically includes:

- Gathering necessary documentation, such as proof of ownership and any relevant financial statements.

- Filling out the application form accurately, ensuring all required fields are completed.

- Providing detailed information about the property and the reasons for seeking the exemption.

- Reviewing the application for completeness before submission.

- Submitting the application by the specified deadline, either online or via mail.

Eligibility Criteria for the Application For Ad Valorem Tax Exemption Mississippi

To qualify for the Ad Valorem Tax Exemption in Mississippi, applicants must meet specific eligibility criteria. Generally, these criteria may include:

- Ownership of the property for which the exemption is sought.

- Use of the property for qualifying purposes, such as charitable, educational, or religious activities.

- Compliance with any local or state regulations regarding property use and taxation.

It is essential for applicants to review these criteria carefully to determine their eligibility before proceeding with the application.

Required Documents for the Application For Ad Valorem Tax Exemption Mississippi

Submitting the Application For Ad Valorem Tax Exemption requires specific documentation to support the request. Commonly required documents include:

- Proof of property ownership, such as a deed or title.

- Financial statements that demonstrate the property's use and financial status.

- Any additional forms or documentation requested by the local tax authority.

Having these documents ready can streamline the application process and improve the chances of approval.

Form Submission Methods for the Application For Ad Valorem Tax Exemption Mississippi

Applicants can submit the Application For Ad Valorem Tax Exemption through various methods. The most common submission methods include:

- Online submission via the state’s tax authority website, if available.

- Mailing the completed application to the appropriate local tax office.

- In-person submission at designated tax offices or local government buildings.

Choosing the right submission method can depend on the applicant's preference and the resources available in their locality.

Legal Use of the Application For Ad Valorem Tax Exemption Mississippi

The Application For Ad Valorem Tax Exemption is legally binding once submitted and processed by the relevant tax authority. It is essential for applicants to understand that providing false information or failing to comply with the terms of the exemption can lead to penalties, including the potential loss of the exemption and additional tax liabilities. Therefore, accuracy and honesty in the application process are paramount.

Quick guide on how to complete application for ad valorem tax exemption mississippi

Effortlessly Prepare Application For Ad Valorem Tax Exemption Mississippi on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Application For Ad Valorem Tax Exemption Mississippi on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Alter and eSign Application For Ad Valorem Tax Exemption Mississippi with Ease

- Obtain Application For Ad Valorem Tax Exemption Mississippi and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form-hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Application For Ad Valorem Tax Exemption Mississippi and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Application For Ad Valorem Tax Exemption in Mississippi?

The Application For Ad Valorem Tax Exemption in Mississippi is a formal request submitted to local authorities to obtain tax exemptions on property or assets. This application allows eligible entities to reduce their tax burden based on specific criteria set by the state.

-

How can airSlate SignNow assist with the Application For Ad Valorem Tax Exemption in Mississippi?

airSlate SignNow streamlines the process of completing and submitting your Application For Ad Valorem Tax Exemption in Mississippi. Our platform provides an intuitive interface that simplifies document preparation, electronic signing, and secure submission, ensuring compliance and efficiency.

-

What are the pricing options for using airSlate SignNow for tax exemption applications?

airSlate SignNow offers affordable pricing plans designed to fit various business needs. Benefits include unlimited documents and templates for the Application For Ad Valorem Tax Exemption in Mississippi, competitive rates, and a free trial to explore our features without commitment.

-

Are there any specific features for tax exemption applications in Mississippi?

Yes, airSlate SignNow includes features tailored for the Application For Ad Valorem Tax Exemption in Mississippi such as customizable templates, e-signature functionality, and tracking options. These features ensure your application is accurately filled, signed, and submitted quickly.

-

How secure is airSlate SignNow when handling sensitive documents?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your documents, including the Application For Ad Valorem Tax Exemption in Mississippi. Our platform complies with industry standards, ensuring that your information remains confidential and secure.

-

Can I integrate airSlate SignNow with other applications for tax exemption processing?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for the Application For Ad Valorem Tax Exemption in Mississippi. This integration allows for smoother data management and improved collaboration across teams.

-

What benefits can I expect from using airSlate SignNow for tax exemption applications?

Using airSlate SignNow for your Application For Ad Valorem Tax Exemption in Mississippi offers numerous benefits including improved efficiency, reduced turnaround times, and increased accuracy. Our platform also enhances collaboration by allowing multiple users to sign and share documents effortlessly.

Get more for Application For Ad Valorem Tax Exemption Mississippi

- Service canada delivers employment and social deve form

- Aish cppd benefits administration instruction form alberta

- Nelson minor hockey tournament player roster form nelsonmha

- Rehab pre admission form elective hip and knee surgery

- Dental spore test log sheet form

- Afm pre authorized chequesystematic withdrawal plan change request e form

- Electronic funds transfer form for non cibc bank accounts only cibc investor services inc

- Investment agreement template south africa form

Find out other Application For Ad Valorem Tax Exemption Mississippi

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template