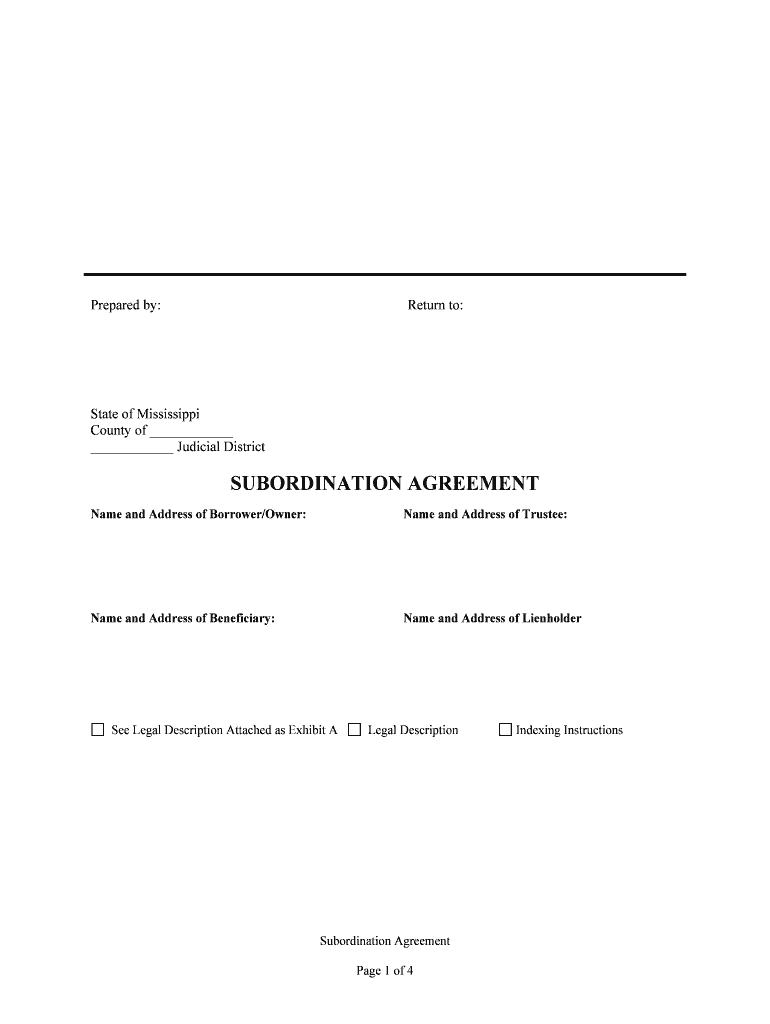

Name and Address of BorrowerOwner Form

What is the Name And Address Of BorrowerOwner

The Name and Address of BorrowerOwner form is a crucial document used in various financial transactions, particularly in real estate and lending contexts. This form typically collects essential information about the borrower, including their full name and current address. It serves as a means of identifying the borrower and establishing their legal obligations in a transaction. Accurate completion of this form is vital as it ensures that all parties involved have the correct information for communication and legal purposes.

Steps to complete the Name And Address Of BorrowerOwner

Completing the Name and Address of BorrowerOwner form involves several straightforward steps:

- Gather necessary information: Collect your full name, current residential address, and any additional required details.

- Access the form: Obtain the form through your lender or financial institution, or download it from a trusted source.

- Fill in the details: Carefully enter your name and address, ensuring accuracy to avoid any issues later.

- Review the form: Double-check all entered information for correctness and completeness.

- Sign the form: Provide your signature to validate the document, which may be required for legal purposes.

- Submit the form: Follow the submission guidelines provided by your lender, which may include online submission or mailing the form.

Legal use of the Name And Address Of BorrowerOwner

The Name and Address of BorrowerOwner form holds legal significance in various transactions. When properly completed and signed, it acts as a binding agreement between the borrower and the lender. This form is often required for loan applications, mortgage agreements, and other financial contracts. Its legal validity is supported by compliance with regulations such as the ESIGN Act, which recognizes electronic signatures and documents as legally binding, provided certain criteria are met.

Key elements of the Name And Address Of BorrowerOwner

Several key elements must be included in the Name and Address of BorrowerOwner form to ensure its effectiveness:

- Full Name: The complete legal name of the borrower as it appears on official documents.

- Current Address: The borrower's residential address, including street, city, state, and zip code.

- Date of Completion: The date when the form is filled out and signed.

- Signature: The borrower's signature, which confirms the accuracy of the provided information.

How to use the Name And Address Of BorrowerOwner

The Name and Address of BorrowerOwner form is used primarily in the context of financial transactions, such as applying for loans or mortgages. To use this form effectively:

- Ensure you have the most current version of the form.

- Fill it out accurately with your personal information.

- Submit it along with any other required documentation to your lender or financial institution.

- Keep a copy for your records to track your application status and for future reference.

Examples of using the Name And Address Of BorrowerOwner

There are various scenarios where the Name and Address of BorrowerOwner form is utilized:

- Applying for a mortgage loan when purchasing a home, where lenders require this information to assess creditworthiness.

- Refinancing an existing loan, necessitating updated borrower information for the new agreement.

- Obtaining a personal loan, where lenders need to verify the identity and address of the borrower.

Quick guide on how to complete name and address of borrowerowner

Effortlessly Prepare Name And Address Of BorrowerOwner on Any Device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without unnecessary hold-ups. Manage Name And Address Of BorrowerOwner on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Name And Address Of BorrowerOwner with Ease

- Obtain Name And Address Of BorrowerOwner and click on Get Form to begin.

- Utilize the tools available to submit your document.

- Highlight important sections of the documents or obscure sensitive information using features that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or mismanaged files, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Name And Address Of BorrowerOwner to ensure excellent communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What information should I include for the Name And Address Of BorrowerOwner?

When filling out the Name And Address Of BorrowerOwner, ensure you provide the full legal name and the complete address. This information is crucial for accurately identifying the borrower or property owner in agreements and documents. Providing accurate details helps in maintaining clear records and avoids potential disputes.

-

How does airSlate SignNow ensure the security of the Name And Address Of BorrowerOwner?

airSlate SignNow prioritizes security by using advanced encryption to protect the Name And Address Of BorrowerOwner and other sensitive data. We comply with industry standards to ensure that your information is safe during transmission and storage. You can trust that your documents and details are secure with our platform.

-

Can I edit the Name And Address Of BorrowerOwner after sending a document?

Yes, you can modify the Name And Address Of BorrowerOwner details before the document is signed. If you realize an error after sending, simply recall the document, make the necessary changes, and resend it for eSignature. This flexibility allows you to maintain accuracy and compliance.

-

Is there a limit to how many times I can enter the Name And Address Of BorrowerOwner?

There is no limit on the number of times you can input the Name And Address Of BorrowerOwner in our system. You can input this information for various documents as needed. This feature is particularly useful for businesses that frequently handle multiple borrowers or property owners.

-

What are the benefits of accurately stating the Name And Address Of BorrowerOwner?

Accurately stating the Name And Address Of BorrowerOwner can signNowly reduce the likelihood of legal disputes and enhance the validity of your documents. It ensures that all parties are correctly identified, fostering transparency and trust. Moreover, it improves compliance with legal requirements for documentation.

-

Does airSlate SignNow integrate with other platforms that require the Name And Address Of BorrowerOwner?

Yes, airSlate SignNow integrates seamlessly with various platforms, making it easy to share the Name And Address Of BorrowerOwner where needed. This could include CRM systems, document management software, and more. Our integrations simplify the workflow and enhance efficiency in managing documents.

-

How can I access templates that require the Name And Address Of BorrowerOwner?

airSlate SignNow offers a variety of templates that require the Name And Address Of BorrowerOwner. You can easily access these templates from our template library, which is designed to streamline your document creation process. Choose a template that fits your needs, fill in the required information, including the borrower's details, and send it for signing.

Get more for Name And Address Of BorrowerOwner

- Uscg sar addendum form

- Form 113627 insurance and annuity change of ownership due to death use this form for riversourceinsurance or annuity policies

- Solar contract template form

- Solar company contract template form

- Sole proprietor contract template form

- Solar sale contract template form

- Sole trader contract template form

- Sole proprietorship contract template form

Find out other Name And Address Of BorrowerOwner

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document