PREMIUM FINANCE AGREEMENT and DISCLOSURE STATEMENT Form

What is the premium finance agreement and disclosure statement?

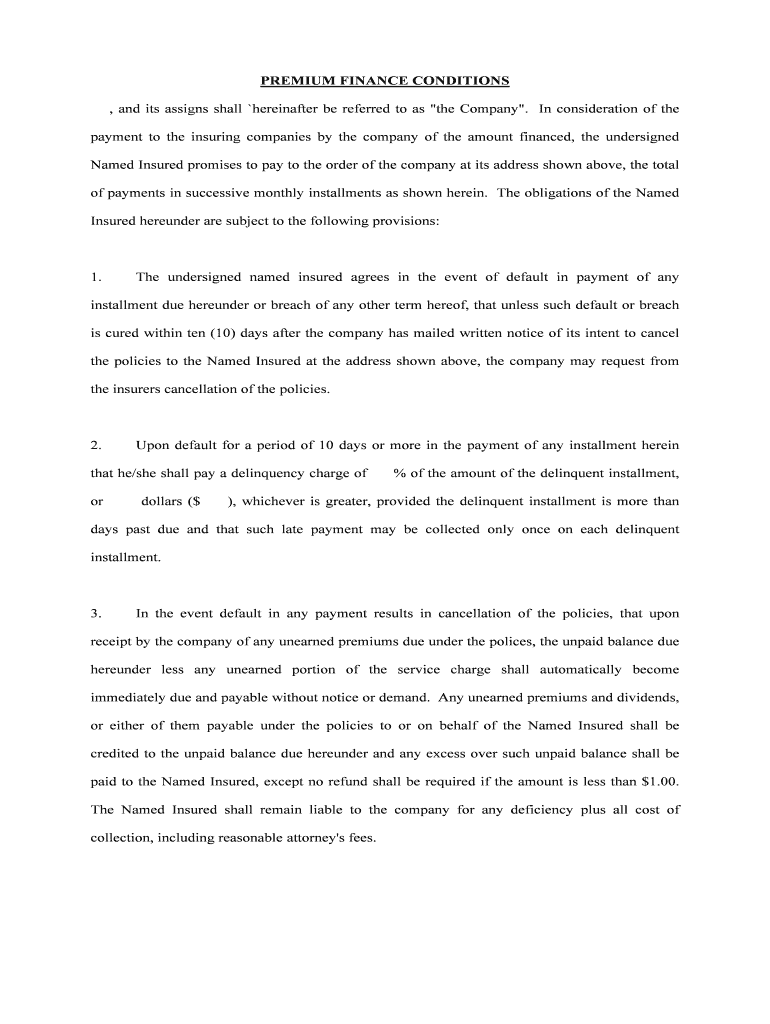

The premium finance agreement and disclosure statement is a legal document used primarily in the insurance industry. It outlines the terms and conditions under which a borrower finances their insurance premiums. This agreement allows individuals or businesses to pay their insurance premiums over time instead of in a lump sum. The disclosure statement provides important information about the financing arrangement, including interest rates, fees, and payment schedules. Understanding this document is crucial for borrowers to make informed financial decisions regarding their insurance coverage.

Steps to complete the premium finance agreement and disclosure statement

Completing the premium finance agreement and disclosure statement involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information, including personal details, insurance policy information, and financial data. Next, carefully read through the agreement to understand the terms, including interest rates and payment schedules. Fill out the form completely, ensuring all sections are addressed. Once completed, review the document for any errors or omissions. Finally, sign the agreement electronically or in person, depending on the requirements of the financing company.

Key elements of the premium finance agreement and disclosure statement

Several key elements are essential in the premium finance agreement and disclosure statement. These include:

- Borrower Information: Details about the individual or business taking out the loan.

- Insurance Policy Details: Information about the insurance policy being financed, including the insurer's name and policy number.

- Loan Amount: The total amount being financed for the insurance premiums.

- Interest Rate: The rate at which interest will accrue on the financed amount.

- Payment Schedule: Information on how and when payments are to be made.

- Fees and Charges: Any additional costs associated with the financing agreement.

Legal use of the premium finance agreement and disclosure statement

The premium finance agreement and disclosure statement must comply with various legal requirements to be considered valid and enforceable. In the United States, it is essential that the agreement adheres to state and federal regulations governing financing and lending practices. This includes providing clear disclosures about interest rates, fees, and the borrower's rights. Ensuring compliance with laws such as the Truth in Lending Act (TILA) helps protect consumers and promotes transparency in financial transactions.

How to obtain the premium finance agreement and disclosure statement

Obtaining the premium finance agreement and disclosure statement typically involves contacting a financial institution or insurance company that offers premium financing options. Many companies provide these documents online, allowing borrowers to download and print them. Alternatively, borrowers can request a physical copy from their insurance agent or broker. It is important to ensure that the agreement is the most current version and meets all legal requirements before proceeding with the financing process.

Examples of using the premium finance agreement and disclosure statement

Examples of using the premium finance agreement and disclosure statement can vary based on individual circumstances. For instance, a small business may use this agreement to finance its commercial liability insurance premiums, allowing for manageable monthly payments instead of a large upfront cost. Similarly, an individual might finance their homeowners insurance, spreading the payments over the policy term. Each scenario highlights the flexibility of premium financing and the importance of understanding the terms outlined in the disclosure statement.

Quick guide on how to complete premium finance agreement and disclosure statement

Complete PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without interruptions. Manage PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and electronically sign PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT without hassle

- Obtain PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT?

A PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT outlines the terms and conditions under which an insurance premium is financed. It clarifies the financial obligations of the borrower and the lender, ensuring transparency in the financing process. Understanding this document is crucial for making informed decisions about premium financing.

-

How does airSlate SignNow facilitate the signing of a PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT?

airSlate SignNow streamlines the process of signing a PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT through its user-friendly interface. Users can easily send documents for eSignature, track their status in real-time, and securely store completed agreements. This efficient process saves time and enhances compliance.

-

What are the costs associated with preparing a PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT?

The costs associated with a PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT can vary depending on the lender and the specific terms of the agreement. Generally, these costs include interest on the financed premium and possible administrative fees. It's advisable to review the agreement carefully to understand all potential charges.

-

What benefits does a PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT provide?

A PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT offers signNow benefits, including improved cash flow for policyholders and the ability to maintain coverage without upfront payments. It also provides clear terms and conditions, which help avoid misunderstandings between parties. This transparency helps build trust in the financing relationship.

-

Are there any specific features of airSlate SignNow that enhance premium finance documentation?

Yes, airSlate SignNow offers several features that enhance premium finance documentation, including customizable templates for PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT. Our solution also supports smart fields and conditional logic, allowing users to streamline the filling process. Additionally, the platform ensures high-level security for all stored documents.

-

What integrations does airSlate SignNow support for handling PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT?

airSlate SignNow seamlessly integrates with various business applications, enhancing the management of PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT. Popular integrations include CRM systems, document management tools, and payment processors. These integrations help increase efficiency and facilitate better data management.

-

Is it safe to sign a PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT online?

Yes, signing a PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT online with airSlate SignNow is safe and secure. Our platform utilizes advanced encryption and security measures to protect sensitive information. Users can sign documents with confidence, knowing their data is safeguarded throughout the process.

Get more for PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT

- Trulos motor vehicle drivers certification of violations and annual form

- Return to work template form fill online printable fillable

- Pet rehoming agreement this agreement documents th form

- Wedding photography checklist shutterfly com form

- Print form madrid waddington central school excuse

- Fsa claim form myuhc com

- Person with disability parking placardlicense plate application form

- Fees for requests with incorrect or illegible vehi form

Find out other PREMIUM FINANCE AGREEMENT AND DISCLOSURE STATEMENT

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online