Sbi Account Opening Form PDF

What is the SBI Account Opening Form PDF

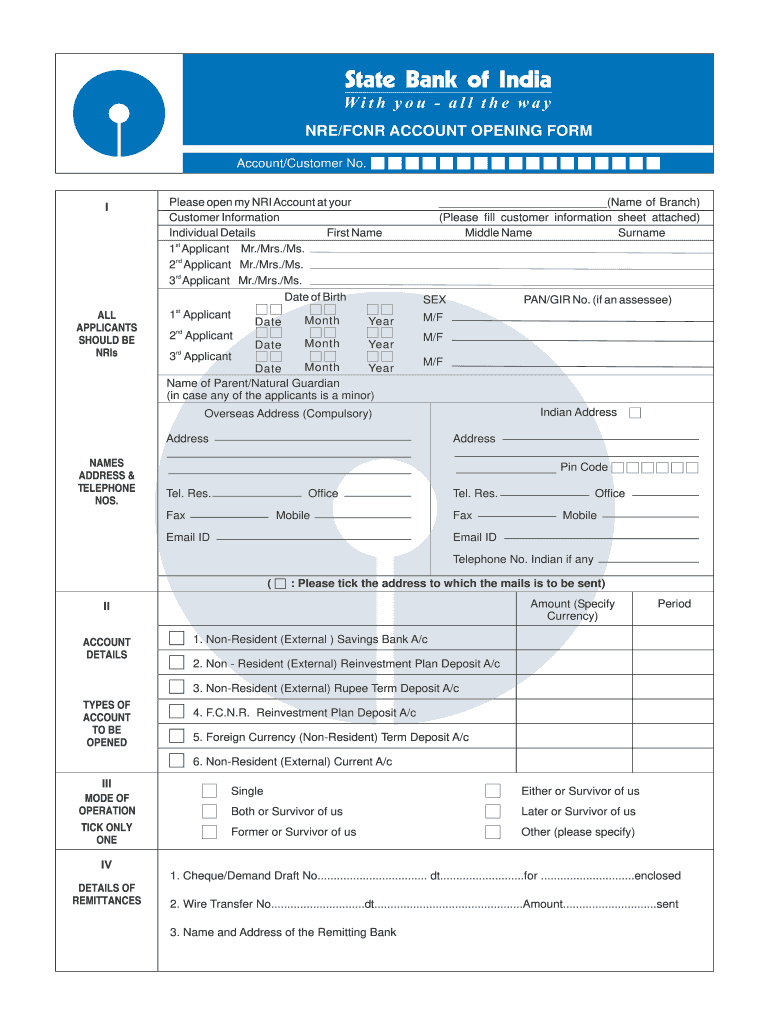

The SBI Account Opening Form PDF is a standardized document used for initiating the process of opening a new account with the State Bank of India (SBI). This form is essential for individuals who wish to establish a banking relationship with SBI, whether for personal savings, checking accounts, or other banking services. The form captures vital information such as personal identification details, contact information, and the type of account being requested. It is designed to ensure that all necessary data is collected to comply with banking regulations and to facilitate a smooth account opening process.

Steps to Complete the SBI Account Opening Form PDF

Completing the SBI Account Opening Form PDF involves several key steps to ensure accuracy and compliance. First, download the form from a reliable source. Next, fill in your personal details, including your full name, address, date of birth, and Social Security number. It is crucial to provide accurate information, as discrepancies may delay the account opening process. After filling out the required fields, review the form to ensure all sections are complete. Finally, sign and date the form before submitting it to your local SBI branch or through the specified submission method.

Required Documents for SBI Account Opening

When applying for a new account with SBI, certain documents are necessary to verify your identity and address. Commonly required documents include:

- Government-issued photo identification (e.g., driver's license, passport)

- Proof of address (e.g., utility bill, lease agreement)

- Social Security number or Tax Identification Number

- Recent passport-sized photographs

Having these documents ready will streamline the account opening process and help avoid any potential delays.

How to Obtain the SBI Account Opening Form PDF

The SBI Account Opening Form PDF can be obtained easily through various channels. You can visit the official SBI website to download the form directly. Alternatively, you may request a physical copy at your nearest SBI branch. Additionally, financial service providers or banking consultants may also have copies available. Ensure that you are using the most recent version of the form to comply with current banking regulations.

Legal Use of the SBI Account Opening Form PDF

The legal use of the SBI Account Opening Form PDF is crucial for establishing a valid banking relationship. When filled out correctly, the form serves as a binding document that allows SBI to process your account application. It is important to ensure that all information provided is truthful and accurate, as any false information can lead to legal consequences, including account denial or potential charges. Understanding the legal implications of the form reinforces the importance of careful completion and submission.

Form Submission Methods

Once the SBI Account Opening Form PDF is completed, you have several options for submission. You can submit the form in person at your local SBI branch, where bank officials can assist you with any questions. Alternatively, some branches may allow for online submission through their secure portal. If you prefer to send the form via mail, ensure that you use a reliable postal service and include any required documents to avoid delays in processing your application.

Quick guide on how to complete how to fill up sbi account opening form sample

A concise manual on how to create your Sbi Account Opening Form Pdf

Finding the right template can be a hurdle when you need to submit formal international documents. Even if you possess the necessary form, it can be tedious to swiftly fill it out according to all specifications if you rely on paper versions instead of handling everything digitally. airSlate SignNow is the web-based eSignature service that assists you in overcoming these obstacles. It allows you to obtain your Sbi Account Opening Form Pdf and rapidly complete and sign it on-site without the need to reprint documents in case of an error.

Follow these steps to prepare your Sbi Account Opening Form Pdf using airSlate SignNow:

- Click the Get Form button to instantly upload your document to our editor.

- Begin with the first vacant field, enter your information, and continue with the Next function.

- Complete the empty fields utilizing the Cross and Check tools from the toolbar above.

- Select the Highlight or Line features to emphasize the most crucial details.

- Click on Image to upload one if your Sbi Account Opening Form Pdf requires it.

- Employ the right-side panel to add additional fields for you or others to complete if needed.

- Review your entries and approve the document by clicking Date, Initials, and Sign.

- Sketch, enter, upload your eSignature, or capture it via a camera or QR code.

- Conclude your edits by clicking the Done button and choosing your file-sharing preferences.

Once your Sbi Account Opening Form Pdf is prepared, you can distribute it in your preferred manner - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your completed documents in your account, organized into folders based on your choices. Don’t spend time on manual document filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How can I fill out an online application form for a SBI savings account opening, as I have a single name not a surname or last name?

go paperless. open your account at your home using SBI YONO apps.

-

What form do I have to fill up to complain about a blocked SBI account?

If you check whether your block account is because of you not using the account for more than 2 yrs or whether you have loans and have any outstanding dues as such.If not such thing is there kindly go to your home branch and let an employee check that out for you

-

How do I fill up a form for a new joint account of SBI?

For opening an account , you have to fill up two type of forms. One is CIF form i.e. customer information file and second is account opening form.(AOF)You have to fill up CIF form for each applicant and a common AOF. E.g. If joint account has two persons then two CIF forms.Usually forms ask for your personal information, Photograph, Proof of Identity and Proof of Address. POI and POA are govt approved documents. Carry a photocopy along with original document.You also have ti mention services required like ATM card , Internet banking, SMS alert required and mobile banking. Banks also offer insurance, credit card, Mutual fund etc along with account opening.Accept these products only if you mere them.

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

Create this form in 5 minutes!

How to create an eSignature for the how to fill up sbi account opening form sample

How to create an eSignature for the How To Fill Up Sbi Account Opening Form Sample in the online mode

How to create an electronic signature for the How To Fill Up Sbi Account Opening Form Sample in Chrome

How to generate an electronic signature for signing the How To Fill Up Sbi Account Opening Form Sample in Gmail

How to create an electronic signature for the How To Fill Up Sbi Account Opening Form Sample right from your smartphone

How to create an eSignature for the How To Fill Up Sbi Account Opening Form Sample on iOS

How to make an electronic signature for the How To Fill Up Sbi Account Opening Form Sample on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to SBI Bank?

airSlate SignNow is a powerful eSignature solution that simplifies the way businesses manage their document workflows. With a strong focus on usability and affordability, airSlate SignNow can be integrated with SBI Bank services to facilitate quicker transactions and approvals. This allows users of SBI Bank to efficiently send and sign documents online, enhancing overall productivity.

-

How does airSlate SignNow benefit SBI Bank customers?

SBI Bank customers can benefit from airSlate SignNow by streamlining their document signing processes, reducing the time and effort required for approvals. This tool allows for secure electronic signatures that are legally binding, ensuring compliance while improving customer satisfaction. Consequently, SBI Bank users can conduct their banking business more swiftly and conveniently.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to meet different business needs, including options suitable for those using SBI Bank services. Each plan provides essential features, with a free trial available for new users to explore the platform. Whether you’re a small business or an enterprise, there’s a pricing tier that aligns with the needs of SBI Bank customers.

-

Can airSlate SignNow integrate with SBI Bank services?

Yes, airSlate SignNow can be seamlessly integrated with SBI Bank services, allowing users to manage their banking documents effectively. This integration facilitates easy access to banking functionalities while utilizing eSignatures for important documents. As such, agreements and forms can be completed quickly, enhancing the overall user experience for SBI Bank clients.

-

What features does airSlate SignNow offer for SBI Bank users?

airSlate SignNow offers a range of features that cater specifically to the needs of SBI Bank users, including multiple signature options, templates, and mobile access. These features ensure that customers can easily create, send, and sign documents from any device, making banking more accessible. Furthermore, the platform provides audit trails and compliance verification, enhancing document security for SBI Bank clients.

-

Is airSlate SignNow secure for SBI Bank transactions?

Absolutely, airSlate SignNow prioritizes security with features such as data encryption and secure cloud storage. SBI Bank customers can rest assured knowing their sensitive documents are protected against unauthorized access. Moreover, the platform complies with legal eSignature regulations, ensuring that all transactions carried out are secure and valid.

-

How does airSlate SignNow improve the document signing process for SBI Bank clients?

airSlate SignNow signNowly improves the document signing process for SBI Bank clients by eliminating the need for physical paperwork and in-person signatures. With its intuitive interface, users can send, receive, and sign documents in just a few clicks. This efficiency not only saves time but also enhances transaction accuracy for SBI Bank customers.

Get more for Sbi Account Opening Form Pdf

Find out other Sbi Account Opening Form Pdf

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online