Tc1 Form

What is the TC1?

The TC1 form is an essential document used for applying for a tax clearance certificate in the United States. This certificate serves as proof that an individual or business has met all tax obligations to the state and federal authorities. It is commonly required when engaging in various financial transactions, including securing loans, entering contracts, or applying for government grants. Understanding the purpose of the TC1 is crucial for anyone looking to ensure compliance with tax regulations.

How to use the TC1

Using the TC1 form involves several straightforward steps. First, gather all necessary personal or business information, including tax identification numbers and details about your tax history. Next, accurately complete the form, ensuring that all required fields are filled out with correct information. Once completed, you can submit the TC1 form through the designated channels, which may include online submission, mailing, or in-person delivery to the appropriate tax authority. Following these steps carefully helps ensure a smooth application process.

Steps to complete the TC1

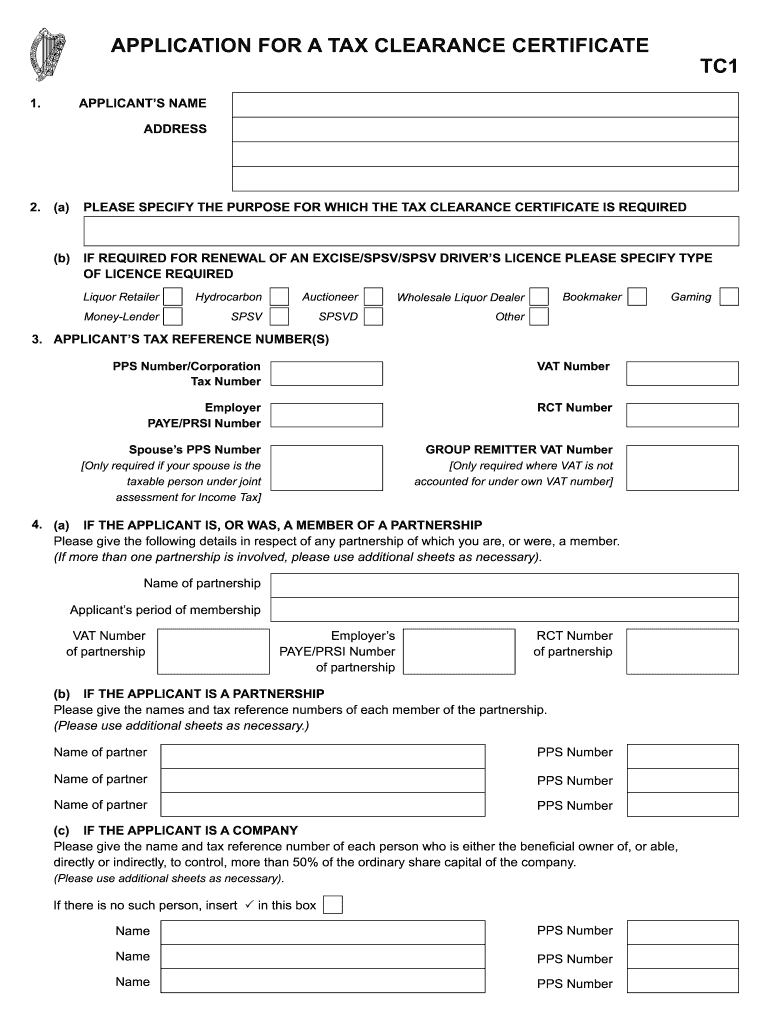

Completing the TC1 form requires careful attention to detail. Start by downloading the TC1 PDF from a reliable source. Fill in your name, address, and tax identification number at the top of the form. Provide information regarding your tax status, including any outstanding tax liabilities. Ensure that you review the form for accuracy before submission. Finally, sign and date the form to validate your application. Keeping a copy of the completed TC1 for your records is also advisable.

Legal use of the TC1

The TC1 form is legally binding once it is filled out and submitted correctly. It is critical to provide truthful and accurate information, as any discrepancies may lead to legal repercussions, including penalties or denial of the tax clearance certificate. The TC1 form must be used in accordance with state and federal tax laws, ensuring that all submissions comply with the relevant regulations. Understanding the legal implications of the TC1 is essential for maintaining compliance and avoiding potential issues.

Required Documents

To successfully complete the TC1 form, several documents may be required. These typically include proof of identity, such as a government-issued ID, and recent tax returns to verify your tax status. Additionally, any documents related to outstanding tax liabilities or previous communications with tax authorities may be necessary. Preparing these documents in advance can facilitate a smoother application process and help ensure that your TC1 form is processed without delays.

Application Process & Approval Time

The application process for the TC1 form can vary depending on the jurisdiction. Generally, once the form is submitted, it may take several days to weeks for processing. The approval time can be influenced by factors such as the completeness of the application and any outstanding tax issues. It is advisable to check with the relevant tax authority for specific timelines and any additional requirements that may affect the processing of your application.

Quick guide on how to complete tax tc1 form

A concise manual on how to prepare your Tc1

Locating the correct template can prove to be a difficulty when you are required to produce official international documents. Even if you possess the necessary form, it may be cumbersome to quickly fill it out according to all the specifications if you use physical copies instead of handling everything digitally. airSlate SignNow is the web-based eSignature solution that assists you in overcoming these obstacles. It allows you to obtain your Tc1 and swiftly complete and sign it on-the-spot without the need for reprinting documents whenever you make a mistake.

The following are the procedures you must follow to prepare your Tc1 with airSlate SignNow:

- Click the Get Form button to immediately upload your document to our editor.

- Begin with the first blank field, enter your information, and proceed with the Next tool.

- Fill in the empty spaces using the Cross and Check tools from the menu above.

- Select the Highlight or Line options to emphasize the most crucial information.

- Click on Image and upload one if your Tc1 requires it.

- Utilize the right-side pane to add more fields for you or others to complete if needed.

- Review your responses and validate the document by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing process by clicking the Done button and selecting your file-sharing preferences.

After your Tc1 is prepared, you can share it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your finalized documents in your account, organized in folders according to your liking. Don’t waste time on manual document filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the tax tc1 form

How to make an eSignature for your Tax Tc1 Form in the online mode

How to make an eSignature for the Tax Tc1 Form in Chrome

How to create an electronic signature for putting it on the Tax Tc1 Form in Gmail

How to make an eSignature for the Tax Tc1 Form right from your mobile device

How to generate an electronic signature for the Tax Tc1 Form on iOS devices

How to generate an electronic signature for the Tax Tc1 Form on Android devices

People also ask

-

What is Tc1 in relation to airSlate SignNow?

Tc1 refers to the specific version of our comprehensive eSignature solution provided by airSlate SignNow. It offers businesses an intuitive platform to send and sign documents electronically. With Tc1, users can streamline their document workflows and enhance productivity.

-

How much does the Tc1 plan cost for businesses?

The pricing for the Tc1 plan varies based on the number of users and the features needed. airSlate SignNow offers competitive pricing designed to fit the budget of businesses of all sizes. For detailed pricing information for the Tc1 plan, please visit our pricing page.

-

What features are included in the Tc1 package?

The Tc1 package includes essential features such as unlimited eSignatures, document templates, and customizable workflows. Additionally, users can benefit from advanced security options and real-time tracking of document status. Tc1 is designed to meet diverse business needs effectively.

-

How does Tc1 improve document management for businesses?

Tc1 simplifies document management by allowing users to create, send, and sign documents all in one platform. This reduces the time spent on manual processes, minimizes errors, and ensures compliance with legal standards. Businesses can focus more on their core activities with Tc1's efficient workflow.

-

Can I integrate Tc1 with other applications?

Yes, Tc1 offers seamless integration with several popular applications, including CRMs, cloud storage services, and productivity tools. This flexibility allows businesses to incorporate eSigning directly into their existing workflows. Check our integration page for a complete list of compatible applications.

-

What are the benefits of using Tc1 for eSigning?

Using Tc1 for eSigning provides numerous benefits, including cost savings, increased efficiency, and enhanced security. Businesses can reduce paper usage and expedite the signing process, leading to faster deal closures. Tc1 also ensures that documents are securely signed and stored.

-

Is technical support available for Tc1 users?

Absolutely! airSlate SignNow provides dedicated technical support for all Tc1 users. Our support team is available to assist with any inquiries or issues, ensuring that you can make the most out of your Tc1 experience. Resources like FAQs and tutorials are also available.

Get more for Tc1

Find out other Tc1

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT