MT DO 1A Form

What is the MT DO 1A

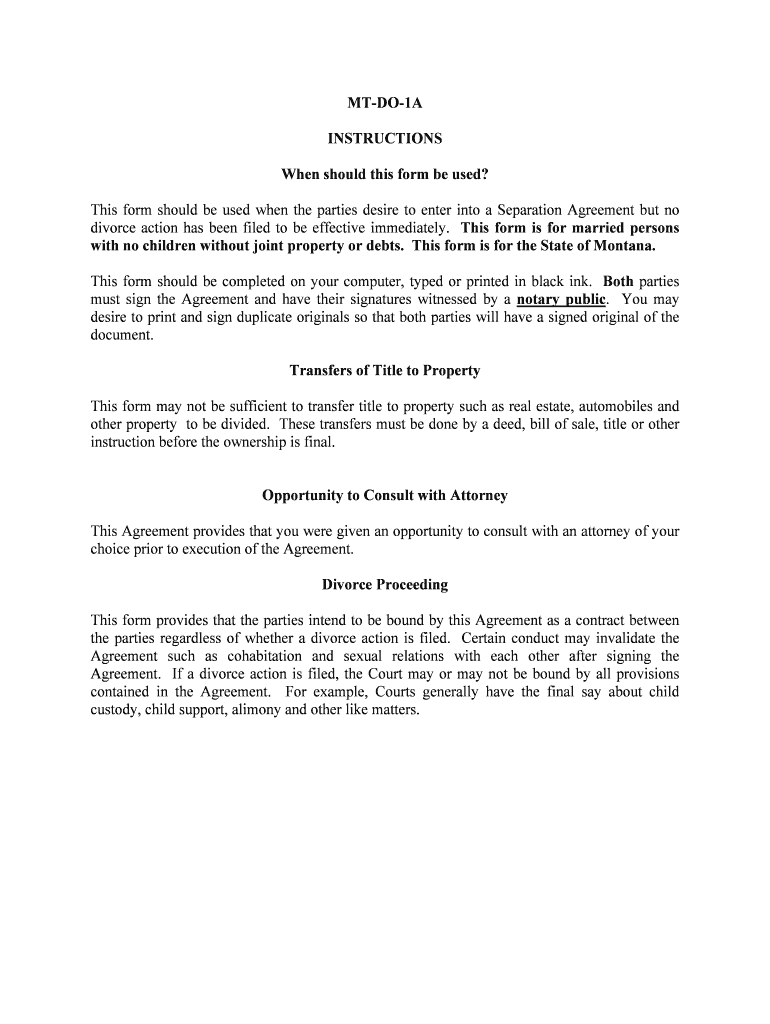

The MT DO 1A form is a document used in the state of Montana for specific purposes related to property tax exemptions. This form is typically utilized by property owners seeking to apply for or renew their exemption status. The MT DO 1A is essential for ensuring that eligible properties receive the appropriate tax benefits, which can significantly reduce the financial burden on property owners. Understanding the specific requirements and details of this form is crucial for compliance and successful application.

How to use the MT DO 1A

Using the MT DO 1A form involves several key steps. First, property owners must gather all necessary information, including property details and personal identification. Once the form is obtained, it should be filled out accurately, ensuring that all required fields are completed. After filling out the form, it needs to be submitted to the appropriate local tax authority for review. It is essential to keep a copy of the submitted form for personal records and future reference.

Steps to complete the MT DO 1A

Completing the MT DO 1A form involves a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary documentation, including proof of property ownership and identification.

- Obtain the MT DO 1A form from the local tax authority or official website.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the local tax authority by the specified deadline.

Legal use of the MT DO 1A

The MT DO 1A form is legally binding when filled out and submitted according to state regulations. It serves as an official request for property tax exemption and must adhere to specific legal guidelines to be accepted. Property owners should ensure that they understand the legal implications of the form and comply with all relevant laws to avoid penalties or denial of their exemption status.

Required Documents

When applying for the MT DO 1A, certain documents are required to support the application. These typically include:

- Proof of property ownership, such as a deed or title.

- Identification documents, like a driver’s license or state ID.

- Any additional documentation that demonstrates eligibility for the exemption.

Ensuring that all required documents are submitted alongside the MT DO 1A form is crucial for a smooth application process.

Filing Deadlines / Important Dates

Filing deadlines for the MT DO 1A form are critical to ensure that property owners do not miss out on potential tax benefits. Typically, the form must be submitted by a specific date each year, which may vary based on local regulations. Property owners should check with their local tax authority for the exact deadlines to avoid penalties or loss of exemption status.

Quick guide on how to complete mt do 1a

Prepare MT DO 1A seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your files quickly and efficiently. Manage MT DO 1A on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign MT DO 1A effortlessly

- Locate MT DO 1A and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and eSign MT DO 1A to ensure effective communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is MT DO 1A and how does it benefit my business?

MT DO 1A is a powerful digital solution within airSlate SignNow that streamlines the document signing process. By using MT DO 1A, businesses can reduce turnaround times and improve workflow efficiency, allowing for faster decision-making and better productivity.

-

How much does the MT DO 1A feature cost?

The pricing for accessing MT DO 1A varies based on the plan you choose with airSlate SignNow. We offer flexible pricing tiers that cater to businesses of all sizes, ensuring that you can utilize MT DO 1A within your budget while enhancing your document management capabilities.

-

What features does MT DO 1A provide?

MT DO 1A includes a range of features such as customizable templates, secure eSignature capabilities, and real-time tracking. These features empower users to efficiently manage document workflows and ensure compliance, all while harnessing the full potential of airSlate SignNow.

-

Is MT DO 1A easy to integrate with other software?

Yes, MT DO 1A is designed for seamless integration with popular applications and platforms. Whether you're using CRM systems, cloud storage services, or other productivity tools, you can easily connect them with airSlate SignNow to enhance your overall workflow.

-

What types of documents can I manage with MT DO 1A?

With MT DO 1A, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility allows businesses to utilize airSlate SignNow for all their electronic signature and document management needs, ensuring that all important paperwork is handled efficiently.

-

How secure is the MT DO 1A feature?

MT DO 1A prioritizes security with advanced encryption protocols and compliance with regulatory standards. airSlate SignNow ensures that your documents remain confidential and protected, giving you peace of mind as you utilize the MT DO 1A functionality.

-

Can I track the status of documents sent through MT DO 1A?

Absolutely! One of the key advantages of MT DO 1A is the ability to track document status in real-time. This feature allows you to monitor when documents are viewed, signed, or completed, giving you better control over your workflows with airSlate SignNow.

Get more for MT DO 1A

- Printable hepatitis b vaccination form

- Dental office waiver for hep b vaccine form

- Hepatitis b declination waiver form

- Form 13825

- Journal of chemical education reviewers form

- Louisiana property management agreement residential real estate management agreement contract form

- Financial affidavit for a dissolution of marriage with no minor or dependent adult children form

- In the iowa district court for county upon the petition of affidavit of form

Find out other MT DO 1A

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors