Montana Fixed Rate Note, Installment Payments Secured Commercial Property Form

What is the Montana Fixed Rate Note, Installment Payments Secured Commercial Property

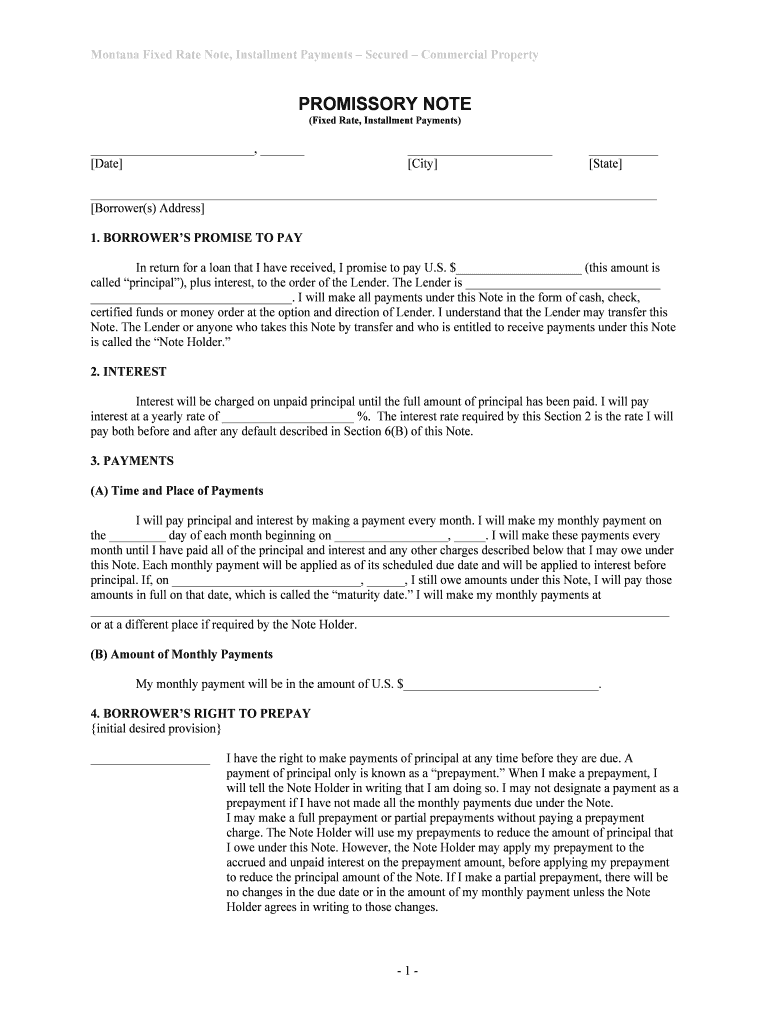

The Montana Fixed Rate Note, Installment Payments Secured Commercial Property is a legal financial document that outlines the terms of a loan secured by commercial property. This note specifies the fixed interest rate, repayment schedule, and conditions under which the borrower must repay the loan. It serves as a binding agreement between the lender and borrower, ensuring that both parties understand their obligations. The secured nature of the note means that the lender has a claim on the property should the borrower default on payments.

How to use the Montana Fixed Rate Note, Installment Payments Secured Commercial Property

To effectively use the Montana Fixed Rate Note, borrowers should first ensure they understand the terms outlined in the document. This includes the interest rate, payment schedule, and any penalties for late payments. Once the terms are agreed upon, both parties should sign the document, ideally using a secure electronic signature platform to ensure the validity of the agreement. After signing, the borrower should keep a copy for their records, while the lender should retain the original document as proof of the secured loan.

Steps to complete the Montana Fixed Rate Note, Installment Payments Secured Commercial Property

Completing the Montana Fixed Rate Note involves several key steps:

- Gather necessary information, including borrower and lender details, property information, and loan terms.

- Fill out the note with accurate details, ensuring clarity on the fixed interest rate, repayment schedule, and any additional terms.

- Review the document thoroughly to confirm that all information is correct and that both parties agree to the terms.

- Sign the document using a reliable electronic signature tool to ensure legal compliance.

- Distribute copies of the signed note to all parties involved for their records.

Key elements of the Montana Fixed Rate Note, Installment Payments Secured Commercial Property

Several key elements are essential in the Montana Fixed Rate Note:

- Principal Amount: The total amount borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal.

- Payment Schedule: Details on how often payments are due, such as monthly or quarterly.

- Loan Term: The duration over which the loan must be repaid.

- Default Conditions: Circumstances under which the lender can declare the borrower in default.

- Property Description: Information about the commercial property securing the loan.

Legal use of the Montana Fixed Rate Note, Installment Payments Secured Commercial Property

The legal use of the Montana Fixed Rate Note is governed by state laws that dictate how secured loans must be structured and enforced. For the note to be legally binding, it must meet specific requirements, such as including the signatures of both parties and clearly outlining the terms of the agreement. Compliance with federal laws, such as the ESIGN Act and UETA, is also crucial when using electronic signatures. This ensures that the document holds up in court and is recognized as a valid financial instrument.

State-specific rules for the Montana Fixed Rate Note, Installment Payments Secured Commercial Property

In Montana, specific regulations govern the use of fixed rate notes secured by commercial property. These rules may address the maximum allowable interest rates, the necessary disclosures that must be provided to borrowers, and the procedures for foreclosure in case of default. It is essential for both lenders and borrowers to familiarize themselves with these regulations to ensure compliance and protect their rights under Montana law.

Quick guide on how to complete montana fixed rate note installment payments secured commercial property

Effortlessly prepare Montana Fixed Rate Note, Installment Payments Secured Commercial Property on any device

Managing documents online has gained traction among both enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed materials, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the features you require to swiftly create, edit, and eSign your documents without delays. Handle Montana Fixed Rate Note, Installment Payments Secured Commercial Property on any device with the airSlate SignNow apps available for Android and iOS, and streamline any document-related task today.

How to edit and eSign Montana Fixed Rate Note, Installment Payments Secured Commercial Property with ease

- Find Montana Fixed Rate Note, Installment Payments Secured Commercial Property and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the specific tools offered by airSlate SignNow.

- Formulate your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Montana Fixed Rate Note, Installment Payments Secured Commercial Property to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Montana Fixed Rate Note?

A Montana Fixed Rate Note is a financial instrument that provides guaranteed installment payments for secured commercial property transactions. This means that the amount owed remains constant over the term of the loan, making it easier for borrowers to budget their costs. Choosing this option can enhance financial stability and predictability when investing in real estate.

-

How do installment payments work with a Montana Fixed Rate Note?

Installment payments with a Montana Fixed Rate Note involve regular, scheduled payments made over a set period. These payments are calculated based on the fixed interest rate, ensuring that borrowers know exactly what they owe each month. This setup simplifies financial planning for businesses acquiring commercial properties.

-

What are the benefits of using a Montana Fixed Rate Note for commercial property?

Utilizing a Montana Fixed Rate Note for your commercial property financing offers numerous benefits, including predictable payments and fixed interest rates. This stability can help businesses manage cash flow more effectively, leading to better investment decisions. Furthermore, it can also protect borrowers from fluctuations in interest rates.

-

Are there specific eligibility criteria for obtaining a Montana Fixed Rate Note?

Yes, obtaining a Montana Fixed Rate Note typically involves meeting specific eligibility criteria, which may include creditworthiness, income verification, and property valuation. Lenders want to ensure that borrowers can manage their installment payments on secured commercial property effectively. It's advisable to check with financial institutions for their specific requirements.

-

Can I integrate airSlate SignNow with my existing financial systems for Montana Fixed Rate Notes?

Absolutely! airSlate SignNow can seamlessly integrate with many existing financial systems, allowing for smooth management of Montana Fixed Rate Notes. This integration streamlines the process of sending and signing necessary documents, ensuring you have everything in one place without disrupting your workflow.

-

What documents do I need to provide for a Montana Fixed Rate Note?

To apply for a Montana Fixed Rate Note, you will typically need to provide documentation such as a purchase agreement, income verification, and credit history. Additional papers might be required based on the lender's policies and the specifics of the secured commercial property. Make sure to consult with your lender for a complete list of required documents.

-

How does airSlate SignNow support the signing process for Montana Fixed Rate Notes?

airSlate SignNow simplifies the signing process for Montana Fixed Rate Notes by allowing users to easily send and eSign necessary documents electronically. This user-friendly platform ensures that all parties can review and sign documents securely and efficiently, speeding up the execution of agreements for installment payments on secured commercial properties.

Get more for Montana Fixed Rate Note, Installment Payments Secured Commercial Property

- Individual amp family plans hipaa ppo guaranteed issue form

- Bp a0629 form

- Pr application costco form

- Fatburger application form

- Migrant and seasonal agricultural worker protection act spanish dol form

- Notice and acknowledgement of pay rate and paydayaviso y labor ny form

- Income in kind verification form

- Checks word templates page 26 form

Find out other Montana Fixed Rate Note, Installment Payments Secured Commercial Property

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile