HAVE EXEMPTIONS Form

What is the HAVE EXEMPTIONS

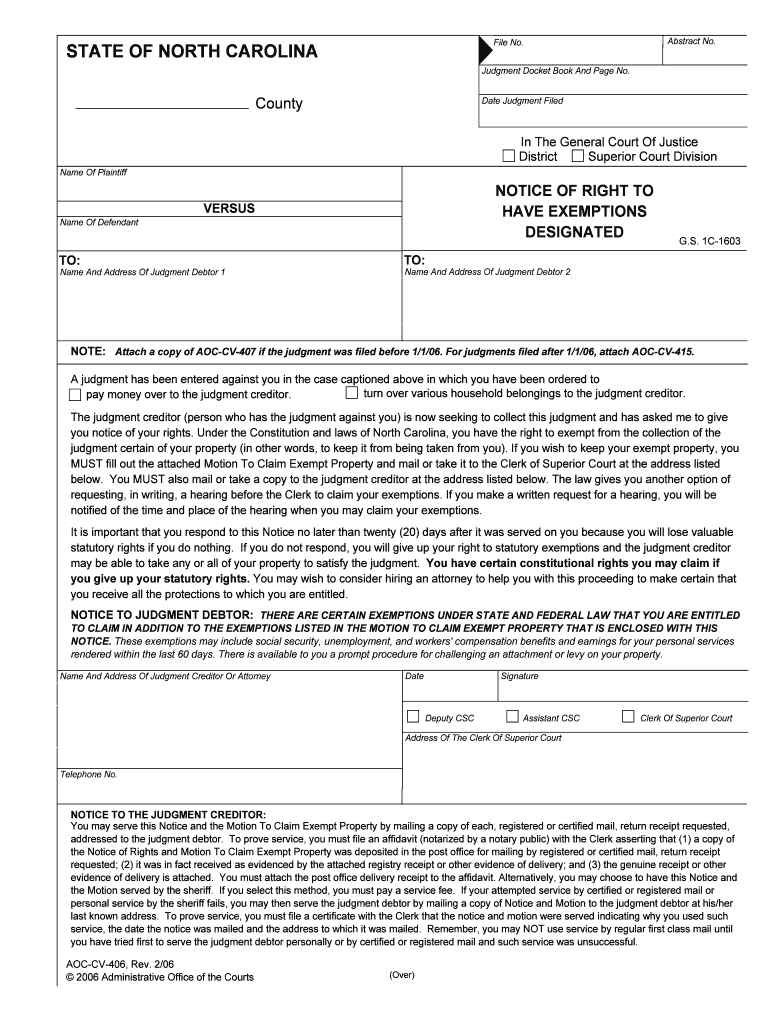

The HAVE EXEMPTIONS form is a crucial document that allows individuals or entities to declare their eligibility for specific exemptions, often related to tax obligations. This form is particularly relevant in contexts where certain exemptions can significantly reduce tax liabilities or compliance burdens. Understanding its purpose is essential for ensuring that one meets the necessary criteria and adheres to the applicable regulations.

Steps to complete the HAVE EXEMPTIONS

Completing the HAVE EXEMPTIONS form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and relevant financial data. Next, carefully fill out the form, ensuring that all sections are completed as required. After filling it out, review the form for any errors or omissions before submitting it. Proper attention to detail during this process can prevent delays or complications.

Legal use of the HAVE EXEMPTIONS

The legal validity of the HAVE EXEMPTIONS form hinges on compliance with established regulations. To be considered legally binding, the form must be filled out accurately and submitted according to the guidelines set forth by relevant authorities. Utilizing a reliable electronic signature solution can enhance the legal standing of the document, ensuring that it meets the necessary legal frameworks, such as the ESIGN and UETA acts.

Eligibility Criteria

To qualify for the exemptions outlined in the HAVE EXEMPTIONS form, applicants must meet specific eligibility criteria. These criteria often include factors such as income level, type of employment, and residency status. It is important to review these requirements carefully to determine if you qualify for the exemptions being claimed. Failing to meet the eligibility criteria may result in denial of the exemptions and potential penalties.

IRS Guidelines

The Internal Revenue Service (IRS) provides comprehensive guidelines regarding the use and submission of the HAVE EXEMPTIONS form. These guidelines outline the necessary documentation, filing procedures, and deadlines that must be adhered to. Familiarizing oneself with these guidelines is essential for ensuring compliance and avoiding any issues that may arise from improper submission.

Form Submission Methods

The HAVE EXEMPTIONS form can be submitted through various methods, including online, by mail, or in person. Each method has its own set of procedures and timelines. Submitting the form online is often the most efficient option, allowing for quicker processing and confirmation. However, individuals may choose to submit by mail or in person based on their preferences or specific circumstances.

Key elements of the HAVE EXEMPTIONS

Several key elements are essential to the HAVE EXEMPTIONS form, including the applicant's personal information, the specific exemptions being claimed, and any supporting documentation required. Accurate completion of these elements is critical for the successful processing of the form. Additionally, understanding the implications of each section can help applicants make informed decisions regarding their exemptions.

Quick guide on how to complete have exemptions

Effortlessly Prepare HAVE EXEMPTIONS on Any Device

The management of documents online has become increasingly favored by both companies and individuals. It presents an ideal environmentally friendly option to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage HAVE EXEMPTIONS across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and Electronically Sign HAVE EXEMPTIONS with Ease

- Find HAVE EXEMPTIONS and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Edit and electronically sign HAVE EXEMPTIONS to ensure excellent communication at any point in your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I know if I HAVE EXEMPTIONS when using airSlate SignNow?

If you HAVE EXEMPTIONS, it's essential to understand how they may impact your document workflows. airSlate SignNow allows you to manage exemptions seamlessly, ensuring that your eSigning process complies with applicable regulations. Make sure to consult our support resources or contact customer service for specific inquiries related to your exemptions.

-

How does airSlate SignNow accommodate users who HAVE EXEMPTIONS?

airSlate SignNow is designed to cater to a diverse customer base, including those who HAVE EXEMPTIONS. Our platform allows you to customize document templates and workflows to ensure that all necessary information regarding exemptions is appropriately captured and processed during eSigning.

-

Are there any additional costs for businesses that HAVE EXEMPTIONS?

Typically, businesses that HAVE EXEMPTIONS do not incur additional costs for using airSlate SignNow. Our pricing model is transparency-driven, meaning all features, including support for exemptions, are included in your chosen plan. Review our pricing page for more information on how you can benefit from our services while managing your exemptions.

-

What features are best for users who HAVE EXEMPTIONS?

For users who HAVE EXEMPTIONS, key features of airSlate SignNow include customizable templates, detailed audit trails, and compliance tracking. These features help ensure that your documents adhere to any specific requirements related to exemptions. Explore our feature set to see how these tools can improve your workflow.

-

How can I integrate airSlate SignNow if I HAVE EXEMPTIONS?

Integrating airSlate SignNow is straightforward, even if you HAVE EXEMPTIONS. Our platform offers a range of integrations with popular applications, allowing you to align your document management processes with your existing systems. Check our integrations page for a list of compatible tools that can streamline your workflows.

-

What benefits does airSlate SignNow offer for businesses that HAVE EXEMPTIONS?

Businesses that HAVE EXEMPTIONS can benefit from airSlate SignNow's efficiency and ease of use. By simplifying the eSigning process, our solution helps you save time and reduce errors associated with manual handling of exceptions. Enjoy peace of mind knowing your documents are compliant and secure.

-

Is customer support available for users who HAVE EXEMPTIONS?

Absolutely! Our customer support team is well-equipped to assist users who HAVE EXEMPTIONS. Whether you need help understanding your exemption options or troubleshooting issues with your documents, our dedicated team is available through multiple channels to provide timely assistance.

Get more for HAVE EXEMPTIONS

Find out other HAVE EXEMPTIONS

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form