NOTEThe Second Option Should Be Checked Only in Cases Where the Decedent Had No Outstanding Debts, or the Personal Representativ Form

What is the NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representative Has Paid In Full

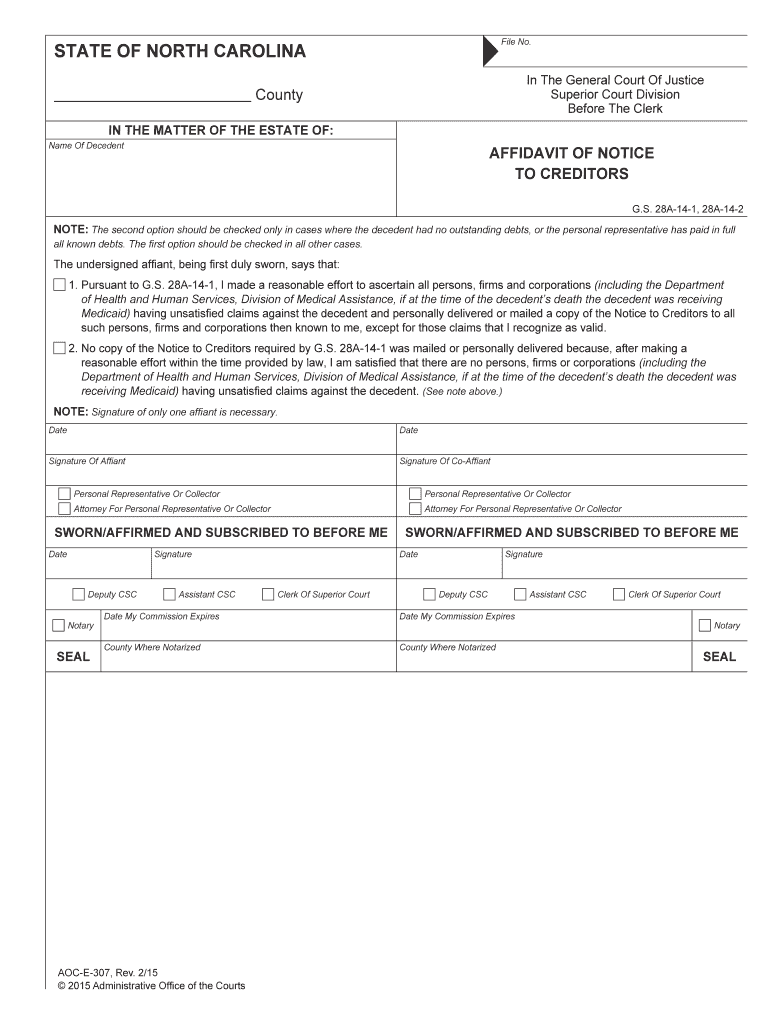

The form labeled as "NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representative Has Paid In Full" is a crucial document in estate management. This form is typically used to indicate that the decedent had no remaining debts at the time of their passing, or that any debts that existed have been fully settled by the personal representative. This declaration is essential for the proper distribution of the decedent's assets, ensuring that beneficiaries receive their inheritance without complications arising from unpaid debts.

Steps to complete the NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representative Has Paid In Full

Completing the form involves several key steps:

- Gather all relevant information about the decedent, including their financial status and any debts that may have existed.

- Determine if there are outstanding debts. If none exist, proceed to check the second option.

- If debts have been paid in full by the personal representative, ensure that documentation of these payments is available.

- Fill out the form accurately, ensuring all information is complete and reflects the current status of the estate.

- Review the form for accuracy before submission.

Legal use of the NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representative Has Paid In Full

This form serves a legal purpose in the context of estate administration. By checking the appropriate option, the personal representative affirms that they have fulfilled their obligations regarding the decedent's debts. This declaration can protect the personal representative from potential claims by creditors and ensures that the estate can be settled in compliance with state laws. It is vital to understand the legal implications of this form, as incorrect information may lead to legal disputes or penalties.

Key elements of the NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representative Has Paid In Full

The key elements of this form include:

- Identification of the decedent and the personal representative.

- A clear statement regarding the status of outstanding debts.

- Signature of the personal representative, affirming the truthfulness of the information provided.

- Date of completion, which is important for legal records.

Required Documents

To complete the form accurately, certain documents may be required:

- Death certificate of the decedent.

- Documentation of any debts that were settled.

- Proof of payment for any debts that existed.

- Identification of the personal representative.

Examples of using the NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representative Has Paid In Full

Examples of scenarios where this form is applicable include:

- A decedent who had no credit card debt or loans at the time of death.

- A personal representative who has paid off all medical bills and funeral expenses before distributing the estate.

- Situations where the estate is small enough that no debts were incurred, allowing for a straightforward distribution to beneficiaries.

Quick guide on how to complete notethe second option should be checked only in cases where the decedent had no outstanding debts or the personal

Effortlessly Prepare NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representativ on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal green alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents quickly and without delays. Manage NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representativ on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representativ with Ease

- Find NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representativ and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a standard wet ink signature.

- Review all the data and click on the Done button to finalize your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representativ and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of checking the second option regarding decedent debts?

The second option should be checked only in cases where the decedent had no outstanding debts, or the personal representative has paid in full. This is crucial as it helps in clarifying the financial status of the estate and ensures compliance with legal requirements during the estate settlement process.

-

How does airSlate SignNow facilitate the eSigning process?

airSlate SignNow empowers businesses to easily send and eSign documents through a user-friendly platform. The process is streamlined, allowing users to manage document workflows efficiently while ensuring security and compliance without the hassle of physical paperwork.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution, especially for small businesses. With flexible pricing plans and features that cater to various needs, it allows companies to handle document signing without stretching their budgets.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking of document status, and multi-party signing capabilities. These features help simplify the document management process, making it easier for users to execute transactions swiftly and securely.

-

Can airSlate SignNow integrate with other software applications?

Absolutely! airSlate SignNow offers seamless integrations with various software applications such as CRM systems and cloud storage services. This flexibility enables users to streamline their workflow and enhance productivity by keeping their tools connected.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes security with features such as encryption, secure access controls, and compliance with legal standards. Users can confidently manage sensitive documents knowing that their data is protected throughout the eSigning process.

-

What benefits does using airSlate SignNow provide for my business?

Utilizing airSlate SignNow offers numerous benefits including time savings, reduced paper usage, and improved workflow efficiency. Businesses can enhance their operational efficiency and focus on core activities while ensuring that document signing processes are quick and reliable.

Get more for NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representativ

Find out other NOTEThe Second Option Should Be Checked Only In Cases Where The Decedent Had No Outstanding Debts, Or The Personal Representativ

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney