Oap 4 Form 2004

What is the Oap 4 Form

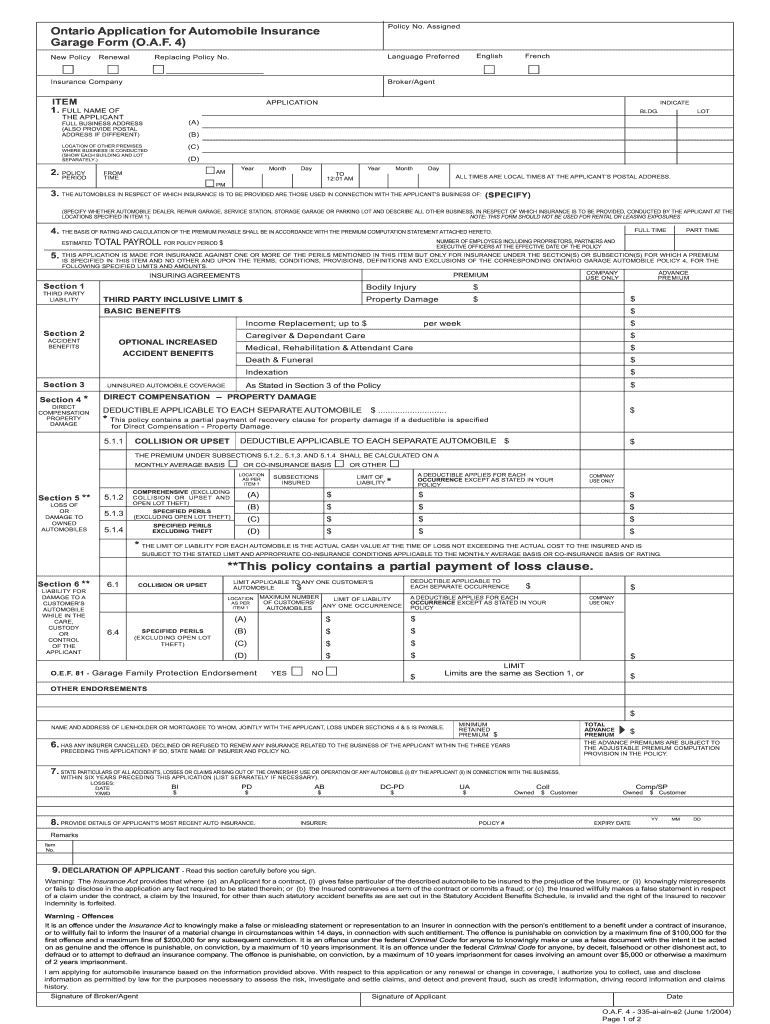

The Oap 4 Form is a specific document used primarily in the context of administrative processes, often related to applications for benefits or services. This form is essential for individuals seeking to provide necessary information to government agencies or organizations. It typically requires personal details, financial information, and other relevant data that helps determine eligibility for the requested services or benefits.

How to use the Oap 4 Form

Using the Oap 4 Form involves several straightforward steps. First, ensure that you have the most current version of the form, which can usually be obtained from official sources. Next, carefully read the instructions provided with the form to understand the information required. Fill out the form completely, ensuring that all fields are accurately completed. After filling out the form, review it for any errors or omissions before submission. This will help avoid delays in processing your application.

Steps to complete the Oap 4 Form

Completing the Oap 4 Form involves a series of methodical steps:

- Gather necessary documents, such as identification and financial records.

- Download or obtain the Oap 4 Form from an official source.

- Carefully read the instructions accompanying the form.

- Fill in your personal information, ensuring accuracy in all entries.

- Provide any required financial details or supporting information.

- Review the completed form for completeness and accuracy.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Oap 4 Form

The legal use of the Oap 4 Form is crucial for ensuring that the information provided is valid and complies with relevant regulations. When filled out correctly, the form serves as an official document that can be used in legal contexts, such as verifying eligibility for benefits. It is important to provide truthful information, as inaccuracies can lead to penalties or legal repercussions. Always keep a copy of the submitted form for your records.

Key elements of the Oap 4 Form

The Oap 4 Form includes several key elements that must be completed for it to be valid. These typically include:

- Personal identification information, such as name and address.

- Details regarding the purpose of the form, including specific benefits or services requested.

- Financial information that supports your application.

- Signature and date, confirming the accuracy of the information provided.

Required Documents

When completing the Oap 4 Form, certain documents may be required to support your application. These documents can include:

- Government-issued identification, such as a driver’s license or passport.

- Proof of residence, like a utility bill or lease agreement.

- Financial statements or tax returns that demonstrate your financial status.

- Any additional documentation specified in the form's instructions.

Quick guide on how to complete oap 4 2004 form

A concise tutorial on how to prepare your Oap 4 Form

Finding the appropriate template can be difficult when you need to submit official international documents. Even if you possess the necessary form, it may be cumbersome to quickly fill it out in accordance with all the specifications if you are using physical copies instead of handling everything digitally. airSlate SignNow is the web-based eSignature platform that aids you in overcoming these challenges. It enables you to select your Oap 4 Form and swiftly complete and sign it on-site without the need to reprint documents if you make a mistake.

Here are the steps you should follow to prepare your Oap 4 Form with airSlate SignNow:

- Click the Obtain Form button to quickly add your document to our editor.

- Begin with the first blank field, enter your details, and continue with the Next tool.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most crucial information.

- Click on Image and upload one if your Oap 4 Form necessitates it.

- Use the right-side panel to add more areas for you or others to complete if needed.

- Review your responses and confirm the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing the form by clicking the Finish button and selecting your file-sharing preferences.

Once your Oap 4 Form is ready, you can share it as you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your preferences. Don’t waste time on manual form filling; explore airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct oap 4 2004 form

FAQs

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the oap 4 2004 form

How to generate an electronic signature for the Oap 4 2004 Form in the online mode

How to make an electronic signature for your Oap 4 2004 Form in Google Chrome

How to generate an eSignature for putting it on the Oap 4 2004 Form in Gmail

How to make an electronic signature for the Oap 4 2004 Form from your smart phone

How to create an eSignature for the Oap 4 2004 Form on iOS

How to create an eSignature for the Oap 4 2004 Form on Android OS

People also ask

-

What is the Oap 4 Form and how does it work?

The Oap 4 Form is a digital document designed to streamline the signing process for various business needs. Using airSlate SignNow, you can easily create, send, and eSign the Oap 4 Form, ensuring that all necessary parties can sign in a secure and efficient manner. This tool simplifies document management and enhances productivity.

-

How can I create an Oap 4 Form using airSlate SignNow?

Creating an Oap 4 Form with airSlate SignNow is straightforward. Simply log into your account, select 'Create Document', and choose the Oap 4 Form template. You can customize the form to meet your specific requirements and add fields for signatures, dates, and other necessary information.

-

What are the benefits of using the Oap 4 Form for my business?

The Oap 4 Form offers numerous benefits, including time savings, increased efficiency, and enhanced security. By using airSlate SignNow, your team can quickly gather eSignatures, reduce paperwork, and maintain a compliant digital record of all signed documents. This leads to improved workflow and better resource management.

-

Is airSlate SignNow affordable for small businesses needing the Oap 4 Form?

Yes, airSlate SignNow is designed to be cost-effective, especially for small businesses. With various pricing plans available, you can choose one that fits your budget while gaining access to features like the Oap 4 Form. The value you receive in terms of document management and eSigning capabilities makes it a worthwhile investment.

-

Can I integrate the Oap 4 Form with other software using airSlate SignNow?

Absolutely! airSlate SignNow allows seamless integration with popular business applications such as Google Drive, Salesforce, and Zapier. This means you can easily incorporate the Oap 4 Form into your existing workflows and enhance your document management processes.

-

What security features does airSlate SignNow provide for the Oap 4 Form?

Security is a top priority for airSlate SignNow, especially when handling important documents like the Oap 4 Form. The platform employs industry-leading encryption methods, secure cloud storage, and features such as audit trails and authentication options to ensure your documents remain safe and compliant.

-

How can I track the status of my Oap 4 Form sent for signature?

Tracking the status of your Oap 4 Form is easy with airSlate SignNow. Once you send the document for signature, you can monitor its progress in real-time through your dashboard. You will receive notifications when the document is viewed, signed, or if there are any pending actions required.

Get more for Oap 4 Form

Find out other Oap 4 Form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract