Less Standard Deduction Single Form

What is the single standard deduction?

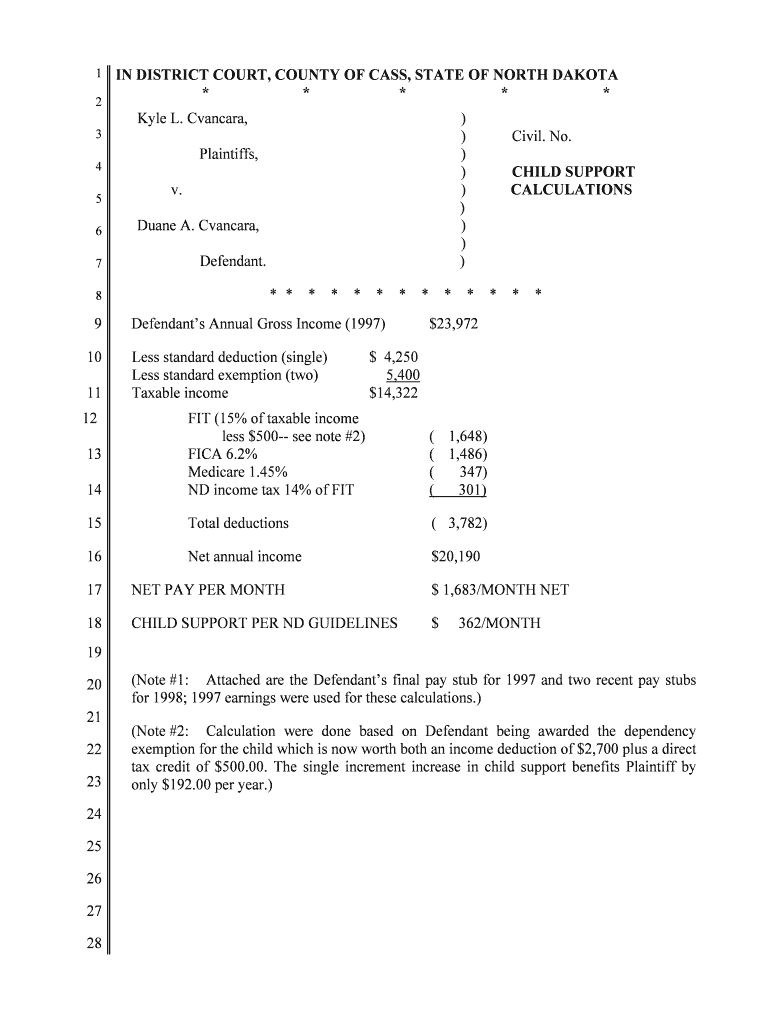

The single standard deduction is a fixed dollar amount that reduces the income on which you are taxed. For the tax year 2023, the single standard deduction is $13,850 for individual filers. This deduction simplifies the tax filing process by allowing taxpayers to deduct a set amount from their taxable income without needing to itemize individual deductions. The single standard deduction is available to all eligible taxpayers, making it a popular choice for many individuals.

How to use the single standard deduction

To utilize the single standard deduction, taxpayers must choose it when filing their federal income tax return. This option is typically selected on Form 1040. By opting for the single standard deduction, you can reduce your taxable income, which may lower your overall tax liability. It is essential to compare the benefits of taking the standard deduction versus itemizing deductions to determine the most advantageous approach for your financial situation.

Eligibility criteria for the single standard deduction

Eligibility for the single standard deduction generally includes individuals who are not married or who do not qualify for a higher deduction due to filing status. To qualify, you must be a single filer, and your adjusted gross income must fall within the limits set by the IRS. Additionally, you cannot be claimed as a dependent on someone else's tax return. Understanding these criteria is crucial for ensuring that you can take advantage of this tax benefit.

Steps to complete the single standard deduction

Completing the single standard deduction on your tax return involves several straightforward steps:

- Gather your financial documents, including W-2s and any other income statements.

- Determine your filing status to confirm that you qualify for the single standard deduction.

- Fill out Form 1040, entering your total income and subtracting the single standard deduction amount.

- Calculate your taxable income and complete the rest of your tax return.

- Review your return for accuracy before submitting it to the IRS.

IRS guidelines for the single standard deduction

The IRS provides specific guidelines regarding the single standard deduction, including annual updates to the deduction amount based on inflation. It is important to stay informed about these changes, as they can affect your tax return significantly. The IRS also outlines rules about who can claim the deduction, including restrictions for certain taxpayers, such as non-resident aliens or individuals who are married but filing separately under specific circumstances.

Filing deadlines for the single standard deduction

Filing deadlines for tax returns, including those utilizing the single standard deduction, typically fall on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these deadlines to avoid penalties and ensure timely submission of their returns. Extensions may be available, but they do not extend the time to pay any taxes owed.

Required documents for claiming the single standard deduction

When claiming the single standard deduction, certain documents are necessary to support your tax return. These include:

- W-2 forms from employers, detailing your income.

- 1099 forms for additional income sources, if applicable.

- Records of any other income received during the tax year.

- Documentation proving your eligibility, such as your filing status.

Having these documents organized will facilitate a smoother tax filing process and help ensure accuracy in your return.

Quick guide on how to complete less standard deduction single

Complete Less Standard Deduction single effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly and without delays. Manage Less Standard Deduction single on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and electronically sign Less Standard Deduction single without hassle

- Find Less Standard Deduction single and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you prefer to share your form—via email, SMS, or an invite link—or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Less Standard Deduction single while ensuring smooth communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the single standard deduction for the current tax year?

The single standard deduction for the current tax year varies depending on your filing status. For single filers, the standard deduction typically reduces your taxable income, allowing you to save money on your taxes. It's important to check the IRS guidelines to ensure you are taking full advantage of the single standard deduction.

-

How does the single standard deduction impact my business's tax return?

The single standard deduction can signNowly lower your overall taxable income, which may affect your business's tax return. By understanding how the single standard deduction works, you can optimize your tax strategy. This deduction can result in substantial savings for your business, freeing up resources for other investments.

-

Can airSlate SignNow help with tax document management?

Yes, airSlate SignNow simplifies the eSigning and management of tax documents, making it easier for you to handle important files related to the single standard deduction. With our platform, you can securely send and sign documents, ensuring that your tax filings are accurate and on time. This efficiency can help you focus on maximizing your deductions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers tiered pricing options to accommodate businesses of all sizes. Each plan provides different features that enhance document management and eSigning capabilities, allowing you to choose the one that best suits your needs related to the single standard deduction. Visit our pricing page to find the plan that works for your business.

-

How secure is airSlate SignNow for sensitive tax documents?

Security is a top priority at airSlate SignNow. Our platform utilizes bank-grade encryption to safeguard sensitive tax documents, including those related to the single standard deduction. With comprehensive compliance certifications, you can trust that your documents are protected throughout the signing process.

-

Does airSlate SignNow integrate with accounting software?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, enhancing your ability to manage financial documents. This integration allows you to efficiently handle paperwork related to the single standard deduction, ensuring streamlined communication between your teams. Not only does it save time, but it also minimizes the risk of errors.

-

What features does airSlate SignNow offer for document collaboration?

airSlate SignNow offers a range of features designed for document collaboration, including commenting, real-time notifications, and document templates. These features make it easy for teams to work together on tax documentation concerning the single standard deduction. Effective collaboration ensures that all necessary signatures are collected promptly.

Get more for Less Standard Deduction single

Find out other Less Standard Deduction single

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form