North Dakota Fixed Rate Note, Installment Payments Unsecured Form

What is the North Dakota Fixed Rate Note, Installment Payments Unsecured

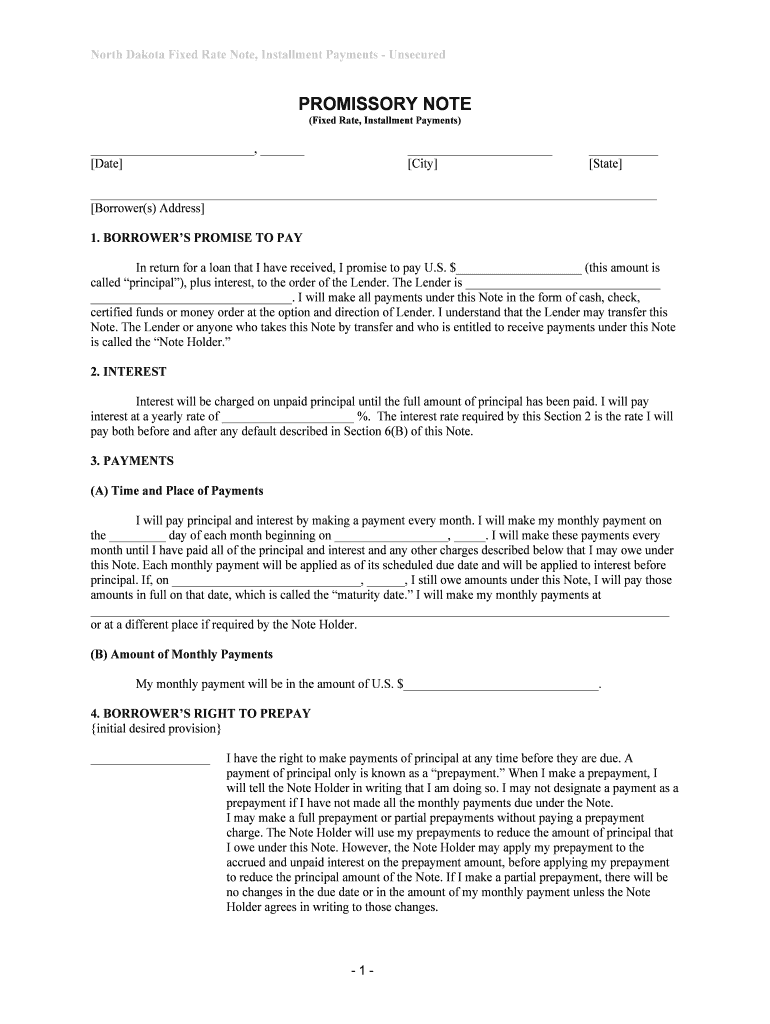

The North Dakota Fixed Rate Note, Installment Payments Unsecured is a financial instrument used to document a loan agreement where the borrower agrees to repay the lender in fixed installments over a specified period. This type of note is unsecured, meaning it is not backed by collateral, which can make it riskier for lenders. The fixed interest rate provides predictability for both parties, as the borrower knows exactly how much they will pay each month, and the lender can anticipate their returns. This note is commonly used in personal loans, business financing, and other situations where borrowers need access to funds without pledging assets.

How to use the North Dakota Fixed Rate Note, Installment Payments Unsecured

Using the North Dakota Fixed Rate Note involves several straightforward steps. First, both the borrower and lender should agree on the loan terms, including the principal amount, interest rate, repayment schedule, and any fees involved. Once these terms are established, the note can be drafted. It is essential to include all relevant details, such as the names of the parties involved, the payment schedule, and the consequences of default. After drafting, both parties should review the document carefully before signing it to ensure mutual understanding and agreement.

Steps to complete the North Dakota Fixed Rate Note, Installment Payments Unsecured

Completing the North Dakota Fixed Rate Note requires careful attention to detail. Here are the steps to follow:

- Gather necessary information: Collect personal details, loan amount, interest rate, and repayment terms.

- Draft the note: Use a template or create a document that includes all agreed-upon terms.

- Review the document: Both parties should read through the note to confirm accuracy and completeness.

- Sign the note: Both the borrower and lender must sign the document, ideally in the presence of a witness or notary.

- Distribute copies: Provide each party with a signed copy for their records.

Key elements of the North Dakota Fixed Rate Note, Installment Payments Unsecured

Several key elements must be included in the North Dakota Fixed Rate Note to ensure its validity and enforceability:

- Borrower and lender information: Full names and contact details of both parties.

- Loan amount: The total amount being borrowed.

- Interest rate: The fixed rate applied to the loan.

- Payment schedule: Specific dates and amounts for each installment payment.

- Default terms: Consequences if the borrower fails to make payments.

Legal use of the North Dakota Fixed Rate Note, Installment Payments Unsecured

The legal use of the North Dakota Fixed Rate Note is governed by state laws regarding contracts and lending practices. For the note to be enforceable, it must meet specific legal requirements, such as clarity in terms, mutual consent, and proper execution. Both parties should be of legal age and mentally competent to enter into the agreement. Additionally, the note should comply with federal regulations, especially if it involves consumer lending. It is advisable for both parties to consult legal counsel to ensure that the document adheres to all applicable laws.

State-specific rules for the North Dakota Fixed Rate Note, Installment Payments Unsecured

In North Dakota, specific rules apply to the execution and enforcement of the Fixed Rate Note. These include requirements for written agreements, interest rate limitations, and disclosure obligations. North Dakota law mandates that lenders provide borrowers with clear information about the terms and conditions of the loan, including any fees or penalties associated with late payments. Understanding these state-specific rules is crucial for both lenders and borrowers to avoid legal complications and ensure compliance with local regulations.

Quick guide on how to complete north dakota fixed rate note installment payments unsecured

Complete North Dakota Fixed Rate Note, Installment Payments Unsecured effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with the tools required to create, modify, and eSign your documents swiftly without delays. Manage North Dakota Fixed Rate Note, Installment Payments Unsecured on any device with airSlate SignNow Android or iOS applications and streamline any document-centered task today.

How to modify and eSign North Dakota Fixed Rate Note, Installment Payments Unsecured effortlessly

- Find North Dakota Fixed Rate Note, Installment Payments Unsecured and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select how you would prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign North Dakota Fixed Rate Note, Installment Payments Unsecured and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a North Dakota Fixed Rate Note, Installment Payments Unsecured?

A North Dakota Fixed Rate Note, Installment Payments Unsecured is a financial instrument that allows borrowers to repay their loans in fixed installments over a specified period. This type of note provides clarity in repayment amounts and schedule, making financial planning easier for borrowers. It is particularly useful for those seeking predictable monthly payments without needing to secure the loan against collateral.

-

How are the interest rates determined for a North Dakota Fixed Rate Note, Installment Payments Unsecured?

Interest rates for a North Dakota Fixed Rate Note, Installment Payments Unsecured are typically influenced by market conditions, the borrower’s creditworthiness, and prevailing lending standards. Lenders will assess these factors to offer competitive rates that align with the risk associated with unsecured loans. It’s advisable to shop around for the best rates before securing a loan.

-

What are the repayment terms for a North Dakota Fixed Rate Note, Installment Payments Unsecured?

Repayment terms for a North Dakota Fixed Rate Note, Installment Payments Unsecured can vary but commonly range from a few months to several years. The specific term will depend on the agreement between the lender and borrower, as well as the loan amount. Clear understanding of terms is crucial for managing repayments effectively.

-

What benefits do I get from a North Dakota Fixed Rate Note, Installment Payments Unsecured?

A key benefit of a North Dakota Fixed Rate Note, Installment Payments Unsecured is the predictability of payments, allowing for easier budgeting. Additionally, since it’s unsecured, borrowers do not risk losing personal assets. These loans often have straightforward applications, making it more accessible for individuals and businesses alike.

-

Can I customize the payment schedule for a North Dakota Fixed Rate Note, Installment Payments Unsecured?

Yes, many lenders allow for customization of the payment schedule for a North Dakota Fixed Rate Note, Installment Payments Unsecured. Borrowers can often choose terms that best align with their financial situation and cash flow. It’s essential to discuss these options with your lender to find the most suitable arrangement.

-

What is the application process for obtaining a North Dakota Fixed Rate Note, Installment Payments Unsecured?

The application process for a North Dakota Fixed Rate Note, Installment Payments Unsecured typically involves filling out an application form, providing financial details, and undergoing a credit check. This process is generally streamlined to ensure quick approval. Many lenders may offer an online application to expedite the experience.

-

Are there any fees associated with a North Dakota Fixed Rate Note, Installment Payments Unsecured?

Yes, there may be fees associated with obtaining a North Dakota Fixed Rate Note, Installment Payments Unsecured, such as origination fees or late payment charges. It’s important to review all the terms and conditions to understand any potential costs before agreeing to the loan. Transparency in fees helps borrowers avoid unexpected expenses during their repayment period.

Get more for North Dakota Fixed Rate Note, Installment Payments Unsecured

Find out other North Dakota Fixed Rate Note, Installment Payments Unsecured

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself