Immediately Preceding Three Years; and Form

What is the Immediately Preceding Three Years; And

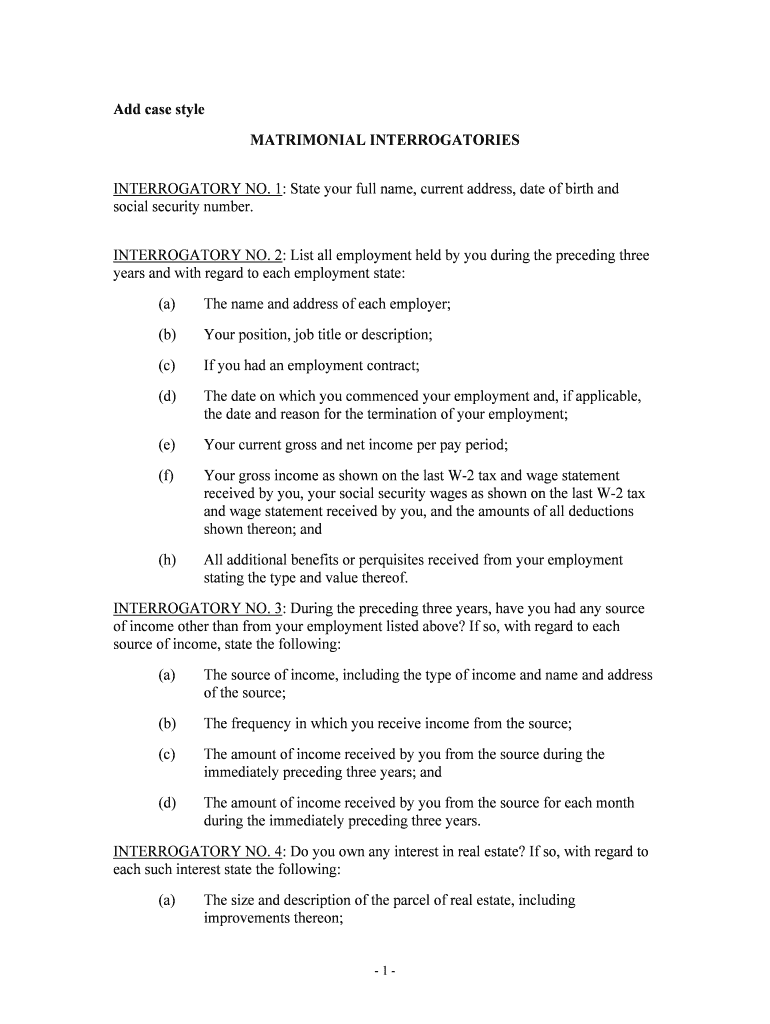

The term "Immediately Preceding Three Years; And" refers to a specific timeframe often used in various forms and legal documents. This period typically encompasses the three years prior to the current date, which may be relevant for tax filings, legal claims, or compliance requirements. Understanding this timeframe is crucial for accurately completing forms that require historical data or information about prior actions, especially in contexts such as tax returns or legal disclosures.

How to use the Immediately Preceding Three Years; And

Using the Immediately Preceding Three Years; And involves gathering relevant information from the past three years. This may include financial records, tax documents, or other pertinent data. To effectively utilize this timeframe, ensure you have access to the necessary documents, such as W-2s, 1099s, or other financial statements. Organizing these documents chronologically can help streamline the completion of any forms requiring this information.

Steps to complete the Immediately Preceding Three Years; And

Completing the Immediately Preceding Three Years; And requires a systematic approach:

- Gather all relevant documents from the last three years, including tax returns and financial statements.

- Review the information to ensure accuracy and completeness.

- Fill out the required form, ensuring that you accurately reflect the information from the preceding three years.

- Double-check for any discrepancies or missing information before submission.

Legal use of the Immediately Preceding Three Years; And

The legal use of the Immediately Preceding Three Years; And is essential for compliance with various regulations. Many legal and tax forms require information from this timeframe to assess eligibility, calculate liabilities, or determine compliance with legal standards. Ensuring that the information provided is accurate and complete can help avoid potential legal issues and penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Immediately Preceding Three Years; And, particularly in the context of tax filings. Taxpayers are often required to report income, deductions, and credits from the previous three years. Familiarizing yourself with these guidelines can help ensure that your filings are compliant and accurate, reducing the risk of audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines related to the Immediately Preceding Three Years; And are critical for compliance. Typically, tax returns must be filed by April 15 of the following year, but specific forms may have different deadlines. Keeping track of these dates is essential to avoid late fees or penalties. It is advisable to mark important dates on your calendar and set reminders to ensure timely submission.

Quick guide on how to complete immediately preceding three years and

Effortlessly Prepare Immediately Preceding Three Years; And on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without interruptions. Manage Immediately Preceding Three Years; And on any platform using airSlate SignNow's apps for Android or iOS and enhance any document-driven workflow today.

The easiest way to edit and eSign Immediately Preceding Three Years; And seamlessly

- Find Immediately Preceding Three Years; And and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form hunting, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Immediately Preceding Three Years; And and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing structure?

airSlate SignNow offers various pricing plans that cater to different business needs, ensuring affordability for all. You can choose a plan based on your expected usage in the 'Immediately Preceding Three Years; And' budget framework, allowing you to scale your services effectively.

-

What features does airSlate SignNow provide?

airSlate SignNow provides a variety of features including document signing, templates, and integrations with popular tools. These features are designed to deliver efficiency in workflows, particularly for tasks spanning the 'Immediately Preceding Three Years; And'.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can streamline their document workflows, save time, and reduce costs in the 'Immediately Preceding Three Years; And' context. This can lead to improved productivity and customer satisfaction.

-

Is airSlate SignNow easy to integrate with existing systems?

Yes, airSlate SignNow seamlessly integrates with various software solutions, ensuring that you can maintain your existing workflows. This alignment can provide benefits that extend to the 'Immediately Preceding Three Years; And' operations.

-

Can I use airSlate SignNow for international transactions?

Absolutely! airSlate SignNow supports international transactions, making it suitable for global businesses. Transactions in the 'Immediately Preceding Three Years; And' will benefit from a secure and compliant signing process.

-

What security measures does airSlate SignNow have in place?

Security is a priority for airSlate SignNow, which implements advanced encryption and compliance protocols. Businesses can confidently operate under the 'Immediately Preceding Three Years; And' disclosure standards with robust data protection.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage documents on the go. This mobility is invaluable for businesses looking to maintain agility in the 'Immediately Preceding Three Years; And' timeframe.

Get more for Immediately Preceding Three Years; And

Find out other Immediately Preceding Three Years; And

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract